How Publicis Won The Data Wars, and What Omnicom-IPG Must Do To Have A Shot

Meet you in Vegas?ADWEEK House will be steps from the Aria during the industry’s big tech moment on January 8. RSVP.

The data unit Epsilon has emerged as one of Publicis Groupe’s biggest weapons of its recent success, helping its stock soar nearly 70% since the beginning of 2023.

“Epsilon and Publicis Media operation are now totally intertwined and at the heart of our connected media ecosystem,” CEO Arthur Sadoun told investors in its Q3 earnings call this year.

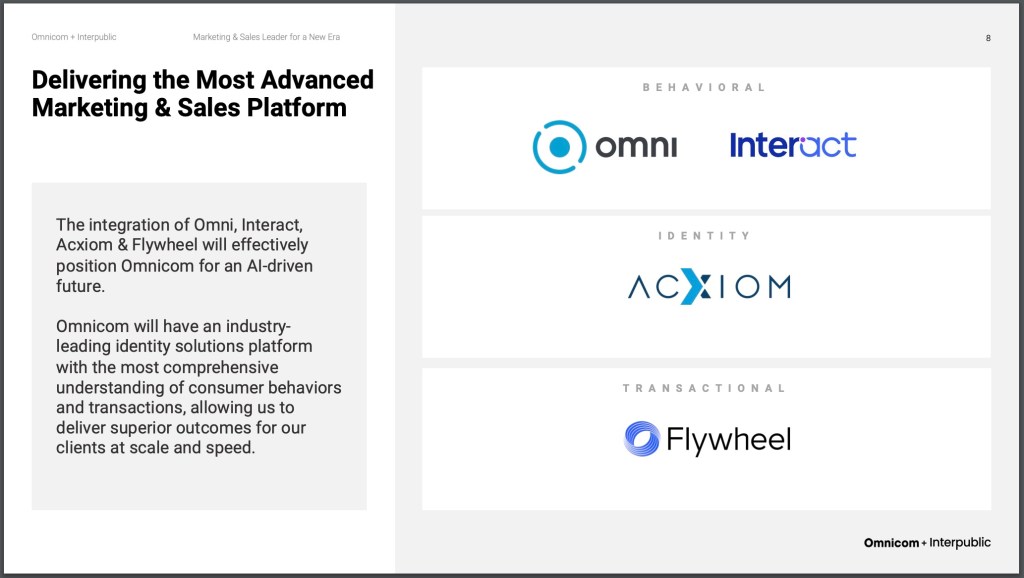

Competitors Omnicom and IPG, in the early stages of a $13 billion mega-merger, claim to have the assets to rival Publicis’ data prowess. The investor presentation of the acquisition touted the integration of Omnicom’s Omni (which provides insights from data), Omnicom’s Flywheel (commerce data provider), IPG’s Interact (a marketing platform), and IPG’s data unit Acxiom.

Yet, neither Omnicom nor IPG had individually been able to match Publicis’ data capabilities, according to multiple sources familiar with their data strategies. The stakes were especially high for IPG, which has spent billions to acquire a data unit.

Many are skeptical that a newly merged company can seize the advantage by combining capabilities.

“It’s four years too late,” said one source familiar with the matter, speaking on condition of anonymity. “This should have all been done before the onset of AI. Publicis is probably much better positioned because they did the hard work first.”

An Omnicom spokesperson said that the company believes that with IPG, “we will have the most advanced marketing and sales platform in the industry.”

ADWEEK spoke with seven sources who have worked at Omnicom, IPG, or Publicis. Some have worked across multiple of these holdco data units. They explained what Publicis did right, how IPG fell behind, and revealed what the merged holdco would need to do to catch up.

“I thought the agencies would warmly welcome us…But they closed the door.”

While both Epsilon and Acxiom were in the data marketing world, they offered different solutions. IPG bought Acxiom in 2018 for $2.3 billion, and Publicis bought Epsilon in 2019 for almost $4 billion.

A second source directly familiar with both data units noted a stark difference in how each holdco integrated them.

Sadoun demanded all of Publicis work with Epsilon.

“It was top-down,” this source said. “The leadership and tone from the top made all the difference. It was very much, ‘This is the way it’s gonna be, and if you don’t like it, you can leave. But we’re going to market as a joined-up solution here, between the agencies and Epsilon.’”

IPG did not go to market with that same degree of urgency, this person said, and CEO Philippe Krakowsky was more “light-handed,” letting each shop decide whether it wanted to work with Acxiom or not.

To be sure, Acxiom has led to client wins for IPG, and its data has been integrated into some IPG agencies.

