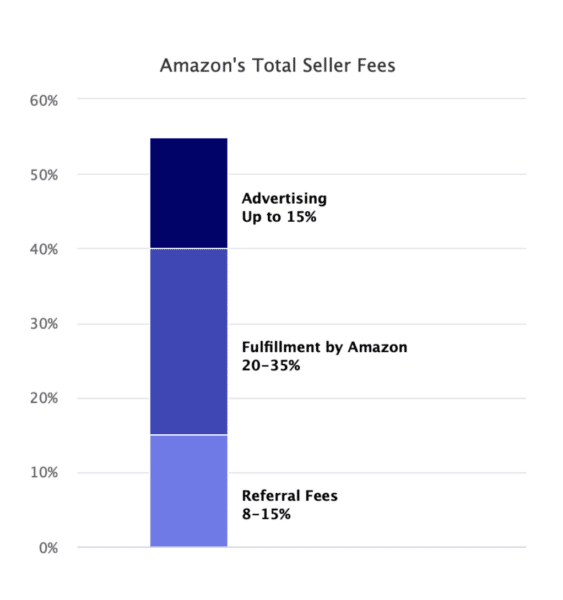

Based on P&Ls provided by a sample of sellers, the fees incurred by a typical Amazon seller include a 15% transaction fee, referred to as a referral fee by Amazon, and 20-35% in Fulfillment by Amazon fees, which encompass storage and other fees. Additionally, advertising and promotional expenses on Amazon can amount to up to 15% of the total fees, with the overall costs varying according to category, product price, size, weight, and the seller’s business model.

While the 15% transaction fee has remained constant for more than a decade, it can vary by category and be as low as 8%. Meanwhile, Fulfillment by Amazon (FBA) fees have increased gradually over time, with Amazon introducing yearly increases in fulfillment fees and storage fees. Given that selling on Amazon is tied to using FBA, most sellers rely on it to succeed on the platform.

Not news for many sellers. I reached out to a few Amazon sellers and agencies and was asked to keep their information private. But I was told:

“For several years Amazon has been prioritizing Advertising revenue and increasing fees which has put pressure on sellers, especially smaller brands. Despite that brands would be leaving money on the table not being on Amazon. Smart brands diversify to other channels(DTC/Retail) and continue to optimize their business to adapt to the changing landscape.”

I’m not an Amazon seller, and my digital experience is more limited to lead generation, so I thought this was eye opening. But for those more familiar with the ecommerce landscape in 2023, it’s not a surprise.

“At the same time it’s not necessarily cheaper to sell elsewhere – fees have gone up everywhere.”

Forcing sellers to advertise. While Amazon does not dictate how much to spend on advertising, competition among sellers who choose to advertise drives up that cost. Unlike other marketplaces, advertising on Amazon is not a choice, as the most prominent screen space is typically reserved for ads.

Consequently, sellers must advertise to increase their chances of being discovered by customers. Some sellers still spend relatively little on advertising, and some resellers spend less than 5% of their sales on ads. However, private label sellers often spend over 10% of their revenue on advertising to grow their brand.

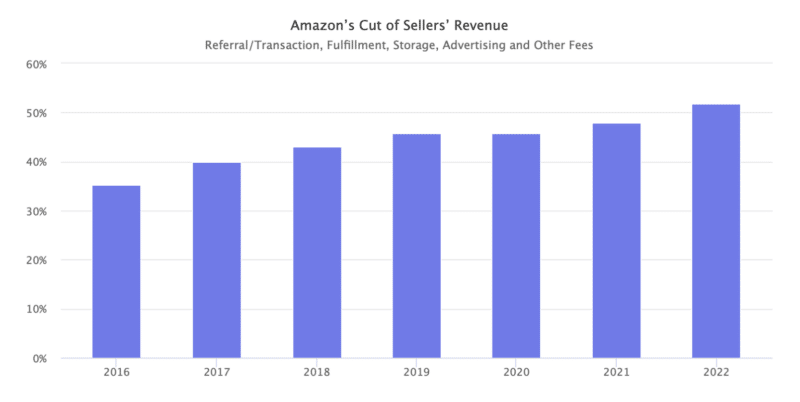

The percentage of fees paid by Amazon sellers as a proportion of their sales increases every year, not because they are using more services, but because the cost of certain services has risen (e.g., FBA) or because certain fees are now unavoidable (e.g., advertising).

Other options for ecommerce sellers. Compared to Amazon, Walmart is a more economical choice, particularly for new sellers that can take advantage of transaction fee discounts. However, Walmart’s market size is significantly smaller than Amazon’s, meaning that sellers cannot entirely replace Amazon with Walmart. Additionally, direct-to-consumer e-commerce platforms like Shopify operate on a fundamentally different business model, and fees are not the sole consideration.

To cope with the rising fees, sellers are either increasing their prices, seeking alternatives to FBA, or branching out from Amazon entirely. Nevertheless, some sellers only realize how little net profit they have left at the end of the tax year, with a few even reporting paying up to 60% or 70% of their revenue to Amazon in fees. They must still account for other expenses, such as inventory, freight, and employees.

Dig deeper. You can read the full study on Marketplace Pulse.

Why we care. Rising fees on Amazon have a direct impact on advertising costs, as advertising is a necessary expense for most sellers on the platform. As more sellers choose to advertise, the competition for ad space increases, driving up advertising costs. Consequently, advertisers may need to adjust their advertising strategies and budgets to account for these costs.

As fees continue to increase, advertisers may face difficulty generating a return on investment, which could impact their bottom line. Therefore, advertisers need to keep a close eye on the costs of selling on Amazon and ensure that they are making informed decisions when allocating their advertising budgets.

Related stories

New on Search Engine Land

https://searchengineland.com/amazons-share-of-seller-revenue-is-now-50-393383