As Publishers Field Controversies, Advertisers Reevaluate Spending Opportunities

Several news organizations have had a change in leadership after internal unrest that has ranged from staff inequality to unequal pay to story selection.

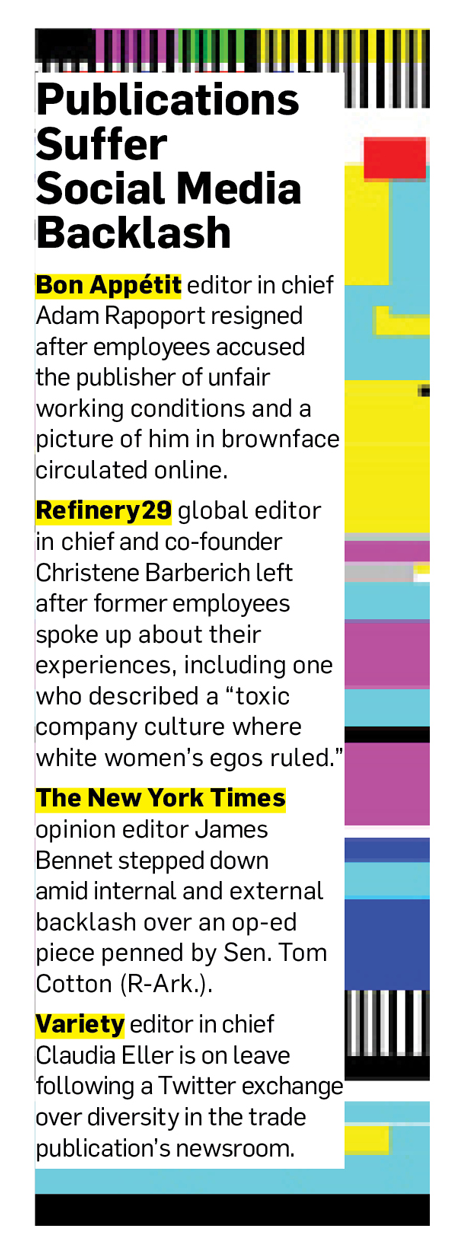

The New York Times, Variety, Bon Appétit and Refinery29 are among the publications that experienced backlash from staffers on social media. But this moment, led by employees who have turned to social media feeds to advocate for better working conditions, feels different than previous missteps. And that could lead advertisers to rethink where they spend in an already hyperconscious environment of brand safety, media analysts and media buyers told Adweek.

“Everything has a spotlight on it. The company you keep matters today. It’s not only what you do as a company but the people you associate with and where you spend your money,” said Allen Adamson, co-founder and managing partner of Metaforce and adjunct professor at New York University’s Stern School of Business. “The company you keep defines your brand as much as the brand itself.”

The New York Times declined to comment. Refinery29 and Variety didn’t immediately respond to a request for comment. Bon Appétit, meanwhile, acknowledges the need to address its D&I efforts. “While we haven’t seen significant impact on our [Bon Appétit] business, we do have work to do to be more inclusive. It’s something we take seriously, and as an industry, something we need to work together on,” said Pamela Drucker Mann, global chief revenue officer and president of U.S. revenue at Condé Nast.

While each of those media companies’ internal debates come amid a broader conversation around the roots of the latest social unrest, each scenario is different and should be treated as such by advertisers, said Barry Lowenthal, CEO of The Media Kitchen.

“Advertisers are going to be more cautious and more particular and a lot more deliberate,” Lowenthal continued, adding that he was hopeful it would create more “accountability through the entire supply chain.”

The global pandemic is expected to shave $11 billion in U.S. ad revenue from linear and digital properties this year, from $224 billion in 2019 to an expected $213 billion in 2020, according to the most recent forecast from Magna Global, the media strategy arm of IPG Mediabrands. Meanwhile, advertising on social media is expected to grow by 7% this year, according to the forecast.

To win over media buyers, publishers must assure advertisers that brand messaging, likely crafted with special attention to appear genuine to the times, will be in a brand-safe environment.

Consumers are paying close attention, said Scott Harkey, co-founder and managing partner at independent agency OH Partners. “If you want your brand to be loved by people, you have to stand for something more than making money or making a product,” he added.

Despite the brand-safety challenges associated with social media—specifically Facebook—brands still turn to those channels to communicate their messages due to their ability to target specific audiences. Facebook alone brought in $70.7 billion in ad revenue last year.

“When in doubt, most clients are going to spend their money in safer, less controversial places because there are so many choices today,” Adamson said.

Advertisers typically look to attract and use the brand equity of tested properties that audiences have already chosen. “If you think that audience levels will erode, then your value is diminished,” said Brian Wieser, global president, business intelligence at GroupM.

The more attention these issues get, in what Wieser called “brand shaming,” the more likely an advertiser is to stay away. “The conversation has to be loud enough and it has to be meaningful enough to the advertisers,” he continued.

Behavior that could have otherwise been overlooked is louder than ever, experts said. It’s up to advertisers to acknowledge it with their media dollars. In the short term, brands like Bon Appétit and Refinery29 could lose ad dollars, said Tim Smith, director of communications and media planning at agency IPNY.

“At the end of the day, it is the client’s decision. No brand manager wants to get a call from the C-suite or the PR department about the company getting called out because of a media placement,” Smith said. “At this point in time, when emotions are running so hot, any brand that senses any kind of turmoil is going to act first and ask questions later.”

https://www.adweek.com/digital/as-publishers-field-controversies-advertisers-reevaluate-spending-opportunities/