Retirement and Health Care Costs: What You Need to Know

Every retiree or anyone who is in the process of retiring is concerned about the cost of health care. As reported in T. Rowe Price’s Retirement Savings and Spending Study (2021), retirees’ top three spending concerns are the following — in order of importance:

- Paying for long-term care

- The cost of health insurance

- Out-of-pocket health care costs

According to some of the leading experts, retirement healthcare costs will be astronomical. As of 2022, the Employee Benefit Research Institute (EBRI) estimates that 90% of employees will be able to cover all their health insurance premiums. Using that figure, a 65-year-old couple would need $296,000.

The Boston College Center for Retirement Research (CRR) estimates that a typical 65-year-old couple will spend $197,000 over their lifetimes, with a 5% likelihood of spending more than $311,000.

Further, a retired couple age 65 in 2022 may need approximately $315,000 in savings, after taxes, to cover their health care expenses in retirement, according to a Fidelity Retiree Health Care Cost Estimate.

Note, however, that long-term care costs can be catastrophic in some cases, so these numbers do not include them.

As a general rule, planning ahead for health care expenses in retirement is important. At the same, there are a variety of factors to consider when determining how much you’ll need. In addition to your income and age, your health, where you live, and whether you have Medicare or supplemental insurance, your costs vary.

No matter where you are in your career, whether you are close to retirement, or already planning your transition out of the workforce, it’s essential to plan for rising healthcare costs.

How to budget for health care during retirement.

Retirement budgets are determined by two factors:

- What will your monthly income be.

- Your total expenditures.

Sadly, 37% of retirees say they have nothing saved for retirement. In addition, according to the latest government data, those 65 and older spend an average of $4,345 per month on rent, groceries and healthcare. A retirement-age American could spend nearly a thousand dollars less in 2016 at $3,564 as a comparison.

When it comes to planning for the future, older Americans may have to tighten their spending even more as inflation cools from 2022’s near a 40-year high.

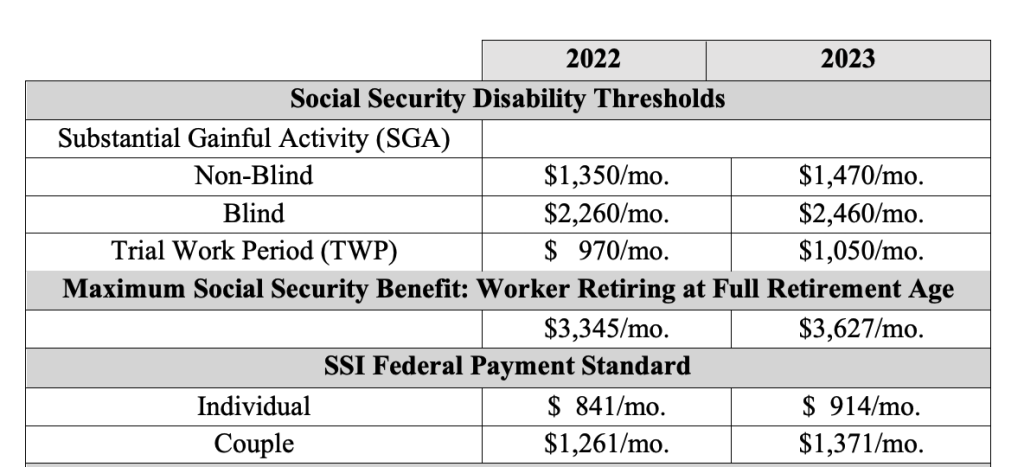

Additionally, those who retire at full retirement age in 2023 are only expected to receive a maximum monthly benefit of $3,627.

For those with medium incomes, Social Security provides about 40% of what they would have earned before retirement, according to the Social Security Administration (SSA).

However, you’ll probably have to look elsewhere for medical expenses if you don’t have Social Security. How much retirement income to budget for health care depends largely on your age and overall health.

