Fanatics and Topps’ Customers Are Aging. How the Brands Are Reaching New Demos

Announcing! Brandweek is headed to Phoenix, Arizona this September 23–26. Join us there to explore the future of marketing, discover cutting-edge strategies and network with the best in the business.

Topps and parent company Fanatics aren’t saying it explicitly, but their recent trading card offerings reflect an unavoidable truth: Millennial sports fans are getting old.

Born between 1981 and 1996, the most wizened millennials will be 43 this year. They’ve already watched Peyton and Eli Manning go from champion quarterbacks to personalities and pitchmen, and Mia Hamm, Julie Foudy and Abby Wambach go from U.S. World Cup soccer icons to part owners of the National Women’s Soccer League’s Angel City FC.

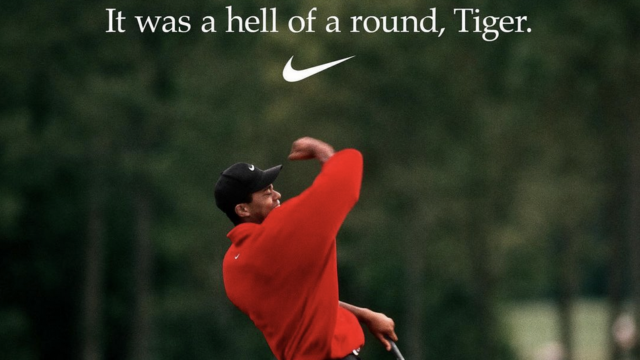

Within the last three years alone, millennials have also watched Serena Williams, Tom Brady, Megan Rapinoe, Roger Federer, Sue Bird, Rob Gronkowski, Allyson Felix, J.J. Watt and Sylvia Fowles—among others—walk away from their respective games. With Tiger Woods breaking from Nike to join TaylorMade and LeBron James leaving a longtime deal with Upper Deck, Fanatics CEO Michael Rubin and Fanatics Collectibles CEO Mike Mahan saw a generational transition and a chance to link an outgoing past with an incoming present.

“The core collector is passionate: They recognize collecting for its intrinsic value in the collection of cards, and the cards themselves have meaning, value and, in most cases, they hold memories,” said Ken Turner, CMO of Fanatics. “As a great marketer, you want to be able to trigger those memories.”

Last year, Topps used its partnership with Brady to promote draft-pick cards from its Bowman brand with a full ad campaign imagining what it would’ve been like if the six-time Super Bowl winner had instead started a baseball career with the Montreal Expos when they drafted him in 1995. The ad includes Brady’s would-be teammates and former Expos Pedro Martinez, Larry Walker and Vladimir Guerrero, whose son Vladimir Guerrero Jr. is an All-Star for the Toronto Blue Jays.

In James’ case, Topps used an image of him in his St. Vincent-St. Mary High School uniform and paired it with one of his son Bronny playing at the University of Southern California for its Bowman Chrome series—surrounding it with a campaign that also included Iowa hoops star Caitlin Clark and Seattle baseball All-Star Julio Rodriguez.

Market Decipher noted that the sports trading card market in the U.S. grew to $12.9 billion after a pandemic boom, but Fanatics doesn’t envision that market growing 13% a year and topping $49 billion by 2032 without tapping into the memory structure of millennial fans while building off of the newly generated recollections of ensuing generations.

“The way you tie that together is in the way that you message it, but also the way that you deliver it,” Turner said, noting that Topps’ new campaigns have blended long-form ads on YouTube with Instagram stories and reels. ”It’s a really good formula that we’ve been using to allow us to engage with the current collector, but also grow and engage with the new collector.”

From nostalgia to newstalgia

From 2019 through 2021—at the height of the pandemic-fueled trading card comeback—consumer analytics platform Civic Science conducted a survey of card buyers and found that 35% to 41% made their purchases based on nostalgia. That outpaced the 26% to 27% who simply liked the player on the card, the 22% to 25% who saw cards as investment, and the 11% to 16% looking to flip them for profit.

While those 24 and under are still more likely to be actively rooting for the player on their card (48%), nostalgia becomes a main driver for collectors from 25-34 (36%) and only gets stronger once they hit 35-54 (44%). Anjali Bal, a professor of marketing at Babson College specializing in sports and entertainment marketing, noted that millennial sports sentimentality holds certain advantages for sports marketers.

“Millennials really started the shift toward where the athletes had the power in the marketing relationship versus a team or a location or a sport,” Bal said. “There’s a connection and a nostalgia to those players who grew up with us, and that’s why we’re seeing millennials favoring millennial athletes even if they’re no longer in the sport.”

The problem for brands like Bowman, Topps and Fanatics is that—as Civic Science found—only about 20% of the general public buys sports trading cards. While 34% of Gen Z and the 39% of the oldest millennials are active collectors, the percentage that’s never owned cards at all jumps from 49% for all millennials to 56% for Gen Z.

So how do you bring in a new generation that’s largely averse to your product? Bal points to the NCAA’s name, image and likeness (NIL) rights that put Bronny James on a card with his dad and his USC jersey. NIL deals have not only given companies like Fanatics increased access to college players, but they provide access to some of the most popular athletes in women’s sports.

“Caitlin Clark, Angel Reese, all the big names within women’s NCAA basketball are staying longer because they can financially benefit from it,” Bal said. “If I can get the people who are in college at the same time as these athletes to stay with me … I think you increase the likelihood that the association of the brand Fanatics is with the future of sports.”

Completing the set

Fanatics and Topps can hold die-hard baseball fans’ interest by having 2023 Topps Series One cover star Julio Rodríguez hand off the 2024 cover to Ronald Acuña Jr. They can post videos of picks, breaks and other events that will keep collectors overjoyed.

But to reach audiences beyond a core Turner identified as broadly male and aged 35 to 54, Fanatics has been expanding the boundaries of trading card relevance. While their Topps truck has been a fixture at Major League Baseball games and All-Star week—doling out free cards and giving fans a chance to make their own—more recently it’s parked at the Little League Softball World Series in Greenville, N.C., where it followed Athletes Unlimited professional softball players who were featured on their own set of Topps cards last year.

Topps loaded this year’s BowmanU Chrome Basketball set with cards featuring Reese, Stanford star forward Cameron Brink, University of Connecticut point guard Paige Bueckers and others. Clark not only has multiple cards of her own, but a special edition card released after she broke the NCAA women’s scoring record sold out in days.

“Any time we have an opportunity to partner and align ourselves with amazing athletes, what we want to be able to do is celebrate those moments and celebrate those memories,” Turner said.

Fanatics’ athlete team and its head of athlete partnerships, former NBA agent Omar Wilkes, have begun working with athletes including San Antonio Spurs rookie Victor Wembanyama and their teams at earlier stages to understand what the athlete wants their brand to be.

According to Bal, creating connections to young athletes gives Fanatics and Topps a tool perhaps more powerful than nostalgia: association. Nike is strongly associated with Michael Jordan and Tiger Woods. Fanatics and its card brands have the opportunity to align themselves with a new, larger generation of athletes as NIL deals help softball, volleyball and women’s basketball grow in both participation and viewership.

“It’s this amazing self-fulfilling prophecy, where if you get somebody dominant in it, who does a really good job of marketing themselves, that markets everything else,” Bal said. “For companies like Fanatics, they are in this awesome position where they can just support everyone because all they have to do is assess talent early on … and they’re probably pretty good at that.”

https://www.adweek.com/brand-marketing/fanatics-topps-lebron-tom-brady-caitlin-clark/