Exclusive: Location App Life360 Is Growing a $10 Million Ad Business

Don’t miss Mediaweek, October 29-30 in New York City. Save 20% on passes and gain winning media strategies to drive growth across channels. Hurry—sale ends Sept 9.

Location-sharing application Life360 is launching its direct advertising sales business today, with Uber as one of its first major advertisers, the company shared with ADWEEK exclusively.

Life360, a publicly traded mobile app company, first said it was starting an advertising business on an earnings call in February, and it expects that business to grow to between $5 million and $10 million by the end of this year, according to Russell Burke, chief financial officer.

“The engagement that we’re having with Uber is emblematic of the kind of direct partnerships we’re creating with various brands that are super-focused on family,” said Brian McDevitt, a Google veteran who started last month at Life360 in a newly created role, vice president of ad sales and strategy. “It’s a sign of many more of those kinds of deals to come.”

Life360 joins a growing list of companies, from retailers to financial service firms to Uber itself, that didn’t start as pure-play media companies but are now looking to translate a captive digital customer base into an audience for advertisers.

Life360 helps families connect by sharing locations and providing other safety services. The company has historically made most of its revenue via subscriptions.

Uber marks the launch of the Life360 direct-sales business, but it tested the program with children’s debit card company Greenlight. Allstate-owned Arity is also a client.

The company has sold ads programmatically since the end of the second quarter of 2024, and it has struck partnerships with The Trade Desk, PubMatic, and Google Ad Manager. In August, Life360 announced a partnership with LiveRamp, which lets advertisers target Life360 on offsite media properties.

The company is a top 10 social networking app, according to the Apple App Store, and it has 70 million monthly active users globally and 40 million in the U.S.

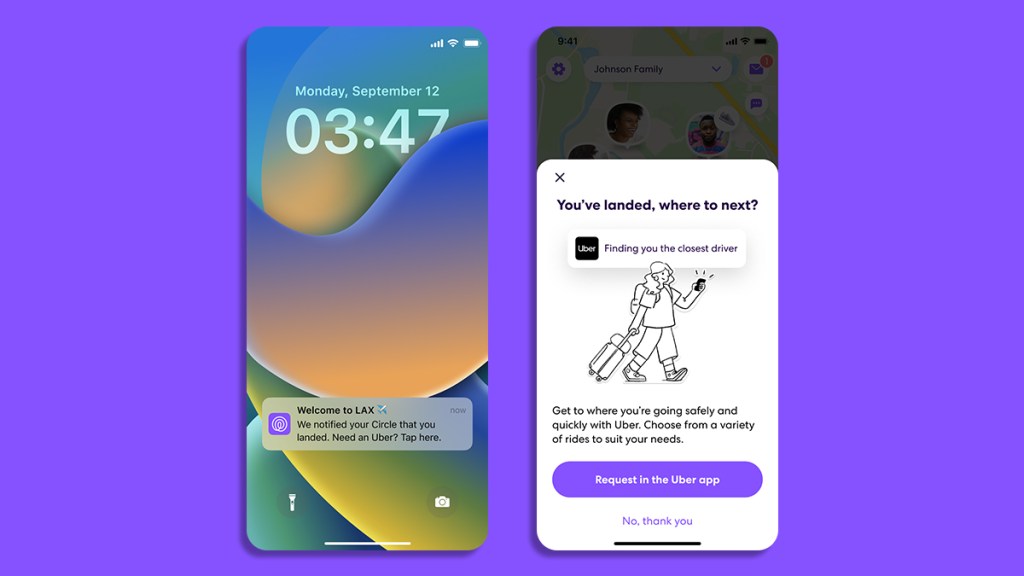

For the Uber campaign, when users land from a flight, they will get a prompt to download the ride-hailing app. Uber will also run in-app ads using Life360’s data on its 18+ users starting in mid-September.

The focus is to target parents of teens with teen accounts on Uber, which lets parents monitor their kids’ Uber use. If parents refer teens to create an Uber teen account, the latter will get six free rides and six free orders in September.

“At Uber, we see a tremendous opportunity to connect with families in meaningful ways through our partnership with Life360,” said Cait O’Donovan, interim U.S. and Canada consumer operations and new verticals lead at Uber. “With their deep understanding of family routines and our commitment to safe, reliable transportation, we’re able to provide solutions that simplify everyday life while ensuring peace of mind.”

Advertisers looking for families and location

Life360 believes it can stand out from competitors because of its family-centric audience and location data.

“We’re starting to generate interest from a lot of other brands that are interested in our proximity to modern family life and families in general,” McDevitt said, “and brands and advertisers that really care about location-specific insights and audiences.”

McDevitt suggested that potential advertisers could include automotive brands, which could use Life360’s data to ascertain whether a family is getting a new driver or if it’s growing in size. McDevitt also listed streaming companies and restaurant brands that could fulfill other needs for a family.

“It’s exciting to contemplate something beyond an individual and a household as a targetable group,” said Ana Milicevic, co-founder of programmatic consultancy Sparrow Advisors. “For example, friend groups or extended family can be particularly impactful with key purchasing decisions.”

In an investor presentation, Life360 cites Uber’s own advertising business, which is expected to hit $1 billion this year, as a case study for how investors can think about the potential growth of Life360’s advertising business.

But achieving that level of success might be the exception rather than the rule, said a mobile advertising executive, speaking anonymously. The exec pointed to community-focused platform NextDoor, which made $218 million in revenue last year, primarily from advertising with around 41.8 million weekly active users.

“Every scaled platform is introducing ads in some form,” the exec said. “NextDoor … has a robust ads product and captures a tiny, tiny, tiny share of wallet from the ecosystem.”

Not alienating users

Life360 is mindful that many users didn’t originally sign up for an app with ads. Certain ad formats, like interstitials and video ads, would “be a bridge too far” for maintaining user experience, CEO Chris Hulls said on an August earnings call. The firm will also control which brands advertise on its platform.

Moreover, children represent a significant chunk of Life360’s user base, and location data is sensitive. After an investigation from The Markup in 2021 found that Life360 was selling precise location data to data brokers, the company said it would stop the sale of this location data to all partners except Arity. A proposed class-action lawsuit was also brought against Life360, according to The Markup.

The company said those under 18 will automatically not be part of the advertising operation.

“Data from users under 18 is strictly excluded from receiving ads and being included in targeted advertising segments,” a Life360 spokesperson said.

https://www.adweek.com/media/exclusive-location-app-life360-with-help-from-brands-like-uber-is-growing-a-10m-ad-business-this-year/