Ligand’s (LGND) Drug-Developing Technologies Holds Potential

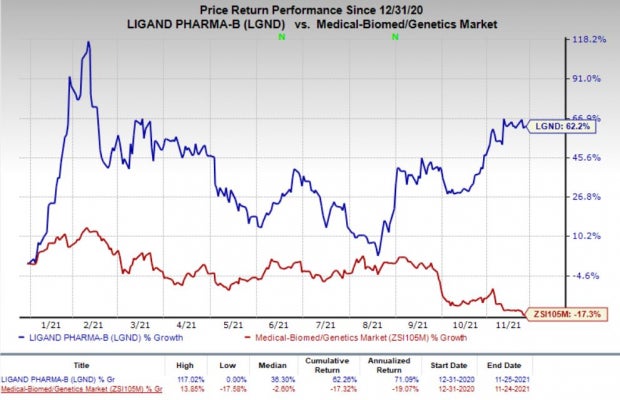

Ligand Pharmaceuticals’ LGND stock has gained 62.2% so far this year against 17.3% decrease of the industry.

– Zacks

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Ligand’s top-line growth is primarily being driven by its Captisol technology. LGND has signed more than 160 Captisol research-use agreements and 13 clinical/commercial license agreements in 2020. These deals provide LGND with license fees and milestone-based payments.

Ligand also earns royalties on the sales of drugs developed using its Captisol technology, including Amgen’s AMGN blockbuster drug, Kyprolis. LGND’s another source of revenues is the sale of Captisol material to its partners.

Ligand’s Captisol technology should continue to be a key revenue driver with rising demand for its partnered drugs and potential approval to the new Captisol-based drugs. New deals will also help drive revenues.

Amgen’s Kyprolis is approved for treating multiple myeloma. It sales generated $824 million in the first nine months of 2021, reflecting year-over-year growth of almost 4%. Moreover, Gilead’s GILD Veklury has also boosted Ligand’s topline in 2021. Veklury is developed using the Captisol technology and Gilead gained a regulatory nod for the drug to treat severe COVID-19 patients.

Gilead recorded Veklury’s sales of $4.2 billion in the first nine-months of 2021. With the rising cases of COVID-19, especially in the European countries, the drug’s demand will likely continue to increase in the upcoming quarters.

Apart from Captisol, Ligand has another promising technology called OmniAb in its portfolio. It is newer than the Captisol technology and has longer patent protection as well. The first OmniAb-derived antibody to receive approval in any country is Gloria Biosciences’ zimberelimab. China approved the drug for treating Hodgkin’s lymphoma in August. Another OmniAb-derived partnered drug, sugemalimab, will likely get a nod in China by 2021-end. Currently, 19 different OmniAb-derived antibodies are under development through different partners.

A few potential approvals for the partnered OmniAb-derived drugs are expected in the upcoming quarters. Management believes that the platform can generate $500 million to $1 billion of annual royalties beginning 2030.

Ligand is planning to spin-off its OmniAb business into a separate public company to intensify its individual focus on Captisol and OmniAb technologies. However, the decision is yet to be finalized.

Ligand has several other technology platforms in its portfolio which have been added through different acquisitions over the past few years. Some of these technologies complemented Captisol and OmniAb platforms while others provided new avenues of growth.

Although Ligand’s technology platforms are encouraging, it is highly dependent on partners for growth. If any of LGND”s partners fails to receive regulatory approvals or terminates a deal, its prospects would be severely hit.

Moreover, Ligand’s royalty revenues are primarily driven by Kyprolis, following the sale of rights to Novartis’ NVS Promacta, which was also developed using the Captisol technology. Any generic approval for Kyprolis will hurt Ligand’s topline substantially.

We note that Promacta is marketed by Novartis worldwide and is available under the trade name of Revolade outside the United States. The sale of its rights to this Novartis’ drug in 2019 helped Ligand earn $827 million of cash.

Zacks Rank

Ligand currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

https://www.entrepreneur.com/article/399412