At least four top pharmaceutical companies suing the federal government over a new requirement to negotiate Medicare drug prices have agreed to come to the table for the first round of negotiations—at least for now.

Merck, AstraZeneca, Bristol Myers Squibb, and Boehringer Ingelheim have all said that they will agree to the negotiations, though some were clearly bitter about it.

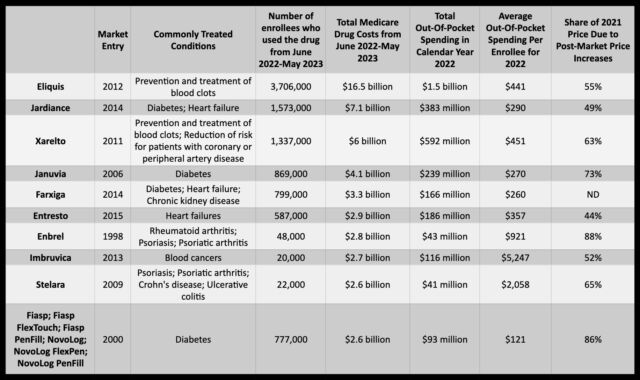

The four companies manufacture prescription drugs that were among the first 10 selected by Department of Health and Human Services to be subject to price negotiations, a provision under the Biden administration’s Inflation Reduction Act. Specifically, Merck makes the Type 2 diabetes drug Januvia, AstraZeneca is behind the diabetes drug Farxiga, Boehringer Ingelheim makes the diabetes drug Jardiance, and Bristol Myers Squibb makes Eliquis, a drug for blood clotting—all of which were selected for drug negotiations.

Eliquis is the costliest of the 10 drugs for Medicare Part D. From June 2022 to May 2023, the program’s gross coverage costs for Eliquis reached $16.5 billion to supply the drug to 3.7 million enrollees. In 2022, out-of-pocket costs per enrollee averaged $441. Bristol Meyers Squibb and partner Pfizer have ratcheted up the drug’s price considerably since it entered the market in 2021. An analysis by AARP earlier this year found that Eliquis’ list price increased by 124 percent between 2012 and 2021, while inflation during that time was 31 percent.

Likewise, Januvia saw its list price increase 275 percent since its introduction in 2006, and Jardiance’s list price increased 97 percent since its 2014 debut. Farxiga, introduced in 2014, was not included in the AARP analysis but was among the top five most expensive drugs for Medicare on the list of 10. Medicare Part D spent $3.3 billion on the drug between June 2022 to May 2023.

“No choice”

If the drug makers reject the negotiations, they would either face an excise tax of up to 95 percent of the drugs’ sales, or have to pull all of their drugs from the Medicare and Medicaid markets.

In a statement to media, Merck said that it agreed to negotiations “under protest,” disagreeing with the negotiations on “both legal and policy grounds.”

But, “withdrawing all of the company’s products from Medicare and Medicaid would have devastating consequences for the millions of Americans who rely on our innovative medicines, and it is not tenable for any manufacturer to abandon nearly half of the US prescription drug market,” Merck’s statement read. “The choice between doing so and weathering the [Inflation Reduction Act’s] massive fines and taxes is no choice at all.”

Bristol Myers Squibb also said it had no choice, with a spokesperson telling Fierce Pharma: “If we did not sign, we’d be required to pay impossibly high penalties unless we withdraw all of our medicines from Medicare and Medicaid,” the spokesperson said. “That is not a real choice.”

Boehringer Ingelheim appeared less sour about the situation in its statement, telling Bloomberg Law Wednesday that it is “committed to engaging in open and transparent conversations” with the Centers for Medicare & Medicaid Services (CMS). “We look forward to sharing detailed information with CMS on the value of Jardiance and to reinforce the need to invest in scientific medical innovation for the patients we serve,” the company said in an emailed statement.

AstraZeneca said something similar, with a statement saying it “plan[s] to participate in the process outlined by CMS.”

Makers of the remaining six drugs up for negotiation are Johnson & Johnson, Novartis, Novo Nordisk, and Amgen. Novo Nordisk provided a vague statement that it will “continue to explore all options that allow us to drive change” for its customers. Amgen has declined to comment.

Novartis and Johnson & Johnson did not immediately respond to Ars’ requests for comment.

Amgen and Johnson & Johnson are expected to be most affected by the negotiations. According to a report by Fierce Pharma on data from Moody’s Investors Service, Amgen’s drug on the negotiation list—Enbrel, an arthritis and psoriasis drug—accounted for 15 percent of the company’s revenue. Johnson & Johnson has two drugs on the list— blood clot drug Xarelto and Stelara, a drug for psoriasis, Crohn’s disease, and ulcerative colitis—which together account for 13 percent of the company’s revenue.

The negotiation period will end August 1, 2024. CMS will publish the first round of negotiated prices September 1, 2024, and they will go into effect January 1, 2026.

https://arstechnica.com/?p=1972343