X (Twitter) Plans to Relax Rules for Cannabis Ads, Again

Head to the Retail Media Summit—on November 2 at the Mall of America, MN—to find out how RMNs can work for you by delivering first-party data from customers close to the point of purchase. Register.

For the second time this year, the social network X (formerly Twitter) plans to relax its advertising rules for cannabis companies.

Though details were scant, the sneak peek at the new policy came at the recent Benzinga Cannabis Capital Conference, with X’s sales and partnership executive Alexa Alianiello saying that feedback from the industry spurred the move.

Alianiello’s appearance at the gathering in Chicago—a semiannual event that draws hundreds of analysts, investors, C-suite execs and cannapreneurs—continues X’s charm offensive on the weed world.

The platform set a precedent in media by lifting its ban on cannabis ads in February, then rewrote the guidelines in May to allow marketers more freedom, both geographically and creatively.

An announcement about the broadening standards is imminent, Alianiello said during the session, hinting that weed products will be able to shed their packaging for the first time. That may be especially significant for companies that sell flower, which makes up the lion’s share of weed sales across the 38 legal U.S. states.

“We have some forthcoming policy relaxation that will allow even more opportunities to feature products,” Alianiello said. “There’s some news coming soon.”

‘100 million impressions’

Some brands still need convincing that X is a valuable and safe media buy, even though paid advertising channels are limited for the federally illegal industry. Meanwhile, others have already jumped in, with multi-state operator Trulieve offering a mini case study during the Benzinga session of its results so far.

The conglomerate broke ground as the first weed advertiser on X, seeing “100 million impressions and 40,000 followers across four states in a matter of months,” according to Iram Cesani, director of digital marketing at Trulieve.

The benefits have included “retargeting, defining the message and delivering timely, accurate product ads based on consumers’ past browsing behavior and past purchase behavior,” Cesani said.

Trulieve has bolstered its “house of brands” approach, he said, touting Roll One in Arizona and Florida, Sweet Top edibles in Arizona and Modern flower in Pennsylvania.

“It has helped build a D2C channel,” Cesani said. “It’s a full-funnel approach.”

Cannaconvos

For all its well-publicized problems, including an advertiser exodus since Elon Musk bought the site, X is hyping its future potential for brands in “audio, video, messaging, payments and banking,” Alianiello said, reiterating a statement from CEO Linda Yaccarino at Vox Media’s recent 2023 Code Conference.

X is a hotbed of cannabis chatter, per Alianiello, who said there have been more than 20 million posts about cannabis from 4 million unique authors in 2023. It’s the top platform for recreational cannabis users, and X users are 25% more likely than non-X users to be recreational cannafans, she said, citing GWI research.

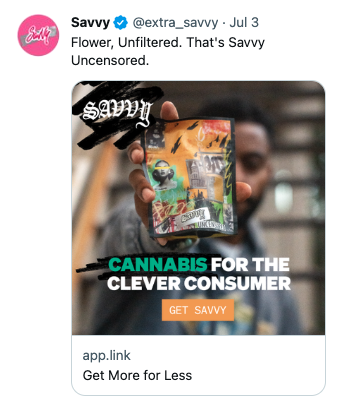

Considering that data and other factors, Illinois-based multistate operator Verano began advertising on X earlier this year in several markets, promoting its Zen Leaf dispensaries and Savvy affordable weed line.

“We saw significant jumps in all major KPIs—ad engagements, web traffic conversion, follower growth—as campaigns optimized,” David Spreckman, Verano’s CMO, told Adweek. “Campaigns remain active, and we’re now seeing sustainable return on ad spend across the board.”

Social buys are appealing in general because of their “expansive reach combined with low barrier to entry,” though options for cannabis companies are few, Spreckman said. “The X platform allows advertisers to be very targeted in delivering impressions—you can generate results and positive ROAS with relatively smaller investments by way of limiting waste.”

Cookies, an influential brand out of Northern California that’s now gone global, hasn’t yet made an ad buy on X but may test the channel later this year or first quarter of 2024, per Crystal Millican, head of marketing and retail.

“Marketing dollars are precious for us, so we’ve waited to see what early Twitter paid adopters are seeing in terms of ROI and to what degree Twitter is able to overcome common cannabis hurdles—difficulty measuring results, attribution challenges and struggling to define incrementality,” she added.

Follow the leader

While the platform continues to court advertisers in all categories—recently introducing new brand safety tools amid an ad revenue drop—it has appealed to cannabis executives repeatedly at IRL events.

Alianiello, who works for well-known cannafan Musk, has publicly shared personal anecdotes about the plant’s role in friends and family members’ lives, establishing herself as an internal advocate at X.

“We are grateful that she is a pioneer pushing for progress in our industry and expanding what cannabis marketers can accomplish in terms of channel mix,” Millican told Adweek.

As for the X move spurring other media outlets and publishers to follow suit, that has yet to materialize. But recent developments in Washington, D.C.—which infused the Benzinga conference with an optimistic vibe—may mean more outlets will be available to cannabis marketers.

“I imagine that some prospective realization of banking reform and/or rescheduling would at the very least encourage other market leaders in media to revisit their ad policies as it relates to the status quo of category prohibition,” Spreckman said.

https://www.adweek.com/commerce/x-twitter-relax-rules-cannabis-ads-again/