4 Reasons Why You Should Add Sarepta (SRPT) to Your Portfolio

Sarepta Therapeutics SRPT concentrates on developing exon-skipping drug candidates targeting Duchenne muscular dystrophy (DMD), a rare genetic disorder affecting children and also the most common type of muscular dystrophy. SRPT’s top line is driven by its three FDA-approved DMD drugs, namely Exondys 51, Vyondys 53 and Amondys 45.

– Zacks

Sarepta is also developing gene therapies targeting different muscular dystrophies and central nervous system disorders. Its lead gene therapy candidate SRP-9001 is being developed in a pivotal study as a potential treatment of DMD.

Here we discuss four reasons why adding the Sarepta stock to one’s portfolio may prove to be beneficial in 2021.

Top Rank, Rising Estimates and Share Price: Sarepta currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

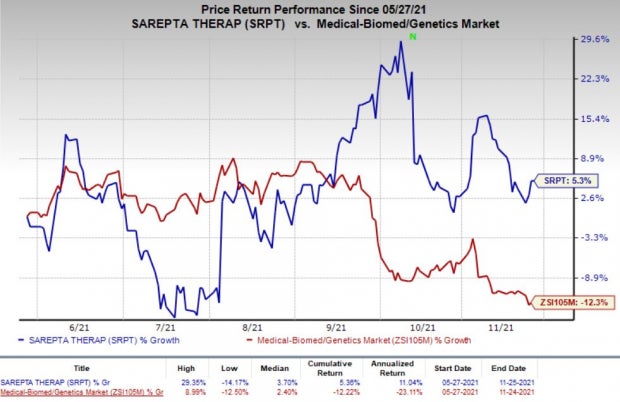

Earnings estimates for Sarepta’s loss per share have narrowed 28.2% for 2021 and 25.3% for 2022 over the past 30 days. The stock has gained 5.3% in the past six months against a decrease of 12.3% for the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Strong Performance of DMD Drugs: Sarepta’s Exondys 51 is the first approved disease-modifying therapy for DMD in the United States and its first product to receive marketing approval. Exondys 51 recorded impressive sales growth in the last few quarters despite the COVID-19 pandemic. Vyondys 53, approved in 2019, is boosting SRPT’s top line by bringing in additional sales. Moreover, Amondys 45 has been showing a strong demand trend since its launch earlier in 2021.

Strong performance of its three DMD drugs in the first nine months of 2021 led Sarepta to raise its revenue guidance for 2021 on its third quarter earnings call. SRPT expects product revenues in the range of $605-$615 million, indicating growth of nearly 34% from the year-ago reported figure at the midpoint. We expect robust growth in product revenues to continue in 2022.

Gene Therapy Pipeline: Sarepta is one of the pioneers in gene therapy development. Earlier this year, SRPT initiated the first pivotal study — EMBARK — to evaluate a gene therapy candidate for DMD patients.

In January 2021, management had announced that SRP-9001 met the biological endpoint of a mid-stage study during its evaluation in DMD patients but failed to achieve a statistically significant improvement in the functional endpoint of the study. This caused a massive decline in Sarepta’s share price in the same month. However, SRPT advanced the development of SRP-9001 to the pivotal EMBARK study based on favorable trends observed for function endpoint in the mid-stage study.

The pivotal study is also evaluating commercially-represented material for SRP-9001. Any positive update from the pivotal study will be a key catalyst for the stock. Sarepta is developing the micro-dystrophin-encoding gene therapy candidate in collaboration with Roche RHHBY.

Sarepta and Roche entered into a licensing agreement to develop SRP-9001 in 2019. Per the agreement, Roche has exclusive rights to launch and commercialize SRP-9001 in the ex-U.S. markets. Roche made $1.15-billion upfront payments and will pay up to $1.7 billion in regulatory and sales milestones to Sarepta.

Apart from DMD, Sarepta is developing gene therapies for treating Limb-girdle muscular dystrophy, Mucopolysaccharidosis type IIIA (MPS IIIA) and Pompe Disease in different clinical-stage studies.

Next-Generation Exon-Skipping Pipeline: Sarepta is looking to build its DMD pipeline beyond PMO-based exon-skipping treatments. SRPT is developing SRP-5051, an exon 51 skipping candidate from SRPT’s next-generation PPMO-technology, for treating DMD patients. The new technology aided in achieving a more durable response compared to PMO.

SRP-5051 targets a similar patient population as that of Sarepta’s lead drug Exondys 51. The candidate showed significantly better responses in patients with its once-monthly doses in clinical studies than the once-weekly doses of Exondys 51.

Successful development will offer DMD patients a better alternative with a much lower dose and a new drug with longer patent protection. SRPT initiated the pivotal part B of the MOMENTUM study in the fourth quarter of 2021.

Conclusion

Strong demand for its commercial DMD drugs and promising pipeline progress represents an opportunity for investors to gain from Sarepta’s potential growth over the next few quarters. On the flip side, shares of SRPT declined more than 50% on Jan 8, 2021, following a negative clinical update on its DMD gene therapy candidate, SRP-9001. However, any positive update from the ongoing pivotal study on SRP-9001 will likely be a catalyst for the stock’s substantial upside going forward.

A few other companies also developing gene therapies targeting DMD patients are Pfizer PFE and REGENXBIO RGNX. Successful development of these gene therapy candidates may increase competition for Sarepta.

Pfizer began dosing in the phase III CIFFREO study last December. The study is evaluating the safety and efficacy of its gene therapy candidate PF-06939926 for treating DMD. Pfizer is the closest competitor of Sarepta in developing a DMD gene therapy with both companies evaluating their respective candidates in late-stage studies. Pfizer’s DMD candidate enjoys fast track, orphan drug and rare pediatric disease designations in the United States.

REGENXBIO plans to start a clinical study next year to evaluate its gene therapy candidate RGX-202 for treating DMD. RGX-202 was designed using REGENXBIO’s proprietary NAV AAV8 vector to deliver an optimized microdystrophin transgene to develop a targeted therapy for improved resistance to muscle damage associated with DMD. REGENXBIO received an orphan drug designation for the candidate earlier this month.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT): Free Stock Analysis Report

REGENXBIO Inc. (RGNX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

https://www.entrepreneur.com/article/399415