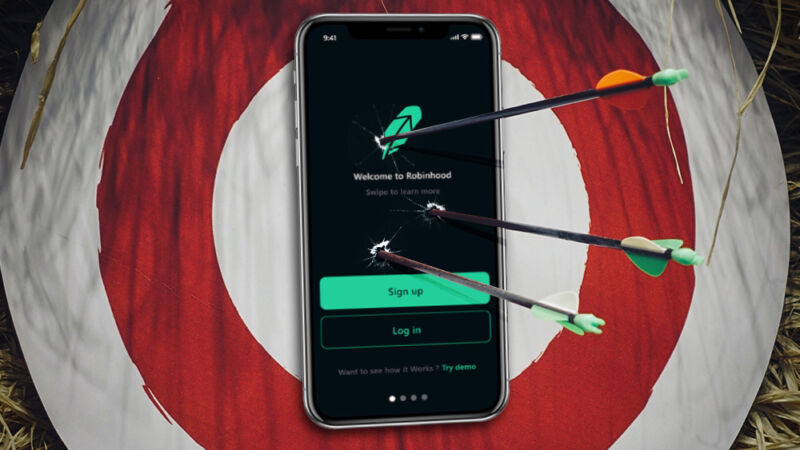

As the price of heavily shorted stocks like GameStop has shot up in recent days, so, too, has interest in retail trading apps like Robinhood. That app, launched in 2013 with a promise to “democratize finance for all,” offers so-called retail investors simple, zero-fee trades as an easy way to gamble on quick movement of individual stocks. But that smooth path to playing the market hit a bump Thursday morning, when Robinhood announced that it was suspending the ability to purchase 13 extremely volatile stocks, including GameStop.

In the hours following the announcement, GameStop’s stock price first shot up to a high of nearly $470, then cratered to a low of about $126 by 11:20am. The price then turned back upward and has currently stabilized around $310 as of this writing.

Robinhood wasn’t the only brokerage to restrict trading in this or similar ways. But as a heavily promoted favorite of the traders at the WallStreetBets subreddit and elsewhere, it was the one that drew the most negative attention.

Politicians as varied as Rep. Alexandria Ocasio-Cortez (D-N.Y.) and Senator Ted Cruz (R-Texas) tweeted their outrage at Robinhood’s “decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit,” as Ocasio-Cortez put it. Senate Banking Committee Chairman Sherrod Brown (D-Ohio) and ranking member of the House Financial Services Committee Patrick Henry (R-N.C.) have already announced plans to hold hearings on the matter. “It’s time for the SEC and Congress to make the economy work for everyone, not just Wall Street,” Brown said in a statement.

As of Friday morning, Robinhood is once again allowing purchases of the 13 volatile stocks it had paused, though with low limits on the total number of shares or options contracts a single user can open. But the fallout from the move is likely to have ripple effects throughout the world of retail investing and financial technology.

[Update (2:53 pm Eastern): Robinhood has updated its buying limits for certain extremely volatile stocks, including lowering the maximum buy to just a single share for stocks like GameStop, AMD, Koss, and Moderna. The original limits set early Friday morning allowed users to buy five shares of GameStock, 25 shares of Koss, and unlimited shares of AMD and Moderna, to cite just a few examples of the changes.]

The conspiracies flourish

Robinhood’s initial statement about its trading restrictions Thursday morning was frustratingly vague. The closest it came to an explanation was saying that the buying restrictions had come “in light of recent volatility” and that the company was “committed to helping our customers navigate this uncertainty.” Somewhat ironically, the announcement of trading restrictions was paired with a statement reiterating that “we fundamentally believe that everyone should have access to financial markets.”

In the absence of a stated reason for the move, some users started to get downright conspiratorial. Tweets started circulating suggesting that Robinhood was automatically selling shares of some stocks without the user’s consent. Robinhood has denied those reports, with a spokesperson telling The Verge, “I can confirm that claims that Robinhood proactively sold customers’ shares outside of our standard margin-related sellouts or options assignment procedures are false” (calling in shares bought on margin is an extreme move for a brokerage house, but it is allowed and does happen if the brokerage needs to cover other movement).

Others noted that Robinhood makes a large portion of its money by selling the details of its “retail order flow” to institutional investors, who then use that information to peel small margins off split-second high-frequency trades against the information. One of the major customers for that Robinhood data, Citadel, spent $2.75 billion earlier this week to bail out Melvin Capital Management, which had a heavy short position in GameStop.

Some observers tried to connect the dots to suggest the tail was wagging the dog, with Citadel supposedly demanding help from Robinhood to protect its newly acquired short positions (even though Melvin reportedly got out of its GameStop short positions on Tuesday). Others suggested (without evidence) that the SEC or other regulators had forced Robinhood to suspend purchases to protect their true masters, i.e. the heavily shorted hedge funds.

It wasn’t until after the markets closed on Thursday that Robinhood finally started to try to put the lid on these theories. “To be clear, this decision was not made on the direction of any market maker we route to or other market participants,” Robinhood CEO Vlad Tenev tweeted at 4:15pm Thursday.

Where’s my money?