Healthier people typically allocate less money toward healthcare expenses during retirement. Also, a healthier lifestyle will result in a longer life expectancy, so retirees should plan to retire for a longer period of time.

“In order to retire successfully, you need a plan and strategy that encompasses a multitude of factors,” Anthony Colancecco, a financial adviser with Ballentine Capital Advisors in Greenville, South Carolina, told MarketWatch. “You will want to consider your health, income, expenses, inflation, and other financial goals, as well as whether you have sufficient assets and are confident in your understanding of what retirement entails.”

What is the cost of Medicare and what is covered by it?

Americans aged 65 and older can enroll in Medicare, which is the government’s health insurance program. Medicare doesn’t cover all healthcare needs, so retirees still face significant out-of-pocket expenses.

In addition to Medicare Parts A, B, and D, there are private supplements, such as Medigap plans and Medicare Advantage plans, which can be purchased under Medicare Part C.

Medicare Part A

The Medicare Part A program generally covers inpatient hospital care, skilled nursing facility care, and home health care for up to 100 days. During the last six months of a patient’s life, it also pays for hospice care.

Medicare Part A does not require a premium. The catch? Participants failed to pay Medicare taxes for a period of ten years.

Medicare Part B

In addition to preventative services, ambulance services, and mental health treatment, Medicare Part B covers more routine medical services and supplies.

Medicare Part B monthly premiums will decrease by $5.20 from $170.10 in 2022 to $164.90 in 2023. For all Medicare Part B beneficiaries in 2023, the annual deductible will be $226, a $7 decrease from the annual deductible of $233 in 2022.

Deductibles and coinsurance are also required for Part B participants.

Medicare Advantage: Part C

A Medicare Advantage plan, also known as a Part C plan, is a private plan that replaces A and B, and often D of the Medicare program. Generally, this plan protects you against expenses that were not covered by your original plan.

Depending on the plan, this coverage may vary.

Medicare Part D

Prescription drugs are covered by Medicare Part D. The cost of your Medicare Part D premium will vary by your plan and income, as well as the type of medication you purchase and whether you purchase it at an in-network pharmacy or not.

Premiums range from $0.00 to over $77.40 for those earning over $500,000 a year. In 2023, however, each Part D-covered insulin supply will cost no more than $35 per month.

Medigap

Supplemental plans for Medicare Parts A and B are known as Medigap plans. Usually, they cover the costs of coinsurance and hospital stays after Medicare Part A benefits have been used as well as coinsurance or copayments for Medicare Part B. In addition, some Medicare-eligible services incurred abroad and within the United States are covered.

The program does not cover certain services, such as long-term care, dentures, and acupuncture. The cost of some Medicare services is also subject to copays, premiums, etc.

Pay for health care beyond retirement savings.

You don’t have to dwindle your nest egg because of rising medical costs. In retirement, there are two ways for pre-retirees to create a safety net for healthcare expenses.

Health Savings Account (HSA)

Health savings accounts (HSAs) offer retirement healthcare savings if you’re not enrolled in Medicare. There are three tax advantages to high-deductible health plans (HDHPs):

- Contributions that are tax-deductible

- Growth that is tax-deferred

- Withdrawals for qualified medical expenses are tax-free

Certain medical premiums, including Medicare and long-term care insurance, can be paid with HSA funds.

Catch-up contributions and employer contributions can still maximize these plans for those in their 50s. An additional $1,000 can be contributed by individuals 55 and older each year. Preventative screenings, such as mammograms and annual physicals, are covered by your HDHP and can be paid for through your HSA.

For 2023, the regular HSA deduction limit is $3,850 (up from $3,650 in 2022) for individuals and $7,750 (up from $7,300 in 2022) for families. Employee contributions and employer contributions are both subject to these limits.

It’s important to note that HSA contributions are no longer permitted by Medicare-enrolled individuals.

