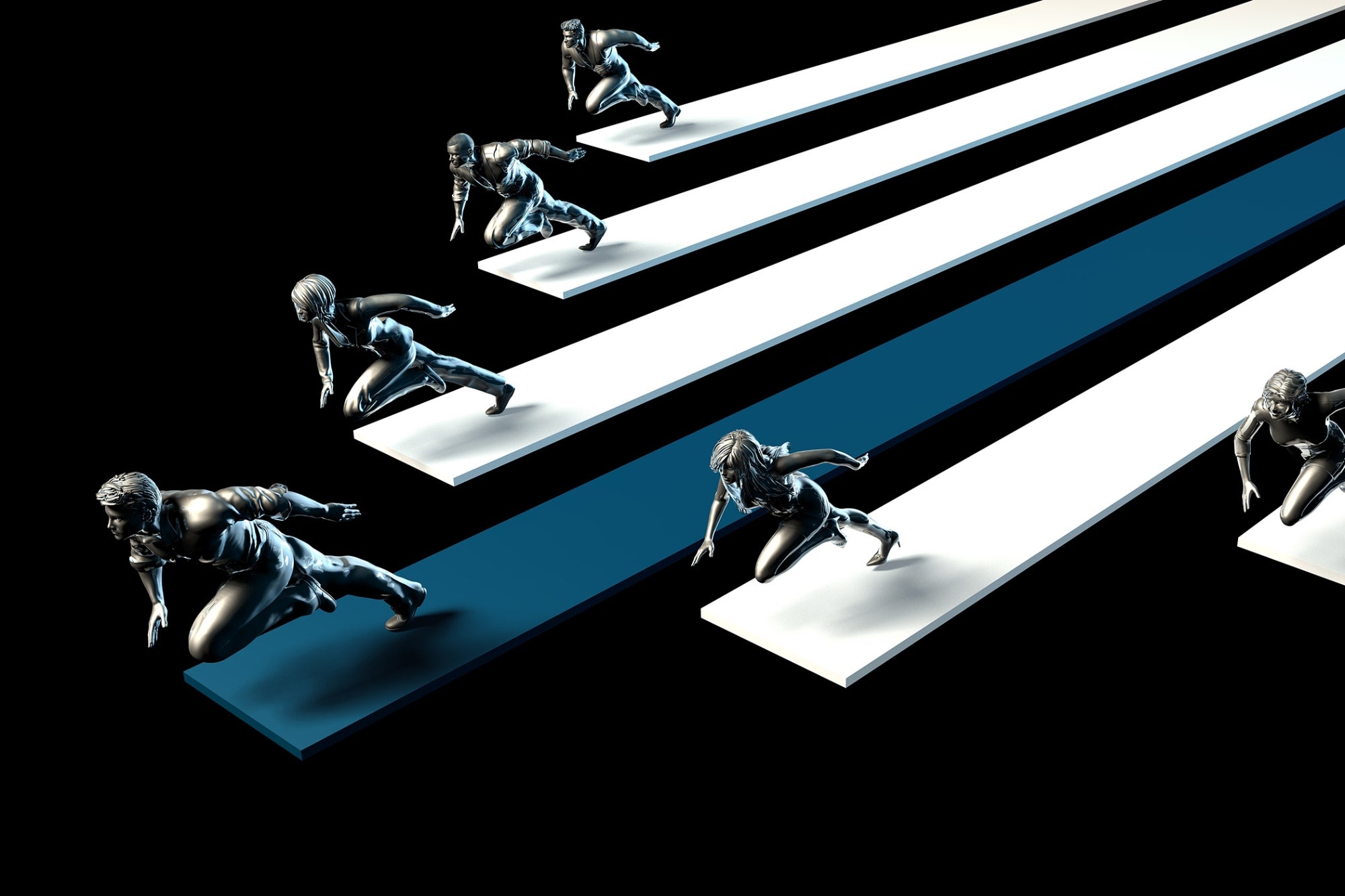

In a Crowded Field of Emerging Franchises, Only the Strongest Brands Thrive

Opinions expressed by Entrepreneur contributors are their own.

According to FRANdata, an average of 250 new franchise brands have launched every year in the U.S. since 2001. That’s as many as 5,250 brands launched over the last 21 years. Yet in 2022, FRANdata counted only 4,000 total active franchises — up from 3,000 in 2010, which was flat also at 3,000 back in 1990. So, where did all those emerging brands go?

