The tech antitrust problem no one is talking about

After years of building political pressure for antitrust scrutiny of major tech companies, this month Congress and the US government delivered. The House Antitrust Subcommittee released a report accusing Apple, Amazon, Google, and Facebook of monopolistic behavior. The Department of Justice filed a complaint against Google alleging the company prevents consumers from sampling other search engines.

The new fervor for tech antitrust has so far overlooked an equally obvious target: US broadband providers. “If you want to talk about a history of using gatekeeper power to harm competitors, there are few better examples,” says Gigi Sohn, a fellow at the Georgetown Law Institute for Technology Law & Policy.

Sohn and other critics of the four companies that dominate US broadband—Verizon, Comcast, Charter Communications, and AT&T—argue that antitrust intervention has been needed for years to lower prices and widen Internet access. Analysis by Microsoft last year concluded that as many as 162.8 million Americans do not use the Internet at broadband speeds (as many as 42.8 million lack meaningful broadband), and New America’s Open Technology Institute recently found that US consumers pay, on average, more than those in Europe, Asia, or elsewhere in North America.

The coronavirus pandemic has given America’s gaping digital divide more bite. Children without reliable Internet have been forced to scavenge bandwidth outside libraries and Taco Bells to complete virtual school assignments. In April, a Pew Research Center survey found that one in five parents with children whose schools had been closed by coronavirus believed it likely they would not be able to complete schoolwork at home because of an inadequate Internet connection.

Such problems are arguably more material than some of the antitrust issues that have recently won attention in Washington. The Department of Justice complaint against Google argues that the company’s payments to Apple to set its search engine as the default on the iPhone make it too onerous for consumers to choose a competing search provider. For tens of millions of Americans, changing broadband providers is even more difficult—it requires moving. The Institute for Local Self-Reliance, which promotes community broadband projects, recently estimated from Federal Communications Commission data that some 80 million Americans can only get high-speed broadband service from one provider.

“That is quite intentional on the part of cable operators,” says Susan Crawford, a professor at Harvard Law School. “These companies are extracting rent from Americans based on their monopoly positions.”

The United States has suffered, and broken up, telecom monopolies in the past. AT&T had a government-sanctioned monopoly for much of the 20th century, until it was broken up in 1984. The 1996 Telecom Act included rules for phone providers aimed at encouraging competition, but it excluded “information services,” leaving broadband companies freer rein.

“Much more could come to the surface”

Crawford and other industry critics say cable companies have used that freedom to erode choice through mergers and have deployed a deep bench of lobbyists to steer lawmakers to lighten oversight and ban cities from building their own networks. Cities that have done so, like Wilson, North Carolina, generally have higher speeds at lower prices and less restrictive terms, Crawford says. Comcast has spent more than $10 million on lobbying in Washington this year, according to data compiled by OpenSecrets. Only two other companies, Amazon and Facebook, have spent more.

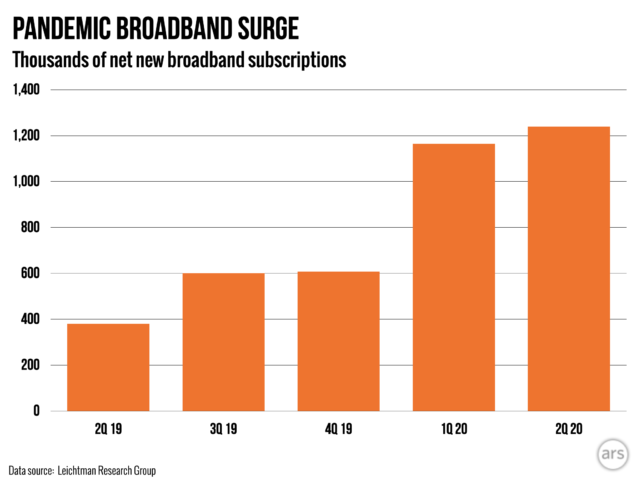

US Internet providers say the American broadband market is doing just fine and that the digital divide is closing. Business in this pandemic year is good: US providers signed on 2.4 million additional subscribers from January through June as school, work, and social life shifted online.

A Comcast spokesperson said the company is not a monopoly and competes with at least one other high-speed provider “in almost every area we operate.” Charter says it spent $25 billion from 2017 through 2019 and made its service available to millions of new homes. AT&T and Verizon directed WIRED to the industry group USTelecom, which recently published an analysis of FCC data showing that prices for residential broadband have fallen over the past five years.

Comcast and Charter cited an Economist Intelligence Unit report paid for by Facebook that ranks the US first in the world for Internet affordability. The ranking is based on the cost of mobile and broadband services, as well as the cost of smartphones, and the full methodology is unclear. A Wall Street Journal analysis of 3,300 broadband bills last year found broadly similar pricing to that reported by New America and concluded that prices were higher in places with less competition.

The Department of Justice and House Antitrust Subcommittee did not respond to requests for comment. Sohn of Georgetown, a former FCC staffer, says she has spoken about the broadband market to subcommittee staff and is hopeful they will take an interest.

Federal oversight of US Internet providers has dwindled under the Trump administration. In 2017 the agency abandoned net neutrality rules, which required ISPs to treat traffic from different sources equally. The Government Accountability Office and two of the agency’s own commissioners have questioned the FCC’s methodology for measuring broadband access, saying it paints an artificially rosy picture of the US market. The agency had allowed ISPs to count an entire census block as served by broadband access if service is available to a single resident, even if that resident has not signed up, but has since voted to require ISPs to submit geospatial maps.

If Joe Biden wins the White House, he is expected to try to restore the FCC’s net neutrality rules. The Democratic platform also includes promises to have the agency scrutinize broadband pricing and to prevent states from blocking municipal broadband networks.

Joshua Stager, a senior policy counsel at New America’s Open Technology Institute, would also expect a Democratic-controlled Congress to consider expanding subsidized broadband programs during the pandemic.

Making US broadband significantly more competitive would require larger and more coordinated action by the White House and Congress. Options worth considering include reversing some of the acquisitions that turned Comcast and others into nation-spanning giants and mandating that companies allow competitors to use their networks, as is common in Europe, Stager says.

Those would be more notable antitrust actions than seen from the US government in a while, but Stager believes the case is there. “The backlog of evidence is certainly there, and with increasing pressure on the networks, much more could come to the surface,” he says.

Disclosure: The Advance/Newhouse Partnership, which owns 13 percent of Charter, is part of Advance Publications. Advance Publications owns Condé Nast, which owns Ars Technica.

This story originally appeared on wired.com.

Listing image by Adrienne Bresnahan | Getty Images

https://arstechnica.com/?p=1718547