Long-Term Care Insurance

According to a study by the Urban Institute and the U.S. Department of Health and Human Services, about 70 percent of Americans who reach age 65 will require some form of long-term care. Nearly half of people will require some kind of paid assistance, although some will receive unpaid care from family members and others. About 24 percent will need more than two years of paid care, and 15 percent will spend two-plus years in a nursing home.

A variety of factors determine the cost of care, including the length of care needed, where you live, and the intensity of your needs. In addition, there are different ways to pay for services.

People who are over 65 and have traditional Medicare will be covered for some skilled care only after being hospitalized due to an injury or illness, but not long-term care. There are Medicare Advantage plans offered by private insurers that provide certain supplemental benefits, such as meal delivery and ride-to-medical appointments.

Traditional long-term care insurance.

Like auto or homeowners insurance policies, long-term care policies typically require premium payments and claims if services are needed.

Coverage can be limited or extensive to help you pay for services at home or elsewhere. Policies typically specify how much you can receive daily or monthly, up to a maximum lifetime amount. In a nursing home, at home, or elsewhere, different amounts may be permitted. For inflation-protected benefits, you pay extra.

Depending on when you need to get care, there might be a waiting period between the time you start needing care and when you start receiving benefits. It usually takes 90 days to get benefits, but you can wait 30 days or accept a 180-day delay for less. Similar to an inflation-protected $100-per-day policy, a $200-per-day policy with a five-year term and compounded benefits will cost more than a $100-per-day policy with no inflation protection for two years.

What long-term care insurance covers.

Depending on the policy, certain conditions may not be covered. It is not uncommon for alcoholism, drug addiction, or war injuries to be denied healthcare. Even if you have a preexisting condition, such as a heart condition or a past cancer diagnosis, the insurance policy may not cover you for a while after the policy is effective.

Generally, though, you become eligible for benefits once you can no longer perform a set number of activities of daily living. A few of these activities include bathing, dressing, eating, using the toilet, transferring from bed to chair, managing incontinence, or developing cognitive impairment. While you receive benefits, premiums are typically waived.

Usually, if you fail to pay your premiums before the need strikes, you will lose your coverage. Your money is invested by the insurance company to pay for other people’s claims, so the company makes money regardless of whether or not you use the coverage.

Long-term care is made easier with annuities.

It is possible to choose from a wide variety of annuities. The types of annuities you can choose from include fixed annuities, fixed-indexed annuities, and variable annuities.

There are two types of variable annuities: immediate and deferred. In addition to the immediate classification and the deferred classification, there are tax implications associated with each type of annuity.

Deferred annuities, qualified longevity annuity contracts (QLACs), 1035 exchanges, and hybrid long-term care annuities are recommended for financing expenses. However, you can probably find the right annuity for your retirement plans depending on your specific situation and needs.

In addition, a long-term care rider can increase the payout of an annuity for a specified period of time in the event long-term care is needed.

Other options, including hybrids.

As part of their efforts to ensure seniors have access to the care they need, lawmakers are urging Medigap insurance policies to cover long-term care.

Meanwhile, some companies offer hybrid policies that combine long-term care with another form of coverage, such as life insurance. If long-term care is never needed, beneficiaries may receive payment in installments or large sums upfront.

In addition, you can get short-term care insurance that covers up to 360 days.

Health Care Options for Early Retirees

Even though you are eligible for Social Security benefits at age 62, if you retire before the age of 65, you must have health insurance to cover your medical costs until you become eligible for Medicare. For workers who are accustomed to having their employers pay for their health insurance, the price can be jarring.

Social Security benefits can be deferred until age 65 if you delay retirement or save enough to cover health care costs. On average, if you wait until 70 to begin collecting Social Security, you will be able to collect more money.

It’s a good idea to research these costs and options before you retire so you can plan accordingly. While Medicare benefits are not yet available, here are some options.

- Employer-Provided Insurance. In an ideal world, your employer would offer retiree health coverage. Until you’re eligible for Medicare, some employers offer this benefit.

