Allstate (ALL) on Track to Shed Its Life and Annuity Business

The Allstate Corporation ALL has inched a step closer in the process to sell its Allstate Life Insurance Company of New York (ALNY) to Wilton Re for approximately $400 million with the receipt of regulatory approval.

– Zacks

The sale of ALNY is in sync with the company’s long-term strategy to move away from life and annuity business and focus on other businesses, such as personal property-liability and protection services.

In a separate move, earlier this year, Allstate agreed to divest Allstate Life Insurance Company to Everlake US Holdings Company. This transaction is expected to close in 2021, subject to regulatory approval and other closing conditions.

These deals will help the company completely exit the domain of traditional life and annuity businesses. Proceeds from these transactions will be deployed to growing core business.

Allstate’s strategy of increasing personal profit liability market share and expanding protection solutions was visible in the recent quarterly results. Property-liability market share increased by approximately one percentage point owing to the acquisition of National General made in January earlier this year. The deal strengthened the company’s strategic position in the independent agent distribution channel. The move advances its policy to increase its market share in personal property-liability, which actually inched up 1%.

National General has a strong position in the higher risk or “non-standard” auto insurance space. The acquisition will be accretive to Allstate’s earnings per share and its ROE will reflect significant cost synergies. The company expects a high-single digit earnings accretion in the first year post close. It also anticipates ROE accretion of approximately 100 bps, mirroring substantial cost efficiency.

Later this year, Allstate expects to launch standard auto and homeowners insurance offerings on the National General platform and intends to place the same in less than two years.

The company is on track to acquire SafeAuto soon. This deal will leverage its recently-closed acquisition of National General. It will add capabilities and distribution to the acquired entity’s direct-to-consumer non-standard auto insurance operations..

Allstate is making concerted efforts to expand its Protection Services business (previously known as Service business), which provides diversification benefits. To this end, it acquired SquareTrade in 2017, a provider of protection plans for mobile phones, consumer electronics and appliances.

The company also acquired PlumChoice in 2018, a leading provider of cloud and technical support services to consumers and small businesses. In February 2019, iCracked was acquired, which expanded SquareTrade’s protection offerings. These buyouts will expand Allstate’s Protection Services business, which improved revenues by 7.3% and 16.6% in 2019 and 2020, respectively.

It is also overhauling its operations by investing in technology. This should increase its efficiency and save operational costs.

We believe, the company is firing on all cylinders to boost growth and that the catastrophe losses will not dent its profitability.

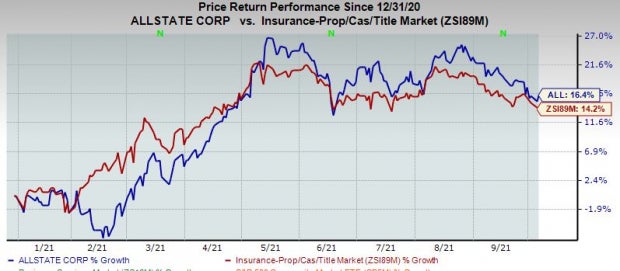

Year to date, shares of the company have gained 15.2% compared with the industry‘s growth of 14.2%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Some better-ranked stocks in the insurance space are American Financial Group Inc. AFG, RLI Corp. RLI and ProAssurance Corporation PRA, each stock currently sporting a Zacks Rank #1 (Strong Buy).

Earnings of both RLI Corp. and American Financial Group beat estimates in the trailing four quarters by 155.2% and 52.82%, respectively, on average.

ProAssurance Corporation’s bottom line beat estimates in three of the last four quarters (missing the mark in one) by 200.6%, on average.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI): Free Stock Analysis Report

The Allstate Corporation (ALL): Free Stock Analysis Report

ProAssurance Corporation (PRA): Free Stock Analysis Report

American Financial Group, Inc. (AFG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

https://www.entrepreneur.com/article/389498