How Fresh Food Needs to Appeal to the Pandemic Shopper

While restaurant closures, remote work and shelter-in-place orders have led to a surge in demand for shelf-stable, packaged-food brands, the story for perishable goods has been more complicated.

A new study from Deloitte shows that even though sales of fresh fruit, vegetables, meat and seafood have been up during the pandemic, fewer visits to the grocery store due to stress and safety concerns has increased the potential for food waste and problems related to supply chains.

Compared to last year, the number of people who said they shopped for fresh food multiple times per week has decreased by half, from 30% to 15%. Instead, more shoppers are now going to the grocery store less than once per week.

“That’s a big shift and a risk,” said Barb Renner, Deloitte’s U.S. consumer products leader and co-author of the report. “Most food doesn’t have a shelf life that you can keep it in the house for that long.”

When a grocery store didn’t have a certain fresh item in stock, virtually no shoppers said they were willing to go to another retailer to find it. When confronted with this situation, 44% said they’d replace the initial item with alternative fresh food product. Over a quarter of respondents said they’d replace the desired item with frozen or processed food, while another quarter said they’d go without until the next time they shop. In total, nearly two-thirds of shoppers said they weren’t able to buy the fresh food they wanted because it was out of stock at least sometimes.

To generate its report, Deloitte surveyed 2,000 U.S. adults in July. Each respondent played a role in their household’s fresh food purchases.

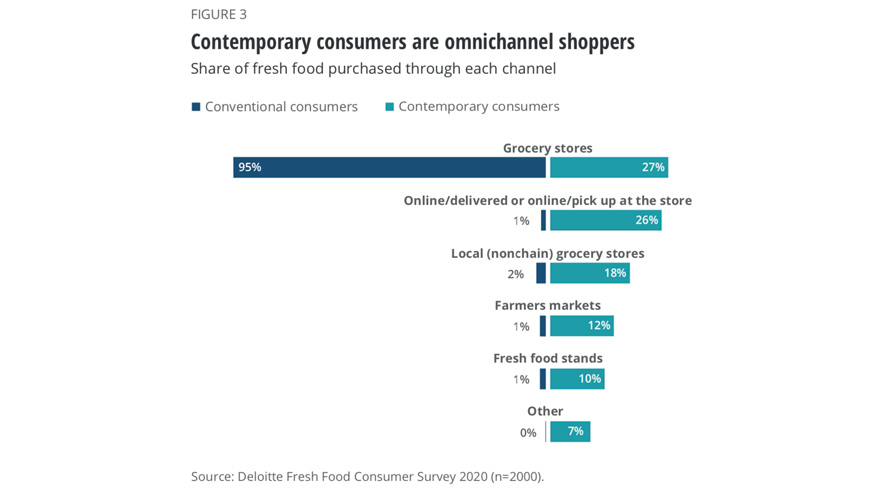

Among its findings, the firm also found that the coronavirus crisis has accelerated shopping trends, resulting in two prominent types of fresh food shoppers: conventional and contemporary.

Conventional shoppers, constituting 60% of the survey respondents, take a more traditional approach, getting most of their produce in-store. This type of shopper is more likely to be older, rural and lower-income.

Contemporary shoppers, on the other hand, tend to be younger, urban, more diverse and more well-off. Members of this group, which represents 40% of the survey respondents, are more likely to purchase fresh food through farmers markets, local grocery stores and ecommerce. They’re also more willing to pay a premium for fresh food.

“(Contemporary shoppers) now find in-store shopping to be the most stressful, and are seeking fresh food online, which has been something we hadn’t seen in the past,” said Renner.

In terms of improving marketing efforts, Renner advised fresh food brands improve their labeling to make their products more distinct and grocery chains to push the message of health and safety.

She added that because the needs and wants of conventional shoppers are different than those of contemporary shoppers, it’s beneficial to have separate strategies of how to reach each group.

Join Adweek for Commerce Week, a live virtual summit on Nov. 9-12, to explore the rapid transformation of the commerce landscape, and what’s next. Register now.

https://www.adweek.com/brand-marketing/how-fresh-food-needs-to-appeal-to-the-pandemic-shopper/