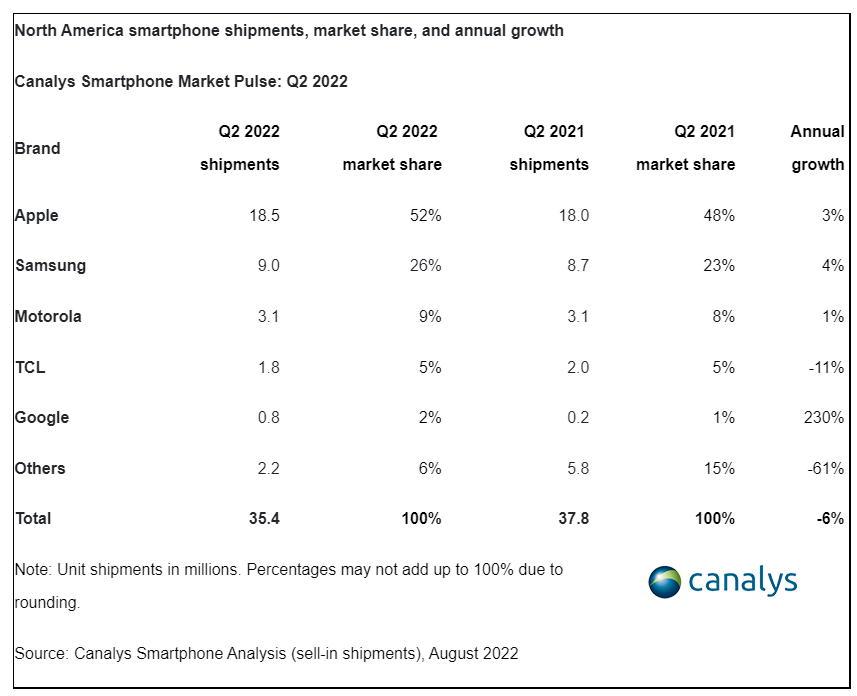

Canalys’ North American smartphone market share numbers are out, and the big mover for Q2 2022 is once again Google, which is seeing huge growth numbers thanks to the Pixel 6. Last quarter, Canalys had Google up 380 percent year over year, and this quarter, the company is up 230 percent.

That sounds incredibly successful, but this is Google’s tiny hardware division we’re talking about, so it’s all relative success. The company is now at 2 percent North American market share, having shipped 800,000 devices for Q2 2022. Along with last quarter, Google is now regularly hitting whole-digit market share numbers. That’s good enough for fifth place, behind Apple (52 percent), Samsung (26 percent), Lenovo/Motorola (9 percent), and TCL (5 percent).

Canalys also has a list of the best-selling models. The top five are all iPhones, of course, with the base model iPhone 13 taking the top spot, followed by the super-cheap iPhone SE. The iPhone 13 Mini, which is rumored to be selling so poorly that there won’t be an iPhone 14 Mini, took the ninth spot. The first Android phone on the list, the flagship Galaxy S22 Ultra, clocks in at No. 6.

Spots 7 and 8 are the $200 Moto G Power and the $250 Galaxy A13, two price points with very little competition compared to the more expensive devices. We would love to see more phone manufacturers (Google) tackle this price range. Canalys is on the same wavelength, with Research Analyst Brian Lynch saying: “The performance of the iPhone SE (3rd Gen), Galaxy A53, and Galaxy A33 are poorer than initially expected. Decreasing purchasing power is forcing buyers who normally would consider devices costing between US$250 and US$600 to look for cheaper options as consumers continue to feel the financial pressure of inflation on everyday expenses.” The report is also full of economic downturn talk, with overall smartphone demand down 6.4 percent.

Next up for Google is the Pixel 6a, which is too new to apply to any of these charts. At $449, it’s more accessible than Google’s $900 and $600 flagships but also right in that “poorer than initially expected” price range of the iPhone SE and Galaxy A53. We’ll have to wait for Q3 to finish to see how that phone is doing.

https://arstechnica.com/?p=1875791