Temu’s Advertising Avalanche Is Impossible to Ignore

Sports marketing leaders from State Farm, the Golden State Warriors, the NBA and more will join ADWEEK Brand Play on May 9 to unpack the trends, techniques and tools you need to break into the space. Register for your virtual pass.

We live in an attention economy. The ecommerce space is filled with companies not only competing for revenue but also consumer awareness.

And ecommerce giant Temu is giving competitors a run for its advertising budget.

Temu’s strategic takeover of advertising space on Meta, Google and other platforms is impossible to ignore. Reports and industry pros suggest an almost audacious investment from the Chinese ecommerce newcomer, with figures rumored around the $2 billion mark in 2023 alone.

This colossal spend aims at carving a substantial footprint in the U.S. retail space, but the implications, challenges and outcomes of such a move truly impact media buyers every day.

Temu is anything but subtle. If you’ve been scrolling advertising or DTC Twitter, you’ll have seen specific callouts of this sweeping uptick in Temu campaigns. I spoke to marketers in the space who called out the potential damage of the Temu ad avalanche as it continues down the mountainside.

Advertising like a billionaire

Attributed to the umbrella of PDD Holdings from China, Temu surged onto the U.S. scene with a vision of dominating the market, employing a mix of aggressive marketing and low-price allure to draw consumers. This seemingly budgetless ad spend on Meta has propelled Temu to one of its top revenue advertisers in 2023.

What if you could find items you normally purchase at Amazon and other retailers for shockingly low prices? Consumers are ready to throw their credit cards at them, with a reported $3 billion in revenue in the first half of 2023 alone and an expected $6 billion this year.

This aggressive push not only impacts the revenue of any potential competitors but also impacts the efficacy of competitive advertising budgets.

Viral Marketing Stars CEO Katya Varbanova has seen this strategy before. “On my team, we have a phrase that says, ‘Outspend your competition, and you’ll have no competition.’ And it seems like Temu is taking that same approach to their advertising.

“As a result, this increases everyone’s CPA (cost per acquisition) on platforms like Meta and Google because large advertisers like Temu are monopolizing ad inventory and heightening the costs of the advertisers targeting the same audiences.”

The strategy behind the spend

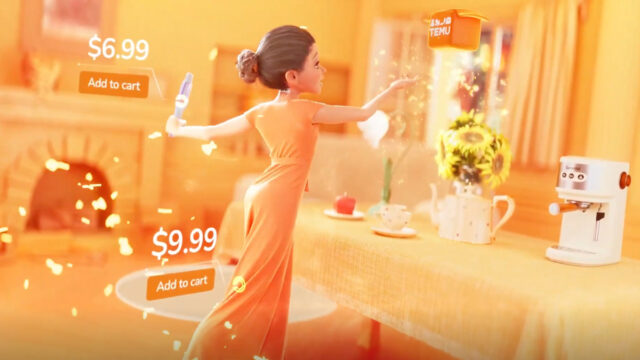

Temu’s campaign is not just about ubiquity; it’s a calculated strike at the heart of consumer desires, merging its “Shop Like a Billionaire” tagline with an inventory that promises bottom-dollar prices. It’s interesting to see an approach where items can be purchased for a few dollars, while over 9,000 active Temu ads are running across platforms.

This approach, which peaked with high-profile campaigns including a Super Bowl ad, has garnered the desired attention. However, it has stirred debate regarding the enterprise’s labor practices and sustainability, as well as fears about data privacy.

After all, these ads are not just an opportunity to influence consumer purchasing habits, but also to gain the data that comes with those interactions.

Mike Ryan, head of insights at Smarter Ecommerce, has been watching Temu’s advertising patterns this year and found that “Temu took a notable step back in their marketing activity across Q1. At first, it seemed related to the Super Bowl, and they ramped back a bit, but then they were very soft again in March.” Ryan observed this in both the EU and U.S., and across both Google and Meta.

“This potentially deserves a mention in the earnings statements of those platforms, because Temu spends so much money. I wouldn’t expect this to hurt in year-over-year terms, but Q/Q could be softer than you would expect from normal seasonality.”

Ecommerce impact

So, what does Temu hope to accomplish?

Ryan believes that Temu’s approach could convert as many consumers as it alienates. “This whole thing is a Trojan horse strategy. Temu’s goal is to poach consumers from these platforms and bring them into its ecosystem. It’s hard for these platforms to stop Temu from doing this and, on a short-term basis, it is very attractive for platform revenue. But in the long term, this [tactic] can alienate both users and advertisers, so I view it as unhealthy for all parties.”

Varbanova worries how this will impact small businesses that will never have a similar ad budget. “How will [Google and Meta] ensure small businesses can remain competitive and reach their goals?’

Future impact

As the conversation around Temu’s marketing push unfolds, the industry is keyed into the ongoing narrative of market adaptation, customer retention and the balancing act of aggressive advertising. The trajectory for Temu, amid scrutiny and speculation, is a subject of interest and debate among consumers and professionals alike.

David Hermann, media buyer and president of Hermann Digital, has advice for other advertising pros experiencing the effects of Temu outspending them. “Be prepared for shifts. These systems (Meta’s auction) are volatile, and businesses should always be prepared to pull back when need be, and have a toolkit of options for where to place their online ad dollars.”

Hermann pointed out other critical factors that could further impact ad inventory. “For 2024, on top of Temu and Shein, we have a presidential election coming. If we think things are high now, it may go even higher.”

In regards to whether or not this type of media saturation is a trend to be concerned about, Hermann doesn’t think so. “Platforms like Temu come along every so often. Wish was the first. Temu is the first company, to my knowledge, to be spending this aggressively. However, is Meta still able to work for the majority of advertisers as a profitable choice of traffic? I still believe so, but it’s not easy and I feel for those in direct competition with a site like Temu.”

With such lofty ad spend, it’s easy to see why companies might be concerned that Meta will play favorites and continue to ensure that Temu spends with them.

Only time will tell as media buyers start work each day ready to fight the tough fight.

https://www.adweek.com/media/temu-advertising-avalanche-meta-google-media-buy/