Britain’s Advertising Sector Is Set for Stagnation

Learn to partner with creators and build customer trust with authenticity. Join leaders from TikTok, the NBA and more at Social Media Week, May 16–18. Register now.

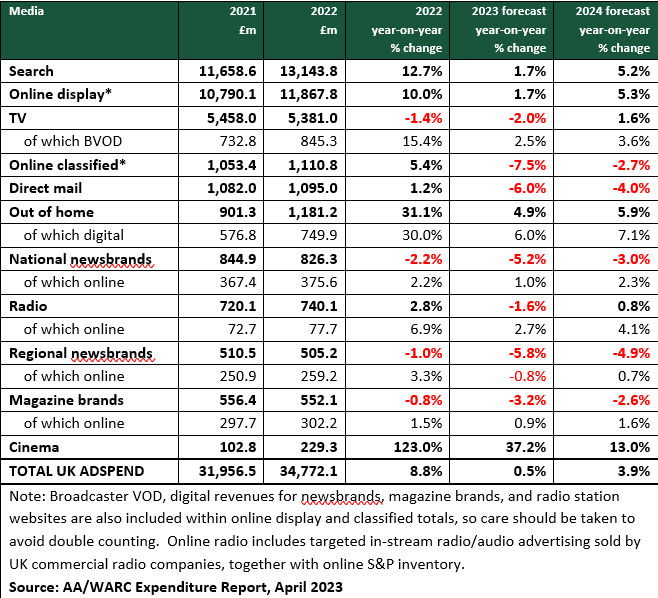

Minimal growth and lower spending on advertising are forecast for the British sector in 2023 due to ongoing economic uncertainty, with the latest figures from the Advertising Association/WARC Expenditure Report forecasting a 0.5% increase on last year’s $43.13 billion (34.8 billion pounds) spend.

According to the latest industry report (released within a week of others from the IPA and IAB), advertisers are expected to be more cautious than previously forecast with 3.8% growth predicted for the year. That has been downgraded following a fall of 5.8% in spend during the final quarter of 2022.

Digital is the exception

That downgrade means an expectation that the market will reach $43.4 billion (35 billion pounds) this year, rising to $45 billion (36.3 billion pounds) in 2024, an increase of 3.9% should high inflation and economic stagnation subside.

This means the U.K. would remain the third largest advertising market with the third fastest growth rate of 2023 within the Top 10 Markets, behind only Brazil (9.7%) and Australia (9.4%). However, it will decline to produce the slowest growth rate this year, despite the ongoing strength of digital advertising.

Last year, according to the IAB’s report produced by PwC, digital ad spending increased by 11% to $32.4 billion (26.1 billion pounds), up 56% on Q1 2020. That includes a year-on-year increase in search by 13% to reach $16.25 billion (13.1 billion pounds), while display was up by 6% to $10.4 billion.

Video grew 9% while podcast spend grew 32% to reach $94.67 million (76.3 million pounds), more than three times the level of investment when IAB UK first started measuring the market in 2020.

It forecasts continuing growth for digital spend in 2023 as advertisers aim to harness retailers’ first-party data with retail media having become a key focus for advertisers seeking alternatives to the impending cull of the third-party cookie by Google next year.

We need to address the talent shortages faced by our industry …. working with government to increase flexibility in apprenticeships, and answering the demand for digital skills.

Annette King, chair, Advertising Association

Hannah Biernat, senior manager for PwC, said the results reflected “a stabilization” in market growth in line with pre-pandemic levels. “Clients appear to be embracing connecting with audiences in emerging formats, as demonstrated by the growth in podcast investment and formats across connected devices. It will be exciting to see how the industry continues to innovate and diversify in formats and channels in the coming year.”

Marginal improvement to come

The IPA’s most recent IPA Bellwether report for the first quarter of the year is less positive, however, with a “small decline” of 0.9% expected in ad spend (it had previously forecast a decline of 0.3%) with “marginal improvement” for 2024 of 0.5% (again down from 1.2%) before expected growth of 1.6%, 2% and 2.2% in 2025, 2026 and 2027 respectively.

It did reveal that 8.2% of companies revised their marketing budgets upward in the first quarter of the year, although 12.9% said they were cutting budgets and two-thirds (66%) saw no change to spend.

According to James McDonald, director of data, intelligence and forecasting for WARC, data suggests the U.K.’s ad market actually entered a recession in the second half of 2022, with the downturn continuing during the first months of this year.

“Sharp and sustained falls in social media spend—the first time this has been recorded in the U.K.—are likely to have been instigated by reduced advertising activity among the SMEs who comprise a ‘long tail’ of ad volume on social platforms and whose margins are under incredible stress as inflation bites. One in every 202 U.K. companies entered liquidation in 2022—the highest rate in seven years—and it is unsurprising to see these pressures reflected to some degree within advertising trade,” he continued.

A plan for growth is missing

Annette King, chair of the Advertising Association, said the U.K. needs “a strong plan for growth” that capitalizes on the advertising industry’s skills to help businesses to innovate and compete.

“We need to address the talent shortages faced by our industry—for example, working with government to increase flexibility in apprenticeships, and answering the demand for digital skills and expertise, which will equip our workforce for the future,” King continued.

Worldwide, marketers have been preparing contingency plans, according to a survey by Gartner that found more than three-quarters (79%) of 400 marketing leaders were expecting to weather the storm of continued economic and geopolitical uncertainty.

It also revealed that 44% of digital marketing leaders who enacted a contingency plan during an economic disruption were able to exceed their organizations’ expected profit growth as a result.

“With ongoing economic and geopolitical disruption, contingency plans are more important than ever,” said Greg Carlucci, senior director analyst in the Gartner Marketing practice. “Having a plan is a good first step, but following through on that plan when disruption occurs is what really matters.”

https://www.adweek.com/brand-marketing/britains-advertising-sector-is-set-for-stagnation/