Ad Tech Is Undergoing an Identity Crisis That’s Been Worsened by the Pandemic

Key insights:

Prior to the economic chaos caused by the Covid-19 pandemic and the subsequent havoc it has wrought on the media industry, ad tech’s biggest priority was cookies—or its identity crisis, to be precise.

In January, Google announced the 2022 the elimination of third-party cookies in its market-leading Chrome browser, prompting talk of Project Rearc, aka “the great collab” between ad tech and publishers at this year’s IAB flagship event.

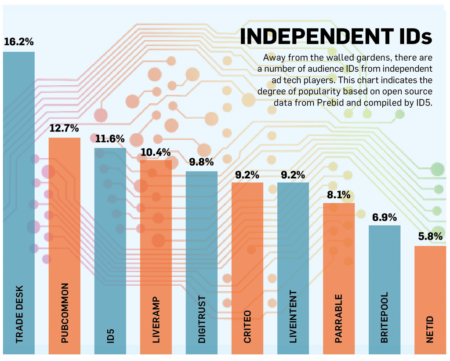

Third-party cookies have been embedded in various tiers of the ad-tech ecosystem since its inception, and with Project Rearc, the IAB hoped to establish a consensus on what effectively amounts to a new operating system. Independent ad-tech players have been searching for such a solution, including PSA announcements, since Mozilla’s Firefox and Apple’s Safari began blocking third-party cookies ahead of Google Chrome’s 2022 plan. The (largely) confused state of inertia among many in the independent ad-tech ecosystem led some to quietly despair and question whether the jig was up come 2022.

Then Covid-19 happened. In a few short weeks, this has prompted a mass contraction in ad spend with a subsequent wave of furloughs and layoffs sweeping ad tech, leading some to question if many independent players in the space will even see 2022. The devastation of the Covid-19 crisis in the media sector has led some to appeal for a stay of execution from the Chrome provider for financial relief and security for the cookie, but documents obtained by Adweek suggest this is not in the cards.

Cohort targeting

In the interim, Google has pushed forward with its Privacy Sandbox initiative, which calls for an “ad-safe but privacy-first approach” with the Chrome provider. It also owns an ad-tech stack called Google Marketing Platform (GMP) and is busying itself with several initiatives on that front.

Included in this was the announcement during Google’s earnings call of an initiative that would let media buyers purchase inventory from within Ads Data Hub (ADH) using Google’s demand-side platform (DSP) and its enhanced privacy standards.

The Privacy Sandbox does not let media buyers target or track users with PII (personally identifiable information). It lets them target large audience groups using “cohort data” with Google’s machine learning technology entrusted to safeguard frequency capping and other attributions.

Google is under simultaneous pressure to provide the public with better privacy measures as well as give advertisers third-party performance metrics of ads on its platform. Hence companies such as Flashtalking are integrated into ADH as measurement providers.

Alternatives targets

However, one source who requested anonymity said entrusting Google with pseudonymization for the entire industry was folly. Especially since Google’s ad stack contains an ad server, plus demand- and sell-side platforms (SSP), in addition to its own media supply source to rival independent ad tech and publishers’ core offerings.

“Some would say it’s like handing independent ad tech and publishers a knife and then sending them to a gunfight with the Google stack,” continued the source.

Separately, John Nardone, CEO of ad server Flashtalking, explained how much of the panic around the decline of third-party cookies among media buyers was overblown.

“You would think we’re going from this perfect scenario where we have perfect cookie coverage [for targeting and measurement] to nothing, but that’s not the case,” he said. “I do think it is going to create the need for a lot of new innovation among the independent ad-tech players.”

Per Nardone, as long as the industry can align around first-party data—whether it is outside or inside the walled gardens—measurement is still possible.

“A lot of [mid- to long-tail] advertisers are going to say, ‘OK, I’m just going to spend my money with Facebook and Google and be done with it,” he continued.

Conflicts of interest

In particular, larger advertisers from verticals that see walled-garden providers such as Amazon and Google increasingly as competition are likely to grow averse to their media offerings.

https://www.adweek.com/digital/ad-tech-is-undergoing-an-identity-crisis-thats-been-worsened-by-the-pandemic/