Get Money (COVID Remix)

Early 2021 was a prosperous time for Austin Richard Post, better known as the “Sunflower” singer Post Malone.

While many of his entertainment-industry colleagues struggled to pay rent under the pandemic-era lockdowns that decimated live music in the US, Post bought a 9,000-square-foot ski chalet in Park City, Utah, which had been listed for $11.5 million, in an all-cash transaction that February.

By May, he’d bought an industrial space in a Salt Lake City suburb that had been listed for $1.45 million. There, he opened a commercial forge to craft knives and swords, “as a hobby,” Post’s representative told the city’s planning commission.

But later that year, a corporation controlled by Post successfully applied for a $10 million grant from a taxpayer-funded federal program intended to provide “emergency assistance” to help struggling arts groups recover from the pandemic.

The program, the Shuttered Venue Operators Grant, was a lifeline for the live-entertainment business. Administered by the Small Business Administration, it doled out $14.5 billion to institutions like movie theaters, ballets, operas, talent agents, performing-arts venues, and museums. Unlike the Paycheck Protection Program, which many venues didn’t qualify for, the Shuttered Venue program was a grant, not a loan. Qualified applicants were eligible for up to $10 million with no obligation to repay it.

“SVOG was there to save us, and to carry us through,” said Meredith Lynsey Schade, who was managing an off-off-Broadway theater company when the pandemic hit.

But the Shuttered Venue program was also plagued by ineffective oversight and loopholes that allowed some of the biggest names in the music industry to get huge payouts, an Insider investigation found.

R&B artist Chris Brown got $10 million. Rapper Lil Wayne got $8.9 million. Nineties rockers The Smashing Pumpkins got $8.6 million. Nickelback — yes, Nickelback — received $2 million.

All told, Insider identified dozens of corporations and limited-liability companies controlled by high-profile musical artists that received grants through the program. A single financial-management firm in Los Angeles successfully submitted grants on behalf of 97 artists, venues, and managers, amounting to more than a quarter of a billion dollars in grant payouts, Insider’s analysis found, including more than $200 million for big-name artists alone.

Did your favorite musician get a big federal payout?

Insider identified dozens of big-name musical artists whose touring companies scored millions of dollars in federal grants during the pandemic.

Source: Small Business Administration

Publicly, the bill that created the Shuttered Venues grant was marketed as supporting behind-the-scenes workers at indie venues and small stages — not arena-filling musicians.

Sen. Chuck Schumer, one of the lawmakers who sponsored what was then known as the “Save Our Stages” bill, told his constituents the money would be used for “independent live venue operators, independent movie theaters, and cultural institutions such as live performing arts organizations and museums,” according to a press release. At a star-studded ceremony in April, Schumer was honored by the Recording Academy, the group behind the Grammys, for passing the bill. A spokesperson for Schumer declined to comment.

I was so honored to be recognized at this year’s @RecordingAcad #GRAMMYsontheHill!

My love for music runs deep.

That’s why I made it my mission to pass the Save Our Stages Act, and I’ll keep up the work to support the music and performance industry. pic.twitter.com/z1OCg22RAU

— Chuck Schumer (@SenSchumer) April 27, 2023

Hundreds of musicians and other performing artists signed an open letter to Congress asking them to support “neighborhood independent venues” where many of them had gotten their starts.

Some of those same artists controlled companies that went on to receive multimillion-dollar payouts from the program, including the electronic-music superstar Steve Aoki ($9.9 million) and the “Feel It Still” crooners Portugal. The Man ($2.25 million).

The Shuttered Venue program “helped save thousands of entertainment venues and operators across the country during the COVID-19 pandemic,” an SBA spokesperson said in a statement. Nearly half the grant money went to businesses with fewer than five full-time employees, “the smallest of small businesses,” the spokesperson added.

But some of the artists’ businesses Insider analyzed would fit into that category. For instance, Aoki’s corporation, DJ Kid Millionaire Touring Inc., told the government it had just four full-time employees on its application for a $71,000 PPP loan.

A lack of controls

There is no indication that payments to big-name artists broke the law. Though the legislation was targeted at “live performing arts organization operators,” an SBA representative confirmed to Insider that artists themselves were included within its scope.

