The bill for Elon Musk’s purchase of Twitter is coming due, with the billionaire facing unpalatable options on the company’s enormous debt pile, ranging from bankruptcy proceedings to another costly sale of Tesla shares.

Three people close to the entrepreneur’s buyout of Twitter said the first installment of interest payments related to $13 billion of debt he used to fund the takeover could be due as soon as the end of January. That debt means the company must pay about $1.5 billion in annual interest payments.

The Tesla and SpaceX chief financed his $44 billion deal to take Twitter private in October by securing the huge debt from a syndicate of banks led by Morgan Stanley, Bank of America, Barclays, and Mitsubishi. The $13 billion debt is held by Twitter at a corporate level, with no personal guarantee by Musk.

Since the takeover, Musk has raced to cut costs, such as firing half the company’s staff, while seeking new revenue streams, such as launching its Twitter Blue subscription service.

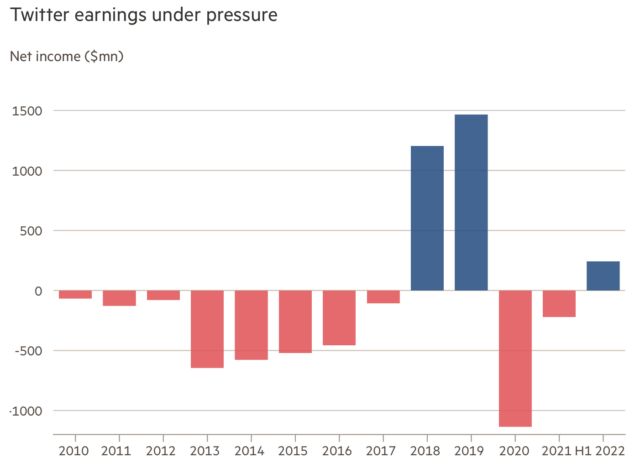

The company’s dire finances—it made a loss of $221 million in 2021 before the acquisition and Musk has said revenues have declined since—have led the new owner to regularly raise the prospect that the company could crash into bankruptcy.

How Musk deals with the looming interest payment is a crucial test of his leadership of Twitter, which has so far been marked by chaotic management that has alienated its corporate advertisers.

“This company is like you’re in a plane that is headed towards the ground at high speed with the engines on fire and the controls don’t work,” Musk said last month.

If Twitter did not make its first interest payment, it would join a small but notorious club of companies dubbed “NCAA” by debt traders—short for “no coupon at all”—that includes US car rental company Hertz and German payments group Wirecard.

Such a default on its debt would probably result in Twitter’s management filing for bankruptcy, at which point the US courts would begin an expensive and bureaucratic debt restructuring process.

Musk could avoid this fate by settling the interest from Twitter’s dwindling cash reserves or selling more equity in the company to fund the payments—both painful options. The business has a cash position of about $1 billion, Musk has said. He has also warned that its net cash outflow could be about $6 billion next year without additional cost-saving measures.

Rising interest rates mean the debt will become more and more expensive, at the same time as Twitter’s enterprise value has been damaged.

https://arstechnica.com/?p=1910459