The fact that several thousand brands stopped actively franchising doesn’t mean those companies failed or closed down. Some switched back to a corporate model, were acquired and re-flagged by competitors, or stopped adding new franchise units. Their franchising efforts went from “active” to “inactive” while the business entity itself carried on. And yes, some emerging franchise brands also failed. Franchisees who thought they were joining something destined to become bigger were sorely disappointed.

A cottage industry of enablers helps businesses launch new franchises. Unfortunately, fees charged for these services create a conflict of interest when it comes to quality control. A consultant whose entire business model is to launch new franchises may be reluctant to tell someone they should delay the launch or are undercapitalized. The best firms that specialize in new concept launches publicly post their track record and have extensive screening and training for newly launched brands. They continue to work with those brands until they reach a level of maturity. Sadly, others will happily take a big fee to tweak a boilerplate Franchise Disclosure Document (FDD). Founders who try to launch their franchise businesses on the cheap without studying franchise best practices are also to blame.

Related: How To Launch, Grow and Thrive in Franchising

If they haven’t taken the time to study franchising, founders have a steep learning curve. Many also don’t understand how competitive the market has become to recruit franchisees. So, they launch, hoping their concept is exciting enough to catch fire and end up disappointed. Those sputtering along hoping private equity buyers will save them before they run out of cash should think again. Private equity investors want growth stories, not unproven brands with no infrastructure. Even PE firms that specialize in working with emerging brands usually want to see at least $500,000 in EBITDA and $1 million+ is preferred. They want good bones, a backable team and real potential.

Franchisee advocates worry that prospective franchisees don’t understand how risky emerging brands are and will join a concept that turns out to be a bad bet. The Federal Trade Commission (FTC) Franchise Rule requires extensive disclosures. Prospective franchisees have an avalanche of information available to them from the franchise itself and the broader industry to help them vet concept viability. In addition to the required disclosures, there are numerous buying guides, (including Entrepreneur’s franchise buying guide,) educational resources, consultants and attorneys out there to help guide candidates. All those resources appear to be having a positive impact on prospective franchisees’ choices. The market appears to be turning away from, or is just too noisy, for the smallest concepts to successfully attract new franchisees.

The market is consolidating

Stronger concepts have momentum, in part due to private equity assistance and investment. Going back to 1990, the top 3% of brands (100 of the then-active 3,000 brands) accounted for 34% of total establishments. Now the top 20% (top 800 of 4,000 brands) represent a commanding 80% of new units sold each year (to both existing franchisees and new franchisees.) The Entrepreneur Top 500 (12.5% of 4,000 brands) are more than half of all open establishments. This represents a significant consolidation and strengthening of top brands. More than 600 franchises are receiving now, or have received, assistance from private equity at some point in their growth cycle. Not surprisingly, there is significant overlap in the top-performing groups.

Everything is more expensive for emerging brands

Over the last two decades, private equity has made it much more expensive to launch and grow a new franchise brand. Their influence and spending habits pull oxygen away from emerging brands in favor of their own portfolio companies and their platforms containing multiple brands.

Private equity firms that invest in franchising bet on growth. They spend on proven expansion tactics including working with brokers and outsourced sales groups. Sales commission can amount to 80-100% of the actual franchise fee collected. Since PE’s profit plan hinges on growing recurring revenues, not one-time upfront fees, they are willing to pay high commissions as part of their comprehensive growth plan. Then they invest in getting sold units open and productive. PE-backed franchises are also highly visible at franchise conferences and expos. These are expensive events for small brands. PE-backed platforms have additional cross-selling advantages. And, of course, Google is the start of most searches and a place where PE-backed brands can afford to maintain high visibility.

Unaffiliated emerging brands find themselves stuck in a very expensive contest to win new franchisees. The cost to maintain an active franchising program often exceeds an emerging brand’s commitment and ability to sell and support franchise units. So, they simply switch back to a corporate model while they are still small. They flip from “active” to “inactive.”

Related: 7 Things You Need to Know Before Becoming a Franchise Owner

The smartest new concepts now launch their franchising efforts when well-capitalized with proven strong corporate unit-level performance. FRANdata’s most recent New Concept Report identified 86 new franchise brands. Of these, 16 were affiliated with existing franchises through their parent company. Forty-seven percent reported annual average unit revenues of $1,299,297. Brands reporting more than $1 million in annual sales doubled from 11 to 22 from the prior year. Two brands were associated with platform companies. Two others already had private equity connections. So, something has changed. These new concepts are launching at a more sophisticated level to try to compete.

The market’s consolidation around quality benefits prospective franchisees who largely appear to be migrating to more proven concepts. It appears that many of today’s buyers see that “getting in on the ground floor” is a high-risk proposition and are waiting for proof of viability.

https://www.entrepreneur.com/article/438633