Unattributable Programmatic Ad Spend is Decreasing Claims ISBA Report

The second report from auditor PriceWaterhouseCoopers (PwC) and The Incorporated Society of British Advertisers (ISBA), which analyzed programmatic transactions between September 1 and October 31 2022, suggests elements of the murky supply chain of programmatic advertising are improving. However, experts caution much more vigilance is needed to accurately map the inner workings of programmatic advertising.

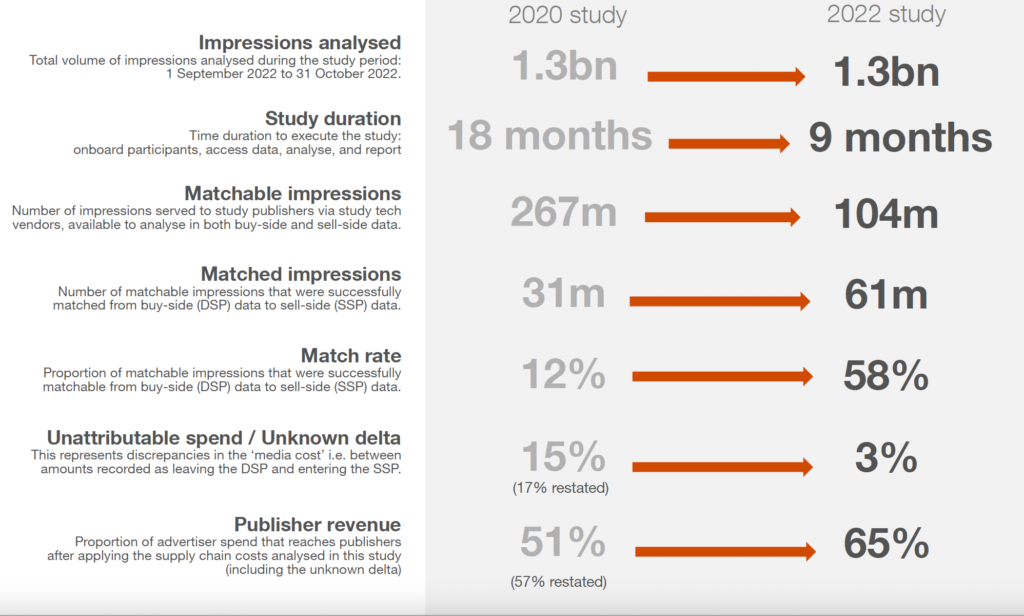

The bodies found that this unknown delta, or the percent of ad spend in the supply chain that could not be accounted for, was down to 3% from 15%, the number it first reported in 2020, causing a stir in a young industry looking to prove itself.

Moreover, the latest report found that 65% of advertiser spend reached publishers. The 2020 report pegged this figure at 51%.

The reports’ authors have noted that the new study excludes variables like agency fees when accounting for ad spend, which were included in the first study, making the restated, apples-to-apples figure for 2020 57%. The 2020 unknown delta figure, if the authors at the time had excluded agency fees and other variables like they did in 2020, would be 17%, making both 2022 findings an improvement.

Statements from those behind the study attributed the improved results to better quality data from study participants, and efforts taken by the industry to clean up the ad-tech supply chain.

“The match rate improvements alone reflect the reforms which have already been implemented throughout the programmatic supply chain by some vendors and agencies in the last two years,” said Clare O’Brien, ISBA head of media, in the report’s press release.

But four other industry sources question the study’s ability to diagnose progress in the programmatic industry. The sample, from which it draws conclusions about attributable spend, is 61 million impressions, which sources said could be around $1 million or less in spend, or about a day’s worth of trading. In the U.S. alone, advertisers spent around $127 billion on programmatic digital display in 2022, per Insider Intelligence.

“This proves there is progress within the scope of the study,” said Ruben Schreurs, group chief product officer at media analytics firm Ebiquity, who noted the study’s sample of 11 top advertisers, seven agencies, 12 tech vendors and 10 publishers was not representative of the industry. “Ad tech vendors are going to tout this figure … It’s a false sense of security which will lull vigilance.”

The challenges with log-file analysis

The report’s authors acknowledge that the study is not a perfect picture of the industry.

“This study is definitely not representative of all programmatic,” Sam Tomlinson, partner and media and marketing lead at PwC told Adweek. “This study shows what can be achieved in premium programmatic, with effort and investment.”

The data is arguably stronger than the 2020 study which originally caused shockwaves (and won an award from the World Federation of Advertisers). That study measured about half as many impressions and was only able to match 12% of impressions between the available buy and sell side data in the sample. The 2022 study matched 58% of impressions and drew exclusively on log files, which show impression-level data. In 2020, the report’s data sources were a mix of log files and aggregated data, which shows groups of impressions and allows for less analysis, Tomlinson said.

Log files are not sufficient to show what money actually leaves an advertiser’s bank account and what money flows into a publisher’s bank account.

Krzysztof Franaszek, founder of ad-tech research outfit Adalytics

Still, log files should not be taken as a panacea, said Krzysztof Franaszek, founder of ad-tech research outfit Adalytics. Franaszek’s firm has found numerous examples of ad-tech vendors deleting or editing log file data, including instances where a demand-side platform was overcharging a media agency an average of 8% each month relative to the sums present in log files.

“A comprehensive audit of the programmatic media supply chains must leverage log files,” Franaszek said. “But log files are not sufficient to show what money actually leaves an advertiser’s bank account and what money flows into a publisher’s bank account.”

Bank statements, which Franaszek said are better for auditing, would require more time, effort and cost for study participants, and would be orthogonal to the study’s purpose of tracking the supply chain, PwC’s Tomlinson said.

Other sources said the difference between the 2020 and 2022 reports is reflective of the complexity and the difficulty of sharing data, not necessarily that ad tech has a transparency problem.

“People pick on programmatic because it leaves such a data trail. But try to carrot the market and you can’t even start,” said Adam Heimlich, CEO of Chalice Custom Algorithms, an ad-tech firm that helps companies evaluate their media buys. “Different people own different data.”

Still, the industry is moving toward shorter supply chains. In 2020, private marketplace spend overtook open exchange across all forms of real-time bidding, including walled gardens, for the first time, Insider Intelligence found. The ISBA sample included PMP buys, Tomlinson said. The report noted the unknown delta for these transactions was less than 1% compared with the open marketplace delta of 3%.

“Even for performance efficiency, we see that big scale and impression opportunity in a more curated controlled environment,” said Geoff Litwer, vp of progrommatic and display media at performance marketing agency Tinuiti.

https://www.adweek.com/programmatic/unattributable-programmatic-ad-spend-is-decreasing-claims-isba-report/