Tesla has engaged in a series of price cuts over the past year or so, but it might soon want to think about making some more for the Model 3 sedan. According to the automaker’s website, the Tesla Model 3 Long Range and Tesla Model 3 Rear Wheel Drive will both lose eligibility for the $7,500 IRS clean vehicle tax credit at the start of 2024. (The Model 3 Performance may retain its eligibility.)

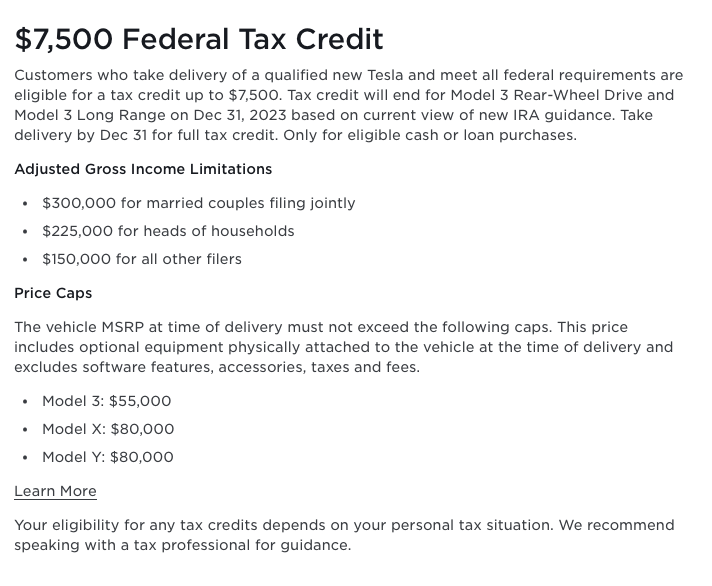

The beginning of 2023 saw the start of a new IRS clean vehicle tax credit meant to incentivize people by offsetting some of the higher purchase cost of an electric vehicle. The maximum credit is still $7,500—just like the program it replaced—but with a range of new conditions including income and MSRP caps, plus requirements for increasing the amount of each battery that must be refined and produced in North America.

A new hiccup appeared at the start of December 2023, though—in the form of new guidance from the US Treasury Department regarding “foreign entities of concern.”

China is one of those foreign entities of concern (along with Russia, North Korea, and Iran), and the new guidance says that an EV cannot be eligible for tax subsidies if the components were manufactured or assembled in those countries, or if some of the battery minerals were extracted or refined in those countries (beginning in 2025). It also applies to batteries made by companies that are owned or controlled by foreign entities of concern.

Given the high degree of Chinese state involvement in that country’s auto industry, this will probably mean that fewer EVs will qualify for the tax credit next year.

Tesla is not forthcoming on its site about the reason for losing the tax credit for these Model 3 variants, but it’s not the only automaker to face this problem. Ford also believes the Mustang Mach-E will lose its $3,750 tax credit eligibility on January 1, 2024.

https://arstechnica.com/?p=1991506