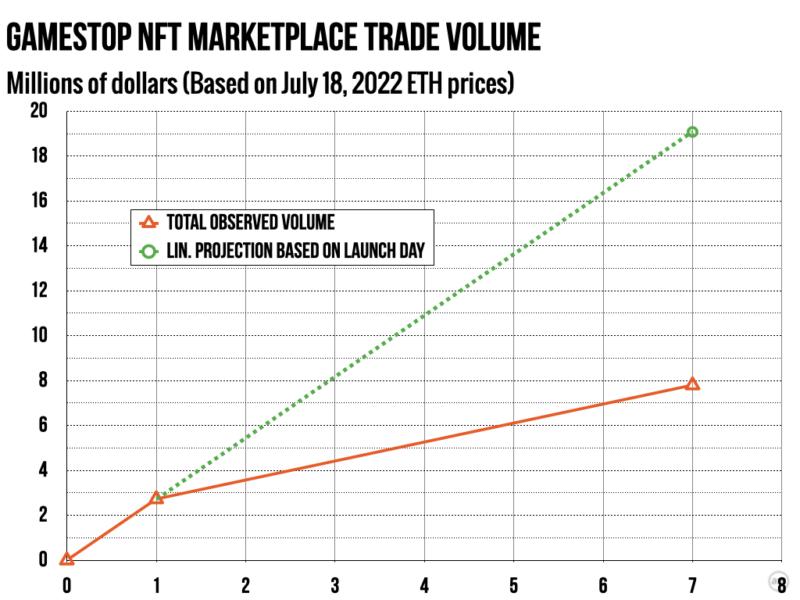

Last week, when Ars analyzed the first day of NFT sales on GameStop’s heavily hyped crypto marketplace, some boosters were quick to suggest that this was just a starting point and that interest and trading volume might increase as time goes on and more people discover the trading platform. Over the marketplace’s first week, though, interest in trading GameStop NFTs seems to be declining when compared to that launch day performance.

An Ars-exclusive analysis of the GameStop NFT marketplace now shows that it has been responsible for about 5,254 ETH in total trading volume in its first week (worth about $7.8 million at current exchange rates). That’s a daily average of about 750 ETH ($1.117 million) in total trade volume. GameStop takes a 2.25 percent fee for all those trades, representing a daily average of 16.9 ETH ($25,113) in direct revenue to the company. All told, six of the over 300 collections on the platform are responsible for a majority of that trading volume.

(Note: Ever-volatile ETH prices have increased about 38 percent since last Tuesday, when Ars did its launch day analysis of the marketplace. Unless otherwise noted, we’re using the current ETH spot price—$1,488.06 as of this writing—for conversions here, even though transactions earlier in the week likely took place at lower dollar/ETH rates.)

The average daily trade volume over the first week is a significant slowdown from the marketplace’s launch day, when it processed 1,831.81 ETH in total trade volume (worth about $1.976 million then or $2.725 million at today’s rates), according to Ars’ analysis. On that first day, GameStop made approximately 41.2 ETH in transaction fees (worth about $44,500 then or $61,331 today).

Of the hundreds of NFT collections that saw some trading activity on the marketplace’s first day, the median collection saw average daily volume shrink by about 50 percent during the first week of trading (when compared to launch-day volume). That doesn’t include 34 collections that have yet to see a single trade on the marketplace, of which 25 have been available since day one.

And the dozens of new NFT collections on the marketplace (i.e., those that saw their first transactions after the marketplace’s launch day) aren’t making up that gap. Those 85 or so collections are responsible for just 556 ETH of total trade volume in the last six days (about $828,575).

The wrong direction

Any way you slice it, total activity on the GameStop NFT marketplace has been slowing down in the days since the service launched. That’s perhaps not too surprising, considering the months of pent-up demand among crypto bulls and GameStop stock enthusiasts that was unleashed on the platform’s launch day last Monday. It’s also not that surprising in the context of the wider NFT market, where a leading marketplace like OpenSea has seen daily trade volume plummet by roughly 90 percent since its peak in January.

Still, the slowdown is a setback for GameStop and crypto boosters who hope the introduction of NFT trading can revolutionize GameStop’s brick-and-mortar-focused business model. For now, if trading on the GameStop NFT Marketplace continues at the same weekly rate, it will see a total trade volume of about 273,000 ETH in its first year. That’s worth about $406 million today, or about just 6.75 percent of GameStop’s $6.011 billion in fiscal 2021 net sales.

Of that volume, GameStop will take about 6,147 ETH in transaction fees (about $9.15 million), which is only about 0.15 percent of GameStop’s fiscal 2021 net sales or 2.4 percent of its $381 million fiscal-year 2021 loss. Even if GameStop HODLs all its ETH and the cryptocurrency spikes back to its all-time high price of about $4,800, then those annualized transaction fees will be worth just $29.5 million (about 0.49 percent of fiscal 2021 net sales; 7.7 percent of fiscal 2021 loss).

Earning tens of millions of dollars annually from a completely new line of business isn’t nothing, of course, especially when GameStop doesn’t have to worry about much in the way of inventory or brick-and-mortar overhead to sell NFTs. Still, this isn’t the kind of bottom-line performance that will severely impact a multi-billion-dollar company in the long run.

It is still the early days for GameStop’s NFT business, though, and the wider market for NFTs could still bounce back from its current doldrums. Or maybe the eventual integration of “web3 gaming” assets on the GameStop marketplace (which the retailer says will be added “over time”) will help it “cement itself as the ultimate destination in the new paradigm of gaming,” as Immutable’s Robbie Ferguson suggested when announcing a deal with GameStop in February.

For now, though, GameStop and its boosters will be watching and waiting for such a turnaround to occur. Until and unless it does, the GameStop NFT marketplace seems fated to be a relatively minor part of the international retailer’s business going forward.

Listing image by MetaBoy / GameStop NFT marketplace

https://arstechnica.com/?p=1867604