Weed in Your Feed: Twitter Expands Rules for Cannabis Ads, but Industry Reaction Is Mixed

Learn to partner with creators and build customer trust with authenticity. Join leaders from TikTok, the NBA and more at Social Media Week, May 16–18. Register now.

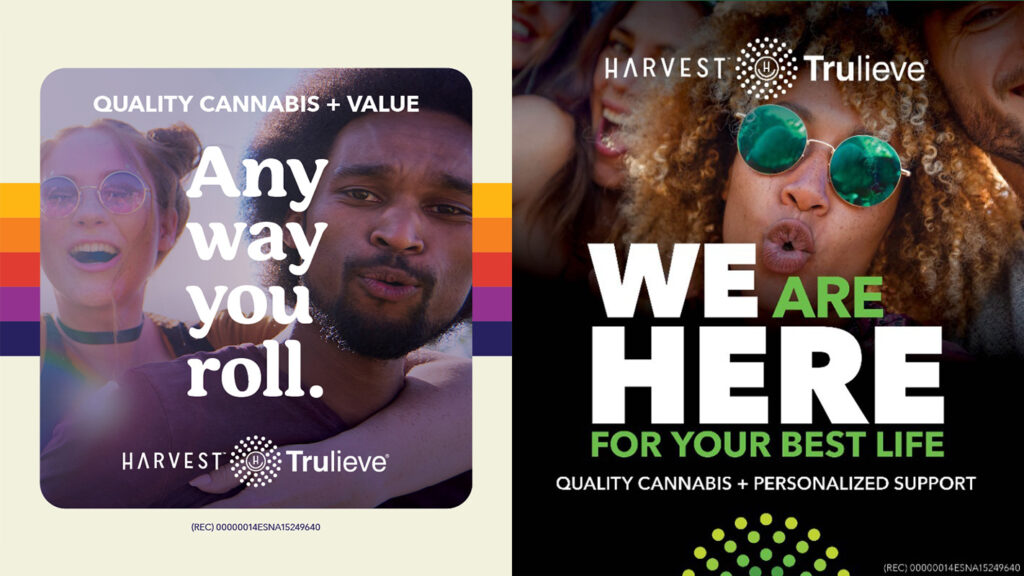

Shortly after running its first paid ads on Twitter this spring, cannabis conglomerate Curaleaf saw its following on the platform balloon by 300%, while its competitor Trulieve got a 214% boost in its web traffic.

Senior leaders at both companies hailed the newfound ability to buy media on the popular but problematic social channel, which broke ground in February as the first mainstream platform to accept ads from weed marketers.

Trulieve’s marketing has “already started to change perceptions and normalize cannabis use,” said chief marketing officer Gina Collins, who told Adweek that “this is only the beginning” of the nascent relationship.

With results and reaction like this, it may be easy to assume the Twitter experiment is a rousing success. That would be premature, though, according to many cannabis brands that called Twitter’s initial guidelines too restrictive and confusing, with scant data to justify the cost and little support in navigating the process.

This kind of “meaningful feedback” has spawned a new set of rules, with Twitter announcing last week it will “create even more opportunity” for the cannabis industry, per the company’s updated blog post tweeted by its cannabis sales and partnership executive Alexa Alianiello.

Twitter’s policy—take two—says weed marketers can now advertise in more parts of the country, across medical and recreational markets, and may show their products for the first time, as long as the THC-spiked goods are enclosed in packaging.

So, problems solved? Not exactly.

Groundbreaking but ‘anti-climactic’

While still shouting out the significance of Twitter’s new openness—optics are important as federally illegal cannabis continues to battle old stereotypes and advertising bans—many industry players remain unconvinced that Twitter is a good investment.

“We were all excited when the platform opened up,” Jeff Ragovin, chief commercial officer at data marketing firm Fyllo, told Adweek. “But it turned out to be anti-climactic.”

The avenue may be more available to deep-pocketed, multi-state operators, who seem to be getting more seamless customer service, per anecdotal evidence. But it’s less attractive to smaller, independent companies in the current economy, according to execs.

“Every cannabis brand I speak with is working with limited marketing funds right now, and we all know there is a lot of work still to do at the trade level, in stores and physically in-market,” Bohb Blair, chief brand officer of the Mary Jones Cannabis Co. and CMO of Jones Soda, told Adweek. “I don’t see a huge portion of brand marketing dollars going in this [Twitter] direction first.”

Ragovin agreed, citing channels like programmatic, connected TV, out of home and experiential as better bets.

“We need more ways to target and convert consumers,” Ragovin said. “It’s still too early for Twitter to be that.”

Courting cannabis

Twitter lifting its prohibition on weed ads, followed by an expansion of its initial policy, comes as the green wave continues to sweep the country. Medical sales are currently allowed in 37 U.S. states, recreational in 22.

Public support for legalization is growing, per BDSA, with 56% of the population backing sales for medical or adult-use purposes. And for a CPG comparison figure, Americans spend more on legal weed than on chocolate, per a recent MJBizDaily study, which pegs 2022 cannabis sales at $30 billion versus $20 billion for cocoa-based sweets.

Twitter, meanwhile, has suffered a mass defection of top-tier advertisers under new owner Elon Musk. Looking to make up some of the shortfall, the platform has turned to cannabis, where weed execs quickly called it out as a mercenary but potentially precedent-setting move.

Alianiello even showed up in person, a rarity for Twitter execs in the Musk era, to court the weed industry at a recent Benzinga investor conference in Miami.

Yet Blair sees a harsh truth to the site that he can’t overlook when deciding where to spend his ad dollars.

“They have consistently been one of the most problematic platforms for ad safety and overall content quality and trustworthiness,” Blair said. “So my scrutiny for cannabis being handled responsibly would be high.”

Awareness builder

Not everyone’s a naysayer, with Curaleaf finding Twitter buys useful to bolster its bona fides as “a thought leader in the industry” and to “build out appropriate yet effective awareness ads,” per executive vice president of marketing Kate Lynch.

Curaleaf, which is running a campaign in Arizona for its new Jams edibles line and in Illinois for its retailers, sees “potential for good ROI” on the platform.

“Ideally we would like to be able to measure revenue generated from these campaigns,” Lynch said, “but due to the nature of display advertising and traditionally low click-through rates, measurement has been hard to come by.”

Even so, “Twitter has opened up a door that cannabis brands and [multi-state operators] do not want to see shut,” Lynch said, noting that the relationship enables “a world of opportunities” for Curaleaf and others “to reach not only new canna-curious consumers and patients but to educate folks about this incredible life-saving plant.”

https://www.adweek.com/brand-marketing/twitter-expands-rules-cannabis-ads-mixed-reaction/