The Student Debt Crisis is Increasingly About Graduate School Debt

When the media talks about the student debt crisis, they tend to focus on six-figure sums, as if the typical student borrows $100,000 or more to fund their college education. Yet, those sums are outliers, or they reflect the experience of graduate students who have accrued more debt by getting into graduate school. The average undergraduate student seldom borrows more than $100,000. America’s student debt crisis is a $1.7 trillion problem and has doubled in the last decade. The fastest-growing segment of the loan market is graduate student loans. According to Brookings, although only 25% of those who take student loans are in graduate school, around half of outstanding student debt is held by graduate students. According to a report by the Center for American Progress, the issuance of federal loans for graduate school rose from $35.1 billion in 2010 to $37.4 billion in 2017. In that time, new undergraduate borrowing declined from $70.2 billion to $55.3 billion.

QuinceMedia / Pixabay – Valuewalk

Q3 2021 hedge fund letters, conferences and more

Graduate Students Take On More Debt In Anticipation Of Greater Earnings

The chart below shows the difference between the typical debt of a person with a bachelor’s degree and a person with a graduate degree:

| Bachelor’s degree | $28,950 |

| Masters in Business Administration (MBA) | $66,300 |

| Master’s degree | $71,000 |

| Law degree | $145,500 |

| Medical degree | $201,490 |

Source: Nerdwallet

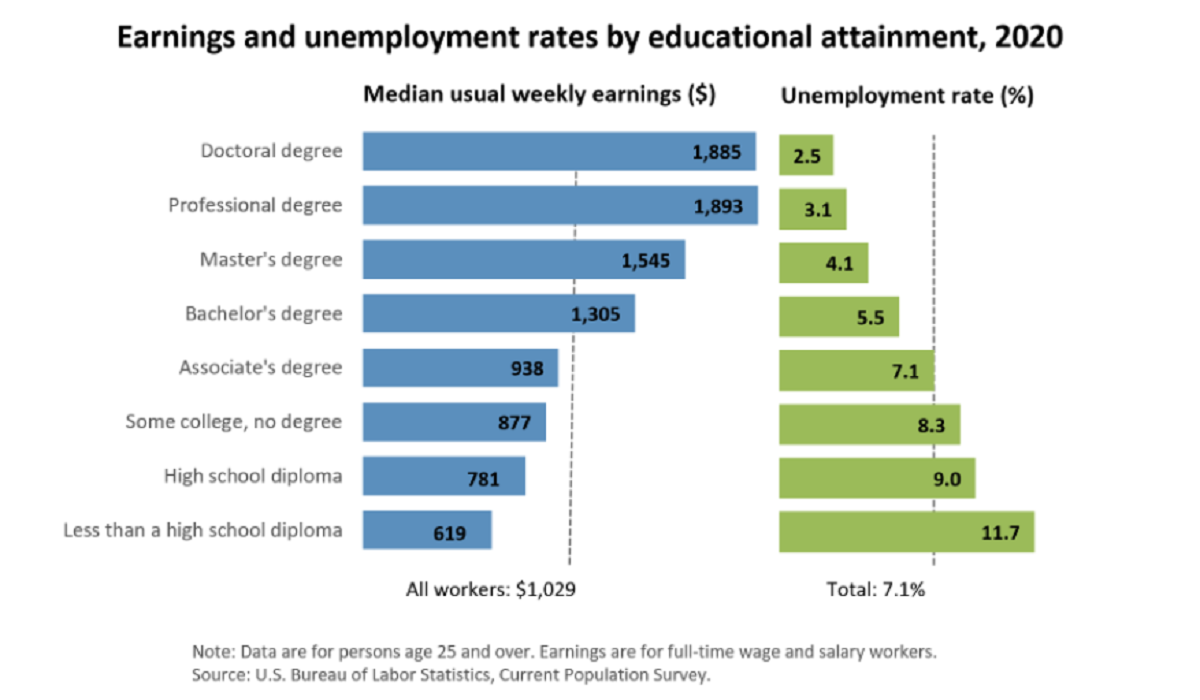

The typical argument is that graduate school students take on more debt because their future earnings will increase by having a graduate degree. For instance, the Bureau of Labor Statistics (BLS) found that a person with a master’s degree typically earns $1,545 a week, and a person with a professional degree such as an MD or JD earns $1,893 a week. A person who only has a bachelor’s degree can expect to earn $1,305 a week, and a person who only has a high school degree will earn $781 a week. People with an advanced degree also have a lower unemployment rate compared to those without, as the BLS chart below shows:

