$20K or More to Expand Your Family? How to Pay for Adoption

August 16, 2021 5 min read

This story originally appeared on NerdWallet

Sarah Bailey’s adoption experience began in 2013 when she connected with an adoption placement agency and paid fees for a parental class and to advertise to birth mothers for one year.

In 2014, and still without a successful adoption, Bailey began paying a monthly $340 advertising fee each time an adoption fell through.

“I didn’t expect the month-to-month” fee, says Bailey, a mental health program director in Indianapolis. As the expenses continued into year two of an expected yearlong process, Bailey became discouraged.

“For me, there was a point where I almost gave up,” she says.

She persisted, and by 2015, Bailey had paid over $22,000 to adopt her son.

The cost of a private agency adoption can range from $20,000 to $45,000, according to the Child Welfare Information Gateway, a service of the Children’s Bureau under the federal Office of the Administration for Children and Families.

The price can include legal fees, a home study to check the safety of your living space and counseling.

But adoption can include unplanned costs — like living expenses and hospital costs for the birth mother during pregnancy — that vary depending on the agency and state, as well as the adoption timeline.

To manage the costs, experts recommend families plan ahead and tap multiple types of financing, from fundraising to borrowing. Here are strategies to consider.

Start with a plan

If you’re working with an adoption agency, you’ll typically receive a list of costs before applying, says Blake Jones, an adoptive parent, certified financial planner and founder of Pomegranate Financial, a Utah-based financial planning firm.

Use that information to create a timeline of the expenses you’ll have over the next six to 18 months before signing the adoption application, he says.

Then, look at financial resources you have access to — savings, home equity, grants — and align what you have with when you may need it, advises Jones.

Building up your savings is the best option, says Marta Shen, a certified financial planner at Spring Street Financial of Raymond James in Atlanta and an adoptive parent who advises clients on managing adoption costs. Repaying a loan on top of new-parent expenses like child care can be financially stressful, she says.

Ask others for help

During her adoption process, Bailey turned to her community to help raise funds.

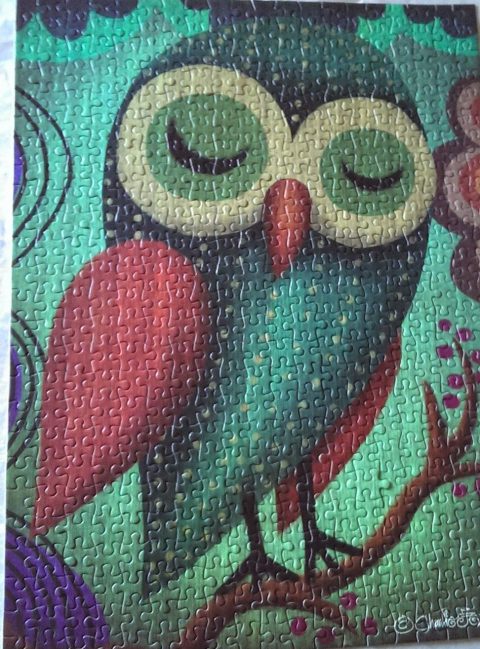

Photo courtesy Sarah Bailey

“I bought a puzzle and I sold pieces so people could be a part of my child’s life,” she says. For “everyone that bought one, I put their name on the back.”

The finished puzzle sits in her now 6-year-old son’s room — a reminder of all those who helped connect them in 2015.

Aaron Johnson, a father of two adopted children from Orlando, Florida, also fundraised for his first adoption in 2017. Johnson raised over $10,000.

“We did a GoFundMe on social media, so a lot of our friends, church members, other family members donated to that,” says Johnson, who since adopting has started a nonprofit organization that awards grants to help other Black families adopt children.

Apply for an adoption grant

An adoption grant — funds that don’t need to be repaid— is another way to fund adoption. Helpusadopt.org and the Gift of Adoption Fund offer grants to cover adoption costs.

With organizations like these, you’ll need to check deadlines and eligibility requirements, like parental status and financial need. Upon submitting the application, you may need to pay a fee, provide references and show proof of an approved home study.

Consider a HELOC

A home equity line of credit provides access to cash based on the value of your home. It allows you to draw money and pay it back monthly. It’s more flexible than a loan, says Shen.

Some people prefer a set amount they know they have to repay, like a one-time lump sum of a personal loan, Shen says, while others are fine with the revolving credit line of a HELOC. If parents are not sure how much they’ll need upfront, a HELOC may be a better option.

Personal loans can be a last resort

If fundraising falls short, you can’t qualify for a grant or don’t own a home, a personal loan may be worth considering. Borrowers with strong credit may qualify for rates between 12% and 17%.

Before getting a loan, make sure the monthly payments fit comfortably into your budget.

Shen advises clients to avoid too many financial obligations, which can put a strain on a new family.

This article was written by NerdWallet and was originally published by The Associated Press.

More From NerdWallet

The article $20K or More to Expand Your Family? How to Pay for Adoption originally appeared on NerdWallet.

https://www.entrepreneur.com/article/380396