Leaked Pitch Deck Shows Walmart Is Pitching In-Store Ads to New Brands

With C-suite leaders from iconic brands keynoting sessions, leading workshops and attending networking events, Brandweek is the place to be for marketing innovation and problem-solving. Register to attend September 23–26 in Phoenix, Arizona.

The next time you’re in a Walmart store, don’t be surprised if you see an insurance ad looping on TV screens.

Walmart Connect, Walmart’s advertising arm, will begin selling in-store ads to brands that don’t sell products on Walmart’s shelves—known as non-endemic advertisers—like financial companies, auto brands and quick-service restaurants.

The new offering was shared with agencies today in a virtual presentation detailing how those in-store ads will show up on the retailer’s TV wall and self-checkout digital screens. The new formats will begin rolling out Aug. 1, Walmart confirmed to ADWEEK.

“National non-endemic brands, known for their large scale brand-building campaigns, are now recognizing the untapped potential of in-store platforms to increase brand exposure,” a Walmart Connect spokesperson told ADWEEK via email.

Non-endemic advertisers are a big priority for Walmart in chasing Amazon’s lead in retail media. Walmart opened up its ad business to brands that don’t sell on its shelves in April, and this rollout marks the first time that non-endemic advertisers can buy in-store ads.

Non-endemic brands represent big-spending advertisers that can help Walmart grow its retail media ambitions. Amazon has also made a heavy push for ad dollars from non-endemic advertisers through selling streaming TV ads like Prime Video Ads. Walmart Connect made $3.4 billion in 2023 while Amazon made nearly $47 billion from advertising in 2023.

An ad buyer who attended Walmart’s virtual presentation said they have a financial services client interested in buying ads with Walmart’s audience, but they haven’t yet pulled the trigger. In-store ads could sweeten the deal, the person said.

Key slides from Walmart’s presentation are included below.

Walmart is pitching two placements for in-store ads: TV walls where TVs are sold and on the screens at self-checkout kiosks.

In-store is “going to be the next major ad market,” independent retail media analyst Andrew Lipsman told ADWEEK. “I see Walmart as the linchpin for this market to materialize.”

TV wall ads run on an average of 20 screens per store, according to Walmart’s pitch deck. The average ad plays three to 12 times per hour depending on if the ad is a 15- or 30-second spot, according to Walmart. An example was automaker promoting a new car.

Advertisers get data back like how many times a video was played and how many times it appeared every hour, according to the deck.

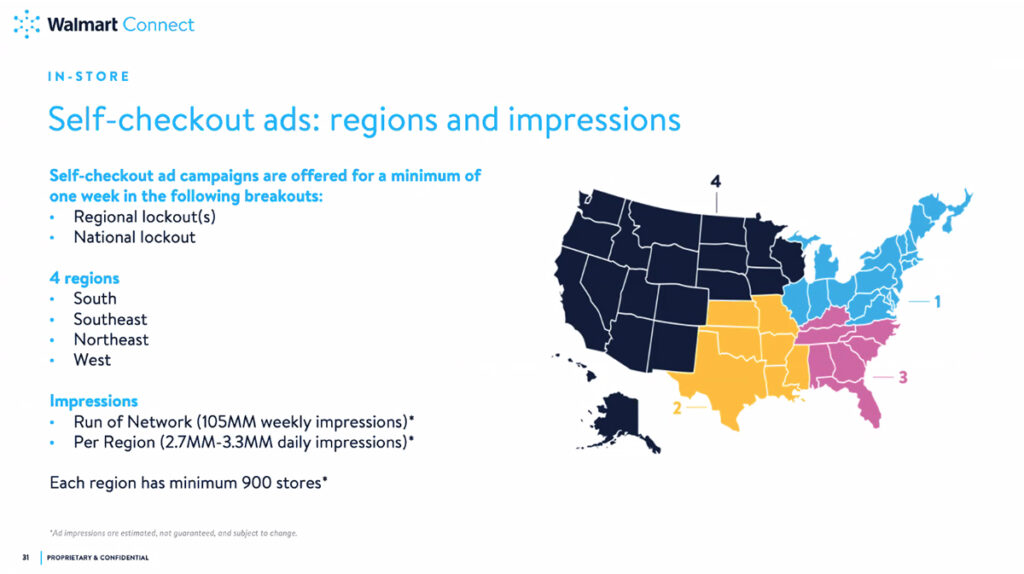

For the self-checkout ads, the ad appears throughout the checkout process. In one example, a quick-service restaurant could advertise to shoppers at checkout in the hopes they’ll swing by for food on the way home.

Walmart claims that the self-checkout ads are seen by 105 million weekly shoppers when run across large regions of the U.S. Smaller ad buys run in specific regions like the West and Southeast are guaranteed to be seen by 2.7 million to 3.2 million daily shoppers, according to Walmart.

https://www.adweek.com/commerce/leaked-pitch-deck-shows-walmart-is-pitching-in-store-ads-to-new-brands/