Insider Intelligence Slashes Outlook for Twitter Global Ad Revenue in 2022

.article-native-ad { border-bottom: 1px solid #ddd; margin: 0 45px; padding-bottom: 20px; margin-bottom: 20px; } .article-native-ad svg { color: #ddd; font-size: 34px; margin-top: 10px; } .article-native-ad p { line-height:1.5; padding:0!important; padding-left: 10px!important; } .article-native-ad strong { font-weight:500; color:rgb(46,179,178); }

Introducing the Adweek Podcast Network. Access infinite inspiration in your pocket on everything from career advice and creativity to metaverse marketing and more. Browse all podcasts.

Insider Intelligence issued its revised forecast for global ad spend in 2022 Wednesday, adjusting its numbers downward for all six companies it analyzed—Amazon, Google, Meta, Snapchat, TikTok and Twitter—but predicting a particularly rough ride for the recently acquired Twitter.

The research firm pegged total 2022 digital ad spending worldwide at $567.49 billion, up 8.6% over 2021, versus its previous forecast of 15.6% growth to $602.25 billion.

Insider Intelligence also lowered its outlook for digital ad spending worldwide in 2024 to $695.96 billion from $756.47 billion.

While its projections were down across the board, Insider Intelligence said it sees each company’s market share remaining relatively unchanged from its previous forecast.

Senior forecasting analyst Oscar Bruce Jr. said in a statement, “Economic instability across the globe will lead to lower growth by the end of the year. China, the second-biggest digital ad market, will post its lowest digital ad growth on record as it deals with tougher regulations and economic headwinds. Europe will see declines in digital ad spend in U.S. dollars given the relative weakness of the local currencies and the economic impact of the war in Ukraine.”

Principal analyst Jasmine Enberg said in a statement, “Before the takeover, Twitter’s ad business was already taking a beating from the economic uncertainty. Tack on Elon Musk’s erratic behavior, his lack of a clear plan for Twitter’s ad business, as well as fears about misinformation and a user exodus, and many advertisers are suspending their advertising on a platform that already isn’t essential to many companies’ media plans.”

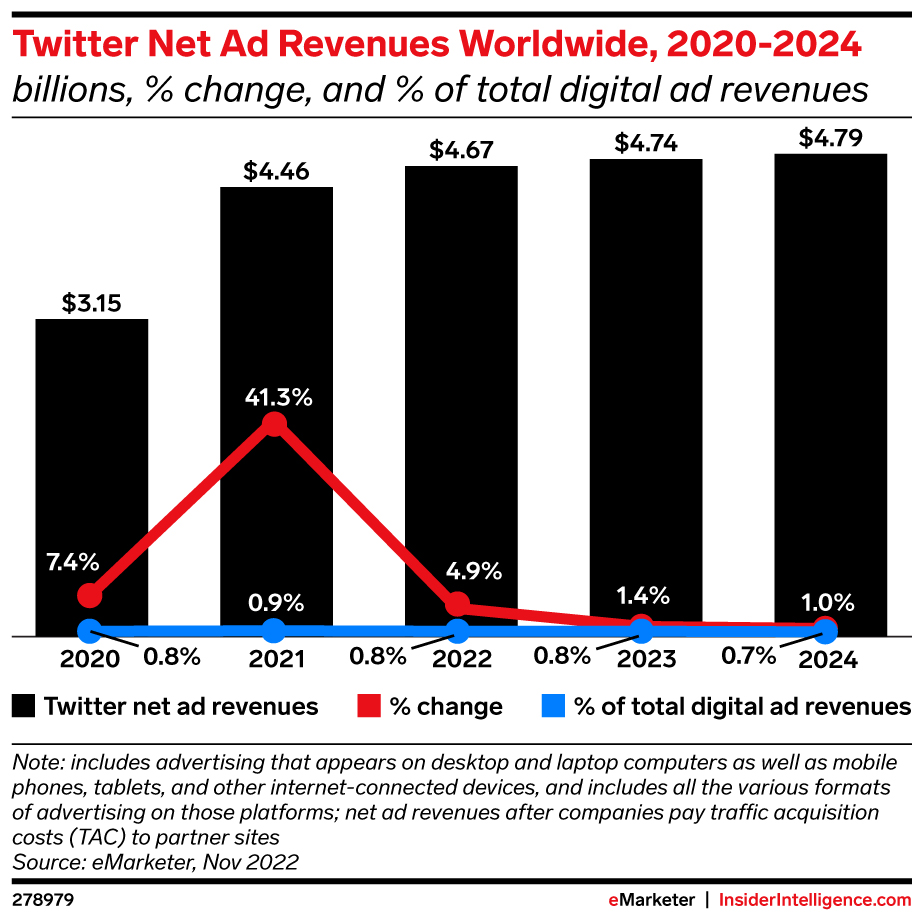

Insider Intelligence slashed its outlook for Twitter’s ad business through 2024 by 39.1%, expecting global ad revenue to grow just 4.9% this year, to $4.67 billion, after projecting 25.1% growth to $5.58 billion in its first-quarter outlook.

