Does the Growth of Connected TV Spell Trouble for Ad Tech?

If the 2010s were the decade of mobile advertising, then the 2020s are gearing up to be the era of connected TV.

Advertisers, media owners and ad-tech companies are pouring resources into CTV as television viewing habits drastically change.

The novel coronavirus pandemic has accelerated these shifts. Streaming is up as people stay home during lockdowns. Plus, the economic fallout of the pandemic is expected to hasten cord-cutting, with traditional paid TV subscriptions expected to fall by 27 million over the next four years, according to MoffettNathanson.

Investments are quickly following. Major media companies like Disney and WarnerMedia reorganized this year to focus more of their business on streaming.

Marketers are moving their budgets accordingly. According to an IAB survey, 60% of digital video buyers plan to move, on average, roughly one-fifth of their linear TV budgets into CTV next year.

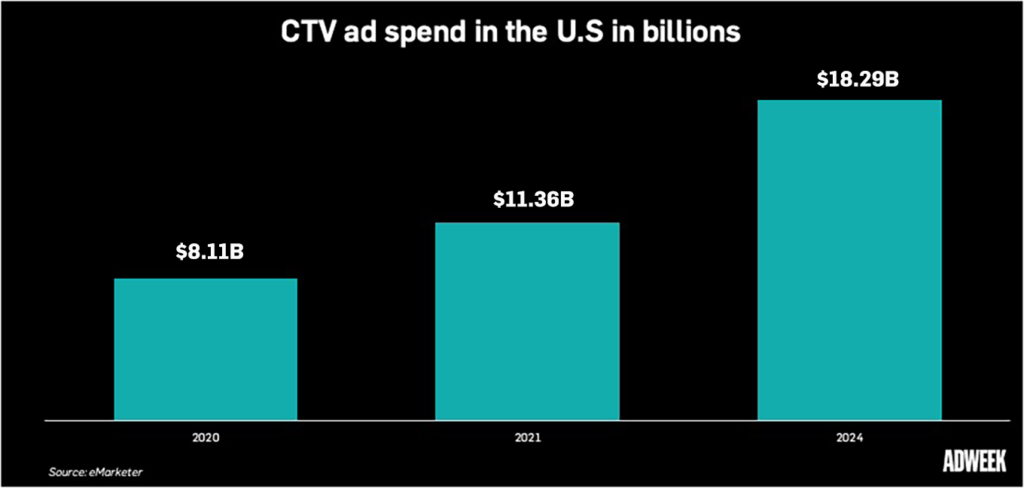

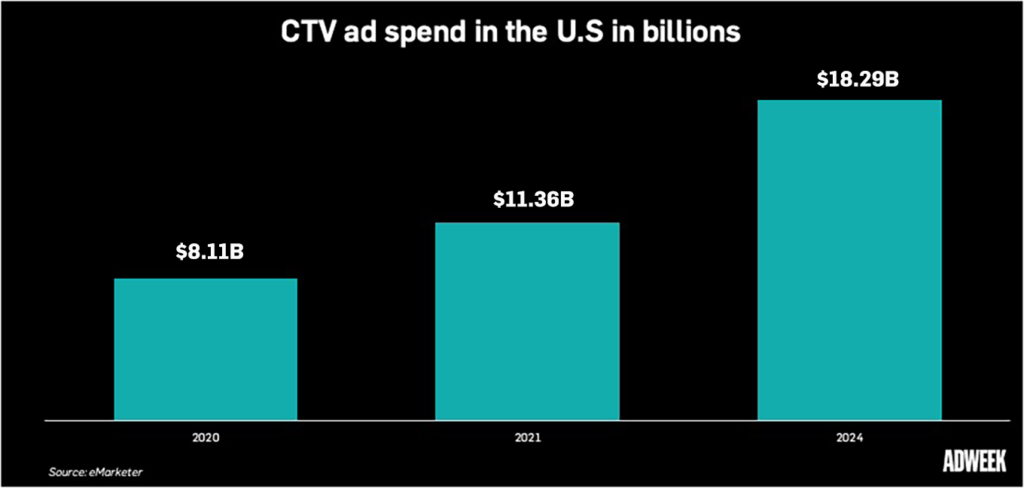

CTV ad spend in the U.S. is expected to total $8.11 billion by the end of 2020 and $11.36 billion in 2021, according to eMarketer. By 2024, total spend is expected to reach $18.29 billion, according to the research firm.

Where does that leave ad tech?

Ad-tech companies, like The Trade Desk and the newly public PubMatic, are also building new products to grab a piece of the growing CTV pie. But their place in the market is still unclear.

Traditional broadcasters want tight controls around their premium inventory as they move into CTV, a common practice in the upfront linear marketplace but an uncommon practice across the open web, where real-time bidding freely exposes publisher data.

As a result, unlike desktop and mobile advertising, CTV ads are typically transacted directly or with more controls, usually through insertion orders, programmatic guaranteed deals or private marketplaces (PMP).

Brian Wieser, global president of business intelligence at GroupM, said that makes less room for ad-tech companies that have helped marketers find specific audiences in display environment, since TV advertising is more about aligning a brand with a piece of content.

“You don’t need all the ad tech. The ad tech is all about … helping advertisers to discover audiences and helping publishers discover advertisers. That’s … nowhere near as necessary in a world where an advertiser wants a specific program, because they think that’s the proxy for getting the audience they want,” said Wieser.

Instead of firing up the open auction, as they would in desktop environments, ad-tech companies are setting up programmatic guaranteed or PMP deals to directly connect publishers and advertisers in CTV.

But building new technologies and offering managed services is expensive. For example, PubMatic said it has experienced “fee pressure” as it operates more PMPs.

Sean Buckley, COO of SpotX, said there’s a lot of “service-related work” in supporting CTV transaction. For SpotX, a supply-side platform, that includes investing more resources in its demand facilitation team.

“Getting the transactions to happen and getting those terms to be fully executed on, that’s not trivial in the programmatic ecosystem, especially in a deal-driven world,” said Buckley.

Overall, SpotX said programmatic guaranteed CTV deals increase by 90% compared to last year, and the company expects to see 150% of that transaction in 2021.

The emerging platforms

The one thing ad-tech companies don’t have to worry about in CTV (yet) is the digital duopoly of Google and Facebook.

https://www.adweek.com/tv-video/does-the-growth-of-connected-tv-spell-trouble-for-ad-tech/