Chip shortages lead to more counterfeit chips and devices

Beginning with the first Wuhan quarantine in January 2020, the COVID-19 pandemic hit the world from both sides of the law of supply and demand. Independent Distributors of Electronics Association (IDEA) founder Steve Calabria believes this two-fisted squeeze will spawn a surge in counterfeit electronics, with consequences for longevity and reliability of equipment built with substandard components.

Supply, demand, and counterfeit

Pandemic lockdowns in industrial cities have pinched supply of both finished goods and raw materials, while demand for electronic products has skyrocketed due to both the need for remote work/school gear and simple boredom from people unable to travel, dine out, and party in the ways they’re accustomed to.

The immediate impact of this shortage is obvious and already well-reported—for example, it’s so difficult to buy a graphics card right now that manufacturer MSI is bringing back the 2014-era Nvidia GT 730. The GT 730 is, frankly, garbage—it offers a bit more than half the performance of Intel’s UHD integrated graphics and less than a fifth the performance of 2015’s GTX 950. But it works—and for the moment, that’s the most important thing to be said about it.

Resurrecting an old product line and accurately labeling it is, of course, fine. But it’s an option only available to large, established manufacturers like MSI—companies with old but valid supply lines, licenses, and in some cases, long-warehoused parts that can be picked up, dusted off, and put back to good use. Smaller and less scrupulous companies hoping to cash in on the pandemic pinch have a quicker, easier way to satisfy unfilled market demand: fake goods.

A hint of things to come

Calabria tells ZDNet that “worldwide shortages have opened the door for criminals to exploit the electronic component marketplace,” adding that he’s already seeing early signs of trouble. “Companies that have never been rated by any other company in the industry [are] showing significant quantities of parts that are in shortage.”

Counterfeit electronics aren’t a new problem, of course. Counterfeit iPhones, Kindles, and so forth have abounded on e-commerce sites like Alibaba and Aliexpress for a long time. But counterfeit chips target their market a bit differently—instead of going after consumers trying to save a little money, counterfeit chips target production lines in danger of shutting down entirely.

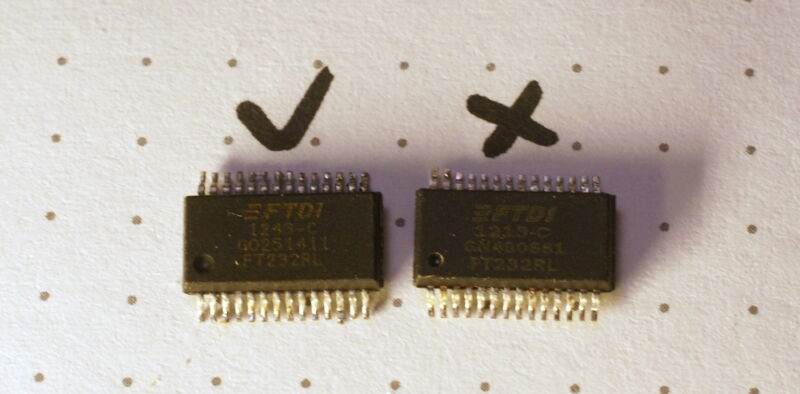

It can be easier to produce a counterfeit chip than an entire device. A consumer device needs an operating system, hardware integration, and more—making most fakes obvious at first glance to a reasonably well-educated purchaser. Faking the chips used to make that device can frequently be a much simpler proposition, with few if any obvious visible indicators that something is not quite right.

A counterfeit chip might be a knock-off designed inexpensively from scratch as a drop-in replacement, or it might be a genuine-but-scavenged part, desoldered from the board it was found on, cleaned up, and pressed back into service as new. Either way, such chips can frequently work well enough to pass muster at first but fail earlier than genuine parts—or under a specific load or in a specific environment that the original would have passed.

Desperate times lead to desperate measures

Manufacturing companies are well aware of counterfeit chips and normally have elaborate measures to detect and avoid them. But according to Diganta Das, a counterfeit electronics researcher at CALCE, those processes can get left behind when it’s a question of whether the line runs or sits idle. When a company needs 5,000 parts next week in order to keep a line running, he says, “you won’t keep to your rules of verifying the vendor or going through test processes.”

Das says it’s still too early to notice a surge in counterfeit reporting databases like the one maintained by the Electronic Reseller’s Association International (ERAI). But like Calabria, he’s confident that a surge in counterfeit parts into the supply chain is already happening—and that it will become more visible in the months to come as companies must deal with the problems caused by the use of fake parts.

This isn’t a problem that is likely to impact the largest tech manufacturing giants, which buy their parts directly from the chip foundries that produce them in massive lots. The risk affects companies that buy their components in smaller batches from distributors further down the supply chain. However, those distributors supply manufacturers in the healthcare, automotive, and defense industries.

One of those distributors, AERI, has an excellent guide to recognizing counterfeit components, with plenty of helpful illustrations. Original components tend to have small cavities in certain locations on the chip—counterfeiters may forget to reproduce them, fill them in during sanding and refinishing (to make old parts appear new), or make them in the wrong size, place, or shape. These indents thus serve similar purposes to security ribbons and threads in paper money.

Physical surface examination isn’t always sufficient to spot the difference between fake and real products. In some cases, time-consuming, destructive disassembly and microscopic examination, such as that seen in this excellent illustrated report at Zeptobars, is required to reliably detect a new knockoff.

Counterfeiters are well aware of the time pressure facing companies and structure their pitch to target them. “I have 5,000 of these in stock but you need to buy today, not next week” can compel a desperate manufacturer to cut corners and forget its normal supply chain verification process. But putting failure-prone counterfeit parts in a product only staves off the crisis. In most cases, it’s a question of whether that company loses money now due to idle lines or loses it later due to product replacements, lawsuits, and mass recalls.

https://arstechnica.com/?p=1773176