The researcher originally pegged growth of 21.6% in 2023 and 16% in 2024, but it now sees the next two years as essentially flat.

Enberg added, ‘Musk’s attempts to keep advertisers happy have been futile. Advertisers are pulling their ads due to brand safety concerns, as well as potential conflicts of interest with Musk’s other businesses. Musk’s management style won’t help motivate employees or comfort advertisers. Many of the employees who could have soothed advertisers’ concerns are now gone.”

Meta

Insider Intelligence sees Meta’s worldwide ad business declining for the first time ever, pegging global digital ad revenue for 2022 at $112.68 billion, down 2% from last year and far below its original forecast of $129.16 billion.

The researcher lowered its ad spend forecast for Meta through 2024 by nearly 20%.

It sees Facebook reaching $69.41 billion in digital ad revenues worldwide, well below its first-quarter forecast of $75 billion and down 4.6% from 2021. Projecting out to 2024, Insider Intelligence sees $75.11 billion in global ad revenues for Facebook, down more than $10 billion from its original call.

As for Instagram, Insider Intelligence sees worldwide ad revenue growth slowing drastically from 50.2% in 2021 to just 2.6% this year, lowering its forecast to $43.28 billion from $54.16 billion. The researcher pegged Instagram for $59.61 billion in global digital ad revenues in 2024, slashing its original forecast by 27%.

Principal analyst Debra Aho Williamson said in a statement, “Meta is no longer an innovative groundbreaker. Mark Zuckerberg’s decision to center his company around a murky and ill-defined concept like the metaverse has jeopardized the near-term health of the company. His vision of the metaverse can’t be willed into reality. Importantly, Meta remains a digital advertising powerhouse. Its ad revenues worldwide will overshadow every other company’s except Google. But Meta has lost its edge. Even the metaverse is a copycat idea.”

Snapchat

Snapchat took a hard hit from Insider Intelligence, too, with its updated prediction of $3.97 billion in total ad revenues worldwide up 17.1% from the previous year but well below the researcher’s original estimate of $4.86 billion.

Insider Intelligence sees Snapchat’s global ad business reaching $5.81 billion in 2024, 33.6% below the $8.75 billion it projected in the first quarter.

Enberg said, “Snap Inc.’s focus on augmented reality isn’t the only reason for the slowdown in ad spending. AR is a niche ad format that’s easy for advertisers to justify cutting when budgets are tight. But AR ads only make up a small percentage of Snap’s ad revenues, indicating that advertisers are cutting other types of Snap ads, as well. The reality is that many advertisers still don’t fully understand Snapchat and stick it into their experimental buckets. Intense competition from TikTok for the attention of Snap’s core Generation Z user base and continued measurement challenges from Apple’s App Tracking Transparency changes are also causing advertisers to hold back spending on the platform.”

TikTok

While Insider Intelligence projected 155% year-over-year growth in global ad revenues for TikTok, totaling $9.89 billion, it still lowered its original call from $11.64 billion. Similarly, for 2024, the researcher’s projection of $18.49 billion in ad revenues worldwide was down 21.6% from the $23.58 billion it predicted in the first quarter.

Enberg said, “TikTok has transformed from an experimental play to a must-buy for many advertisers. But TikTok isn’t immune to the macroeconomic challenges causing advertisers to trim their overall digital ad budgets. Meanwhile, growing anti-TikTok sentiment among media executives and renewed calls by government officials to ban the platform are causing some advertisers to be more cautious about their spending there. For now, TikTok’s continued strong user and engagement growth, as well as advancements in its ad and measurement offerings, will keep many advertisers funneling money into the platform, including some of the lost ad dollars from other social applications.”

Google took far less of a hit than the other platforms analyzed by Insider Intelligence, which lowered its 2022 net digital ad revenue total to $168.44 billion from $174.81 billion, while its projection for 2024 was down just 2.8%, to $201.05 billion.

Analyst Evelyn Mitchell said in a statement, “Google has an edge over its other ad-reliant competitors in an economic downturn, as advertisers facing budget cuts typically prioritize lower-funnel channels with higher return on investment, like search. Search has also retained full functionality in the wake of Apple’s privacy changes. Search ads are served in response to a user query and don’t usually leverage data about that user, so they’re less affected when iOS users opt out of being tracked. Meanwhile, social media advertising relies more heavily on consumer data.”

Amazon

Insider Intelligence’s projection of $37.99 billion in 2022 global ad revenues was down slightly from its first-quarter call of $41.75 billion, and the researcher predicts $55.99 billion in digital ad revenues worldwide in 2024, down from its original prediction of $63.48 billion.

Principal analyst Andrew Lipsman said in a statement, “Amazon’s ad business will take a haircut alongside the other ad platforms, but its fast-growing retail media network will be among the most resilient to macro headwinds. After a first half of the year with slowing growth that coincided with an overall slowdown in ecommerce, Amazon’s ad business regained momentum in the third quarter with the help of the July Prime Day—a success it hopes to replicate during the holiday quarter from the Prime Early Access Sales in October.”

https://www.adweek.com/programmatic/insider-intelligence-slashes-outlook-for-twitter-global-ad-revenue-in-2022/