The government is still determining just how much pandemic-era aid went to fraudulent claims. In June, the SBA inspector general released a report contending that 8% of the loans disbursed by the Paycheck Protection Program, which pumped about $800 billion into the US economy during the lockdowns, might have been fraudulent. The agency’s Economic Injury Disaster Loans, which paid out about $400 billion, had an even higher rate of potential fraud, according to the report: one-third. Fraudsters blew the money on things like sports cars, luxury handbags, and gold bars, the inspector general found.

The SBA has disputed those findings, and touted its oversight of the Shuttered Venue program in particular as wildly successful. The agency estimates that less than 1% of grants disbursed through SVOG were fraudulent, it said in a report last month.

Industry sources contacted by Insider defended the Shuttered Venue program by pointing out that many artists typically contract with hundreds of sound and lighting technicians, costumers, drivers, security personnel, and other contractors when they put together a tour. All those contractors were out of work during the lockdowns, the sources said, and artists applying for grants could have used the money to help keep them afloat.

Electronic music superstar Steve Aoki asked Congress for money to save small stages. Then a company he controls got a $9.9 million grant from the program. Greg Doherty / Contributor / Getty Images

But there was no requirement that they spend the money that way. The grant money was intended as replacement for lost revenue, and recipients could spend it on things like existing mortgage payments, taxes, and payroll — including paying themselves.

The lack of spending controls created opportunities for impropriety, according to the SBA’s inspector general and sources reached by Insider.

For one, applicants needed to get the SBA’s approval on a detailed budget to receive a grant and to submit documentation showing how the money was eventually spent. (The agency denied Insider’s requests under the Freedom of Information Act for records showing how the artists spent the money, citing an exemption for confidential business records.)

But after they had the money, recipients were permitted to shift it around to different authorized uses, the inspector general noted in a report last year. It called the practice “concerning” and out of line with how the SBA administers other grants.

Moreover, companies that contract with artists to support tours were themselves eligible to receive SVOG funding, raising questions about whether some companies were paid from artists’ grants while also receiving grants themselves. For instance, two of the biggest sound-system providers for touring, Eighth Day Sound and Clair Global — which merged in 2020 — each received $10 million grants.

Insider contacted more than 60 grant recipients, including Clair and Eighth Day, as well as all of the artists named in this article, to ask how they spent their grants. None of them shared detailed information, and most did not respond.

Eighth Day’s president, Tom Arko, said he had no insight into how Eighth Day used the grant money because Clair Global has handled its finances since the merger. But he was surprised when an Insider reporter shared the names of some of the artists whose companies received grant money. Other stars like Bonnie Raitt and Justin Bieber paid their production crews from their own pockets when the pandemic canceled their concerts, Arko noted.

There were few limits on how the money could be spent. The grants couldn’t be used directly for some things, like buying real estate or making political donations. But under SBA guidelines, the grants could be used to pay “owner compensation,” an amount the agency capped at whatever the owner earned in 2019. In other words, Post Malone or the members of Nickelback could have used at least some grant money to pay themselves directly without violating the program’s rules. (There is no evidence that they did so.)

And artists weren’t the only ones free to get in on the action: The SBA told Insider that grant recipients could pay the lawyers, managers, and accountants who prepared their applications whatever was “ordinary and necessary” — a figure as high as 15%, according to the complaint in one lawsuit. By contrast, the Paycheck Protection Program capped such fees, which it called “agent fees,” at 1% for PPP loans.

Business managers, talent agents, and others surrounding the artists also cashed in directly. Two companies owned by Post Malone’s comanagers, Austin Rosen and Dre London, received grants totaling nearly $20 million in 2021. Rosen, for one, didn’t appear to be hurting for money: In 2021 and 2022, he spent $25 million to assemble a Miami Beach estate. (Insider found no evidence that either man paid themselves.)

Two entities partly owned by the legendary talent manager Irving Azoff, whose firm’s clients include The Eagles, Lizzo, Harry Styles, and Gwen Stefani, together got $17.5 million from the program.

Music mogul Irving Azoff, pictured here with Gwen Stefani at last year’s Rock and Roll Hall of Fame induction ceremony. Two entities he partly owns got $17.5 million. Kevin Mazur/Getty Images for The Rock and Roll Hall of Fame

Marty Singer, a lawyer for Azoff, told Insider that the companies complied with the SVOG program’s rules and that Azoff himself was not in need of any bailout funds.