So what was behind the move, then? In a statement posted Thursday evening, Robinhood said it was a “tough decision” that was driven by pesky regulations:

As a brokerage firm, we have many financial requirements, including SEC net capital obligations and clearinghouse deposits. Some of these requirements fluctuate based on volatility in the markets and can be substantial in the current environment. These requirements exist to protect investors and the markets and we take our responsibilities to comply with them seriously, including through the measures we have taken today.

The details of the Financial Industry Regulatory Authority’s Net Capital Requirements for Brokers or Dealers get incredibly arcane incredibly quickly. At their base, though, they require brokerages to maintain a certain amount of liquid funding to cover the financial obligations of the stocks and options they hold for customers.

When the stock a brokerage holds is extremely volatile (like the 13 stocks in question here), the brokerage can’t claim the full current value when using that stock as collateral for the overnight borrowing that often helps keep it liquid (i.e. it has to take a significant “haircut” on what the market currently says that stock is worth). Stock clearinghouses, which do the backend processing for trades made through brokerages, also require more significant collateral to cover those trades when a stock is volatile.

“Now I know how Clorox and Lysol felt in the pandemic when they were running out of hand sanitizer and supplies…”

Combine those arcane rules with a large market segment committed to buying and holding huge amounts of extremely volatile stock and you have a situation where even a massive firm like Robinhood is struggling to keep up with the requirements. And the company is already probably a bit on edge about this kind of thing after paying $65 million just last month to settle SEC charges that it misled traders and didn’t get them the best available trading prices.

In an interview with CNBC, Tenev said point blank that “there was no liquidity problem” and that Robinhood’s move was made “pre-emptively and proactively” to “protect the firm and protect customers.” But in the same interview, he said he “know[s] how Clorox and Lysol felt in the pandemic when they were running out of hand sanitizer and supplies,” which suggests that the company didn’t have enough of something (e.g. money) on hand to handle the SEC requirements for the trading influx.

“We just haven’t seen this level of concentrated interest in a small number of names before,” Tenev continued. “So we understand our customers are upset… We stand with our customers, we stand for the everyday investor and we do believe that you should be able to buy and sell the stocks that you want to, subject to all the requirements [emphasis added].”

Can they do that?

SEC rules or no, there’s something unsettling and seemingly unfair about a major brokerage like Robinhood just changing the rules of what a retail investor can and can’t buy at a moment’s notice. A number of class-action lawsuits are already circulating accusing Robinhood of things like “depriv[ing] retail investors of the ability to invest in the open market and manipulating the open market.”

Unfortunately for those retail traders, there’s probably nothing illegal about a brokerage cutting off purchasing of specific stocks at any time. “Generally speaking, any brokerage firm’s contract is going to give them the right to reject your transaction if they want to, and it’s basically at their sole discretion,” said Steve Mellen, a partner at Winget, Spadafora & Schwartzberg who has practiced securities law since 1994.

But this general rule only applies to the ability to buy stocks. If you want to liquidate your position, a brokerage “cannot normally reject an offer to sell a stock assuming it’s a long position, (i.e. you own it in your account with your own money),” Mellen said. “Nor is there a reason they’d want to, really.” That’s probably why Tenev clarified in his CNBC interview that “to be clear, customers could still sell those securities if they had positions in them…”

Some lawsuits (and amateur observers) have pointed to FINRA rule 5310, which requires that brokerages “must make every effort to execute a marketable customer order that it receives promptly and fully.” But Mellen says that only applies if the brokerage accepts the order in the first place. If you state up front that you’re not letting a user make a trade, in other words, then there’s no trade to “execute promptly and fully.”

“Generally speaking, any brokerage firm’s contract is going to give them the right to reject your transaction if they want to, and it’s basically at their sole discretion.”

“I doubt the plaintiffs have any valid claim when they decide they won’t accept any more buy orders, as long as they tell you right away when you try to place the trade,” Mellen said. “Where they [could] get into trouble is if they lead you to believe they accepted your order, and then an hour later they call you to say they’ve decided not to because in that hour you could have gone to a different firm and maybe now you lost your buying opportunity.”

Others have suggested that if some of these stocks continue to rise, Robinhood might be on the hook for unrealized gains that its customers missed out on through the inability to buy on Thursday. “When your only complaint is that you missed out on a buying opportunity, who even knows if it would have been profitable,” Mellen said. “You certainly didn’t know at the time, you just had a hunch, and we don’t know when you would have sold it either. So it’s not actually a great claim for damages either way.”

What happens now

With the legal and regulatory liability seemingly covered, Robinhood’s main problem at this point is reputational. The idea that “everyone should have access to the financial markets” is baked right into Robinhood’s mission statement, after all. Restricting customers’ access to the hottest part of those markets—even temporarily and even with a valid reason—is not a great look, to say the least.

It’s not hard to find the usual angry social media posts and calls for boycotts in the wake of Robinhood’s decision. In the end, though, the lesson of the restrictions on Robinhood’s fee-free trades might be of the “you get what you pay for” variety. Retail trading apps are fine if you want to gamble a few dollars on a hot stock for a lark. But if you want to be assured of reliable access to the latest market moves, you may need a full-service broker that potentially uses fees to help meet all those pesky capital requirements.

https://arstechnica.com/?p=1738244