Krakowsky said in IPG’s Q1 earnings call this April that Acxiom is tied to strong media performance, and an IPG spokesperson said Acxiom “often plays a foundational role” in the holding company’s work.

However, Acxiom did not catch on at IPG the way Epsilon did at Publicis, sources told ADWEEK.

Following IPG’s acquisition, some of the holdco agencies already relied on other data firms, like Experian, to enrich their clients’ data, and opted to keep those existing relationships rather than deal with the cost of switching, two sources said.

“I thought the agencies would warmly welcome us,” said one of those people, a former IPG exec. “But they closed the door, and we couldn’t get in.”

“After a few years, they just said enough…”

Acxiom also struggled to catch on because it didn’t have all of Epsilon’s capabilities. For instance, unlike Epsilon, it didn’t have tech that let clients directly activate media off of its data, and its identity solution LiveRamp was not part of its sale to IPG.

Two sources told ADWEEK that it has been expensive and difficult for IPG to build an activation layer for clients.

The IPG spokesperson said Acxiom has publisher relationships where it can activate data for clients, and that Acxiom also lets clients activate through its Interact platform. The platform was announced Oct. 2024 as an evolution of the holdco’s 2019 Marketing Insights Engine, said the spokesperson. While MIE used Acxiom data, the spokesperson said, Interact has since centralized it and integrated it with a lot more of IPG’s data and tech capabilities.

Two different sources with direct knowledge said that some IPG agencies rejected Acxiom because their clients balked at prices and additional fees.

Acxiom also had trouble explaining the value of its solutions, one of those people said. For instance, at one point, only one client used its rTAG product, which was designed to help clients build identity graphs.

“I was trying to understand when they were trying to pitch rTAG to clients, and even I couldn’t get a straight answer to why this would be valuable,” this person said. “No one could tell the story, because there was no story.”

The IPG spokesperson said that now, most of the large enterprise clients (those who purchase multiple services and products) that have Acxiom manage their first-party data use its ID tools, “including Real ID, and rTag.”

Executives would also sometimes cover for Acxiom’s incomplete data sets, two people said.

“I’m not proud of it, but there were a lot of moments in pitches where things we pitched as being Acxiom data were actually just other data sets we were licensing and making up it was a result of Acxiom,” one of those people said.

IPG said its InfoBase product is the largest “ethically sourced” global database, and that it discloses to clients that it works with multiple data partners.

By 2021, IPG directed its agencies to send more money through Acxiom. And selling Acxiom’s third-party audiences and its other products became part of quarterly targets for those agencies, two sources said. An IPG spokesperson declined to comment on quarterly targets.

Many sources noted that efforts to build an integrated data platform seemed to stall in 2023. IPG saw that year a wave of layoffs and some key account losses.

“After a few years, they just said enough, we can’t figure it out,” said another source familiar with the matter.

The holdco combined data and tech agency Kinesso, digital agency Reprise, and media buying agency Matterkind in Sept. 2023. In June this year, IPG unified Acxiom under Kinesso’s leadership.

Two sources suggested the attempts would have cost tens of millions of dollars.

The IPG spokesperson pointed to the recently-released Interact platform, saying: “We have a roadmap for future modules within Interact and are investing tens of millions of dollars in it as we build out new capability sets.”

“This is a perfect waste of time for them.”

To be successful, Omnicom and IPG need to figure out which data asset will be its centerpiece going forward, according to a source.

“They’ve got a decision that they have to make on what’s going to be their platform of record,” this person said.

Then, Omnicom and IPG have another tough job ripping and replacing data, the source added: “And that is not easy … you have to build entirely new audiences.”

That sort of integration work won’t be done in two or three years, this person said: “That’s not going to happen,” adding that they do not expect Omnicom or IPG clients to have the patience for this.

“This is a perfect waste of time for them,” the source said. “They don’t have time or they won’t do this just because Omnicom wants them to.”

The Omnicom spokesperson declined to comment on the integration.

Publicis, by contrast, has already centered around Epsilon. A slide during a recent company-wide presentation looking ahead to 2025 showcased the unit as the data backbone for Publicis’ paid media, owned media, commerce, and newly-bought creator agency Influential, according to two sources who saw the presentation.

Publicis has already been able to use Epsilon to develop new products quickly. Three months after buying Influential, Publicis introduced a new product called Creator Media Networks, designed to activate media based on who people follow, said one of those sources.

Ultimately, the new Omnicom entity will have its work cut out in trying to compete with Publicis’ Epsilon, particularly in standing up a solid data platform in time before clients flee.

https://www.adweek.com/programmatic/publicis-data-wars-omnicom-ipg/