A pandemic-era asset purchase appears to support Singer’s description of Azoff’s financial position. In November 2021, Azoff purchased a $21.5 million Beverly Hills estate adjoining another home he owns.

“Irving Azoff did not benefit personally,” he said. “My client doesn’t need SVOG money to buy a house.”

Publicly traded companies were ineligible for grant money, but the concert powerhouse Live Nation still was able to benefit from Shuttered Venue funding as a slew of its subsidiaries were bolstered by grant money, The Washington Post reported.

In a statement, a representative for Live Nation said the company has no ability to control whether its subsidiaries access aid programs, adding that the subsidiaries used “every resource legally available to them to support their employees through this crisis, which was not only their right but also an entirely understandable and human thing to do.”

A $496,000 overpayment

Meanwhile, smaller and less celebrated organizations struggled to access Shuttered Venue funding. Many applicants found it difficult to navigate the SBA’s requirements, which contributed to 30% of applications being denied, compared with a 3% denial rate for Paycheck Protection Program funds. The owner of a New Orleans escape-room company complained to The Intercept in 2021 that the SBA was creating “winners and losers in the same industry because of the arbitrariness of the awards.”

The agency was initially so unprepared for the onslaught of applications that its online portal crashed and was offline for two weeks. Some small-business owners were told that the SBA had denied them funding because the agency believed they were dead.

Applicants went to great lengths to qualify for SVOG funds, scrounging up floor plans and marketing materials and amending years of tax returns to revise their NAICS codes, according to lawsuits and a music-industry accountant who spoke with Insider. But for others, the process was far easier. Andre Lorquet, a Florida man, looted $3.8 million from SVOG with a few phony tax documents, court records say. He used some of it to buy a Lamborghini. (Lorquet pleaded guilty to identity theft and money laundering in January.)

A company controlled by the members of the metal band Korn received nearly $5.3 million in taxpayer-funded grant money. Daniel Knighton/Getty Images

The SBA’s inspector general has raised questions about the program’s oversight, finding in a report last year that the “SBA did not follow fundamental grant management controls intended to protect taxpayer funds.”

In one case the inspector general reviewed, an application for $55,000 resulted in a $551,000 grant — a $496,000 overpayment. In another instance, an SBA employee concluded that a recipient who had initially received a $4.9 million grant was actually eligible for only $3 million, but the agency didn’t take any steps to recover the $1.9 million in overpayments.

In a response to the inspector general’s report, the SBA contested those findings, saying both awards were justified. “The SBA has robust compliance control processes in place to ensure funds were used in accordance with congressional statute, including ongoing monitoring programs and audit reviews, and refers any suspicions of fraud to federal law enforcement,” an agency spokesperson said in a statement to Insider.

The inspector general is conducting an additional audit of the grant program, which it expects to release this year.