Not All Graduate Degrees Are Worth The Student Debt It Takes To Get Them

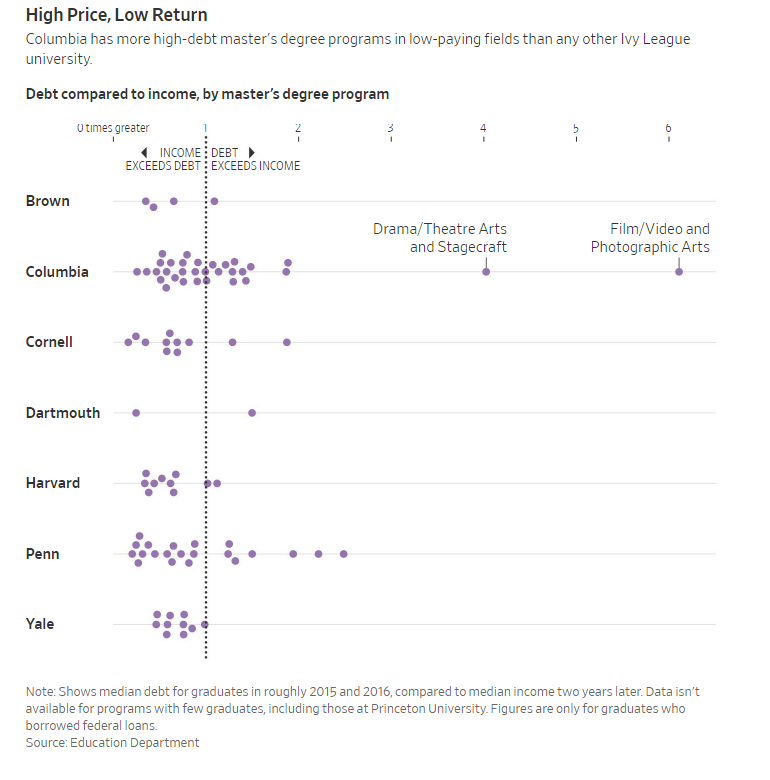

However, a Wall Street Journal report suggests some complacency about the idea that graduate school debt is justified by future earnings power. The Wall Street Journal found that certain graduate school programs left students with debt levels that were more than what their estimated future annual earnings would be able to support. For instance, a film school graduate from Columbia University who takes out a federal student loan has a median debt of $181,000. Yet, two years after attaining their degrees, half of those borrowers were earning less than $30,000 a year. Considering that federal guidelines are that debt should be paid off between 10 and 20 years after it has been taken out, these film school graduates would need an enormous increase in their incomes to be able to repay that debt within a 10 to 20-year framework. The reality for many such students is that student debt leaves them “financially hobbled for life”, as one of the ex-students interviewed by the Wall Street Journal described themselves. The reality is that much of this debt will be left unpaid, and taxpayers will be left on the hook.

Source: Wall Street Journal

Although Columbia University is an extreme example, many private universities, especially elite ones, have awarded thousands of master’s degrees whose earnings potential does not allow graduate students to pay down their federal student loans.

Although undergraduates have been at the brunt of growing loan balances for years, universities have realized that the federal Grad Plus program provides them with an opportunity to earn enormous sums of money. The Grad Plus loan program does not have a cap on how much debt a student can take to pay for their tuition, fees, room and board, and other expenses. So, a university can charge whatever they like, knowing that a student will take out a loan to foot the bill.