- Affordable Care Act Marketplace. Affordable Care Act marketplaces, also known as Obamacare, offer health insurance. Health insurance purchased on the open market is generally more expensive than on exchanges created by the law. If your income is below a certain threshold, you may also be eligible for tax credits.

- COBRA. As part of the Consolidated Omnibus Budget Reconciliation Act, COBRA coverage is also an option, available through your former employer. Due to the lack of employer subsidies, this is the most expensive option. After you leave your job, COBRA is generally available for 18 months. You will need to find another option for coverage beyond that.

- Health Plan of Spouse. Early retirement may be possible if your spouse or domestic partner has health insurance through their employer. You might be able to be added to your spouse’s retiree medical coverage.

FAQs

1. What is long-term care?

Providing ongoing health care to people with chronic diseases or disabilities is known as long-term care. Long-term care can be divided into three levels:

- Skilled care. It’s generally round-the-clock care provided by a doctor, nurse, therapist, or aide.

- Intermediate care. It’s also offered by professionals, but less often than skilled care

- Custodial care. Family caregivers, nurses’ aides, and home health workers provide personal care such as bathing and eating, which is also known as ‘activities of daily living’.

Despite its name, long-term care isn’t just provided in nursing homes. In fact, most long-term care happens at home. In addition to long-term care facilities, adult day care centers and assisted living facilities also provide long-term care services.

2. Why is it imperative to plan for long-term care?

Everyone doesn’t plan for long-term care, but it’s important to be prepared. I’ll give you two reasons:

- After 65, 70 percent of people will need long-term care.

- Between ages 40 and 50, about 8% of people will need long-term care.

You can spend a lot on long-term care:

The cost of long-term care can eat up income and deplete savings for many. In the United States, long-term care costs can be as high as:

- For a semi-private room in a nursing home, it’s $225 a day or $6,844 a month.

- In a nursing home, a private room costs $253 a day or $7,698 a month.

- A one-bedroom unit in an assisted living facility costs $119 a day or $3,628 a month.

- For a health aide, it’s $20.50 an hour.

- The price of a homemaker is $20 an hour.

- The cost of adult day health care is $68 a day.

Long-term care costs vary depending on what type of care you need, where you live, and the provider. Factors that affect costs include:

- The time of day. It’s generally more expensive to get home health and home care services at night, on weekends, and on holidays.

- Facilities may charge extra for services over and above room, food, and housekeeping charges.

- Some programs have variable rates, like adult day care, which is usually based on extra events and activities..

3. Isn’t Medicare supposed to cover long-term care?

It’s a common misconception that Medicare will cover long-term care, which it doesn’t. However, Medicare only covers a limited amount of long-term care, such as physical therapy or skilled nursing. It also doesn’t cover custodial care, which is the type of care older people need the most.

Often confused with Medicare, Medicaid is a joint federal-state program that pays some of the costs of long-term care for about two-thirds of nursing home residents. Generally, Medicaid covers nursing home care, but in some states, it only covers limited home health care if you have a limited income and assets.

4. How do I enroll in Medicare?

Social Security recipients automatically get Medicare at 65. Those who don’t qualify for Social Security can enroll in Medicare three months before and three months after their 65th birthday. For example, if you’re born on April 15, you’re eligible from October to May.

Medicare doesn’t send reminders, so if you don’t enroll during your initial window, you might get penalized.

5. Do I need long-term care insurance?

The goal of long-term care insurance is to protect you against a specific financial risk, in this case, the risk that long-term care will be too expensive. By paying your premiums, the insurance company will cover some of your long-term care costs in the future.

Your assets can be protected and you’ll have access to a variety of care options with long-term care insurance. It’s a little pricey, so make sure you can afford the premiums now and in the future before you buy a policy.

Buying a long-term care policy is mostly about your age. Your premiums will be cheaper the younger you are, but you can also choose which benefits you want.

The post Retirement and Health Care Costs: What You Need to Know appeared first on Due.

https://www.entrepreneur.com/finance/retirement-and-health-care-costs-what-you-need-to-know/450991