‘Outside-the-box’ advisors

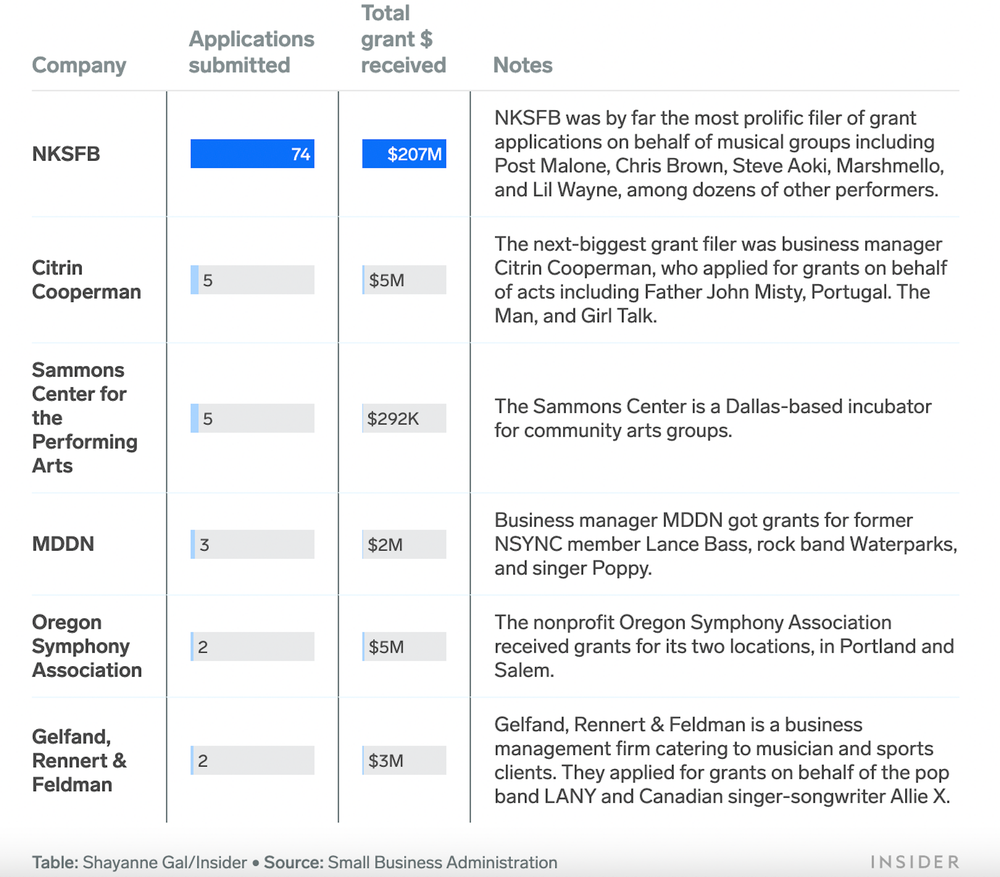

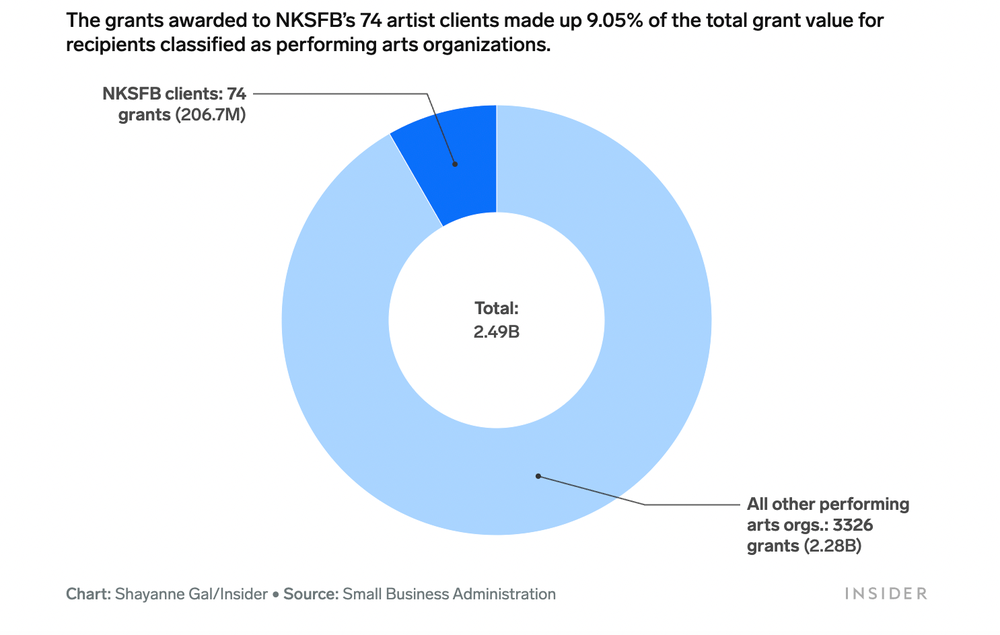

Within the music industry, though, one asset-management firm alone helped unlock more than $260 million in taxpayer money for just 97 artists, venues, and managers, according to an Insider review of the SBA’s grant-recipient database.

That firm, NKSFB, counts some of the biggest names in the music industry as clients, including Post Malone, Marshmello, Aoki, Godsmack, and Korn. It played up its success with Shuttered Venue grants: One partner bragged to Billboard that they helped clients explore “outside-the-box” funding streams like SVOG.

One company obtained by far the most grants for live performers

The firm began applying for Shuttered Venue grants on behalf of its artists starting in July 2021, according to a lawsuit filed against NKSFB by Laurence Leader, a rival business manager who claimed he pitched the firm on the idea of getting grants for their clients — for a 15% commission — only to have NKSFB steal his idea. NKSFB denied the allegations; the case is pending.