In contrast, undergraduates can only borrow up to $12,500 a year, and the total debt is capped at $55,700, although this depends on the individual’s circumstances. The Grad Plus program has an outstanding loan portfolio of $82.8 billion, spread out across 1.5 million people. Not only are loan amounts and interest rates higher than undergraduate loans, but the federal government will also cover any unpaid balances after 20 years.

Universities realized that they could ramp up their prices with impunity and focus mainly on master’s programs because of the enormous demand for them. By 2017, graduate programs, including business schools, had enrolled 49% of all Grad Plus borrowers, according to the Government Accountability Office report.

The program is now the fastest-growing federal student loan program, and interest rates have touched 7.9% in the last few years. At present, Grad Plus loans have an interest rate of 6.28%. This is at a time of declining and historically low borrowing rates.

Graduate degrees are an essential tool toward attaining higher incomes. Still, that reality must be balanced against the fact that not all graduate programs lead to earnings that can support the student debt taken on to get them. A person has to consider their career prospects and potential earnings and weigh that against the costs of paying down graduate school debt. A career as a lawyer or doctor can, for instance, support a graduate school debt, whereas one in film can hobble a person for life. It is also important to look for alternative graduate school loan programs to avoid the near-punitive rates charged by programs such as the Grad Plus loan program.

The Race For Graduate Degrees

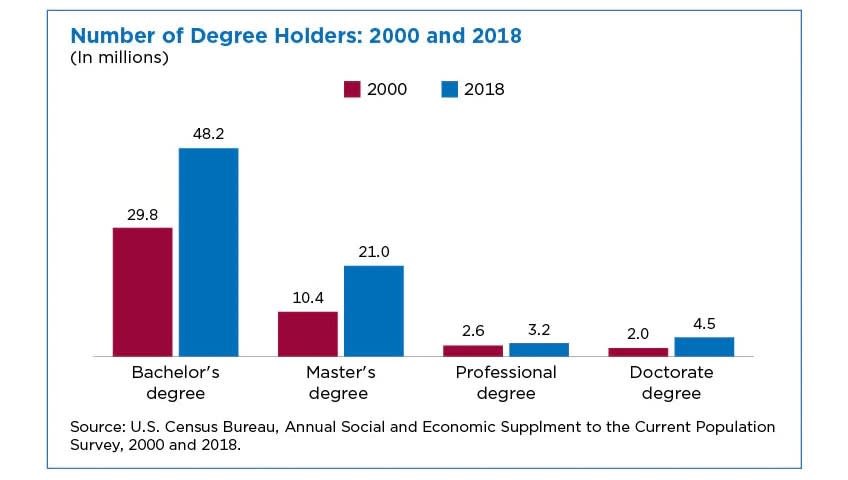

Master’s programs have become incredibly important in the jobs market as bachelor’s degrees have become widely attainable. A person now needs a graduate degree to have a hope of standing out in the job market.

Census data shows that in the 2000 to 2018 period, those who earned a graduate degree (either master’s or doctorate) and aged 25 years and over, doubled in number. In 2000, just 8.6% of adults had a graduate degree, but today, around 13.1% have one.

Job competition is not the only reason people have increasingly turned to graduate degrees. Georgetown Center on Education and the Workforce found that the wage gap motivates women to earn a degree more than men in order for them to bridge gender-based wage disparities. The typical woman with a bachelor’s degree earns $61,000, which is just about what a man with an associate’s degree makeshope to standAs a result, a The same rule applies right through the ladder of educational achievement.

Understanding that graduate degrees are not necessarily tickets to above-average future earnings if graduate students are to be taken as a constituency that is seriously in need of wholesale debt relief. Established in 2005 by Congress, the Grad Plus program has led to a situation in which graduates are on track to surpass the loans taken on by undergraduates in the 2020-2021 academic year.

https://www.entrepreneur.com/article/401545