A veteran NKSFB manager, Michael Oppenheim, was initially skeptical that his clients would qualify for the grant, according to the lawsuit. But after Leader told Oppenheim he’d already submitted an application on behalf of an unnamed jazz musician, Oppenheim decided to give the idea a try, the lawsuit said.

Within weeks, NKSFB had submitted applications on behalf of “dozens” of its “popular mainstream artist and band clients,” according to the suit. Under SBA rules, the firm would be permitted to take a cut of each grant.

NKSFB clients got nearly 10% of the total grants awarded to performing arts organizations

One business manager told Insider his clients began to “aggressively” press for SVOG money once word of NKSFB’s strategy got around. The business manager said he didn’t think artists or managers qualified, and went to a prominent lawyer, who agreed.

“If you look at the name of the program, it’s the ‘Shuttered Venue Operator Grant,'” the manager said. “Nowhere in there do you hear ‘performer’ or ‘artist’ or any of that.”

NKSFB’s managing partner Mickey Segal declined to comment, citing a corporate policy of not discussing client matters. Oppenheim died in April.

NKSFB got its clients more money than the typical grant recipient

‘Comparing wounds’

Schade, the theater-company manager, who says she’s the type of person to “always do my homework,” heard about the bill that would create the Shuttered Venue Operators Grant in early 2021 and threw herself into learning its intricacies. She became something of an SBA whisperer to small and midsize arts groups applying for the grant, reviewing applications and funneling information from the SBA to a 2,500-member Facebook group. Their questions ultimately became so overwhelming that she hired an assistant to help her address them, she said.

Much of the money disbursed through the grant program went to symphony orchestras, theatrical groups — including all five touring productions of “Hamilton,” the Oregon Shakespeare Festival, and the magician David Copperfield — concert halls, zoos, aquariums, and small community-arts organizations, according to a review of the more than 13,000 grant recipients published on the SBA’s website.

Grant officers scrutinized applicants minutely, applicants told Insider, asking them to submit concert posters and contracts from previous tours to prove that they were legitimate performers.

Some recipients say it’s unfair to critique the program in hindsight. At the time it went into effect, pandemic shutdowns had battered the performing-arts industry, leaving tens of thousands of actors, musicians, stagehands, ushers, security guards, lighting and sound technicians, costumers, and set designers out of work. Managers and agents, who take commission payments from artists’ revenue, also saw their source of income dry up as the pandemic canceled tours, three music industry managers told Insider.

Though she was an up-close witness to the struggles of small arts organizations during the pandemic, Schade said she was in no position to judge famous musicians that had received money through the grant program.

Performing arts groups suffered under pandemic lockdowns. Broadway shows were canceled for more than a year. For many, the SVOG funds came as a lifeline. Alexi Rosenfeld/Getty Images

“Comparing wounds during the pandemic is not a healthy way to approach things,” Schade said. Bigger acts have more expenses, she added.

“We can, now, look back three years later and say there wasn’t enough oversight,” she said. “But the reality is that when there’s a fire that’s burning you look around and try to put that fire out.”

The difficulties of the pandemic, though, clearly did not affect all of the grant recipients equally.

Gary Osier, a booking agent whose company represents dozens of acts including ZZ Top, Foreigner, and 98 Degrees, appears to have weathered the pandemic without much financial distress. In November 2021, as the Delta variant raged throughout the nation, he was able to purchase a $2.1 million four-bedroom lake house outside Dallas using cash.

But his company, Gary Osier Presents, wasn’t quite as fortunate. It applied for a $10 million SVOG grant, which it received in July 2021. The company had previously received a PPP loan of $127,000; its application said it had one employee at the time.

The grant came at a time when the SBA was under pressure to do more to help the touring industry. Just a month earlier, 55 senators had sent the agency a letter urging it to disburse the SVOG funds more quickly.

“The SVOG program is unique, with necessary restrictions built in to ensure taxpayer funding goes only to eligible applicants in need,” they wrote. “Bureaucratic process cannot stand in the way of getting these desperately needed funds out the door.”

In a statement, Osier said his company “fully complied with all auditing and monitoring requirements of the SVOG program, including use of grant funding” and “put the grant funds to work solely for the critically important purposes for which the SVOG program was designed.”

When asked what those purposes were, he did not respond.

https://www.entrepreneur.com/business-news/top-musicians-scored-200-million-in-pandemic-taxpayer/457347