It has been nearly 10 years now since Ars Technica first described Bitcoin to readers as “the world’s first virtual currency… designed by an enigmatic, freedom-loving hacker, and currently used by the geek underground to buy and sell everything from servers to cellphone jammers.” A decade later, Bitcoin and other cryptocurrencies are practically mainstream, and even most non-techies know the blockchain basics powering a decentralized financial revolution (or a persistent bubble, if you prefer).

What Bitcoin was to 2011, NFTs are to 2021. So-called “non-fungible tokens” are having a bit of a moment in recent weeks, attracting a surge of venture capital cash and eye-watering speculative values for traceable digital goods. This despite the fact that most of the general public barely understands how this blockchain-based system of digital authentication works, or why it’s behind people paying $69 million for a single GIF.

Fungible? Token?

Perhaps the simplest way to start thinking about NFTs is as a digital version of the various “certificates of authenticity” that are prevalent in the market for real-world art and collectibles. Instead of a slip of paper, though, NFTs use cryptographic smart contracts and a distributed blockchain (most often built on top of Ethereum these days) to certify who owns each distinct, authentic token.

As with cryptocurrencies, those contracts are verified by the collective distributed work of miners who keep the entire system honest with their computational work (the electricity for which creates a lot of nasty carbon emissions). And just like cryptocurrencies, those NFTs can be sold and traded directly on any number of marketplaces without any centralized control structure dictating the rules of those transfers.

What makes NFTs different from your run-of-the-mill cryptocurrency is each token’s distinctiveness. With a cryptocurrency like Bitcoin, each individual unit is indistinguishable from another and has an identical value. Each individual Bitcoin can be traded or divided up just like any other Bitcoin (i.e. the Bitcoins are fungible). NFTs being “non-fungible” means each one represents a distinct entity with a distinct value that can’t be divided into smaller units.

Just as anyone can start printing their own line of Certificates of Authenticity (or anyone can start up their own cryptocurrency to try to be “the next Bitcoin”), anyone with just a little technical knowhow can start minting their own distinct NFTs. Etherscan currently lists over 9,600 distinct NFT contracts, each its own network of trust representing and tracking its own set of digital goods.

These NFT contracts can represent pretty much anything that can exist digitally: a webpage, a GIF, a video clip, you name it. Digital artists are using NFTs to create “scarce” verified versions of their pieces, while collectible companies are using them to create traceable, unforgeable digital trading cards. Video game items and characters can be represented as NFTs, too, allowing for easy proof of ownership and portability even between games controlled by different companies (though the market for such games is still very immature).

There are plenty of even odder examples out there. Vid is a TikTok-like social media network that gives users NFT-traced ownership of their posted videos (and royalty payments for the same). The Ethereum Name Service is using NFTs to set up a decentralized version of the ICANN-controlled Domain Name Service for finding online content. Aavegotchi is a weird hybrid that uses digital pets to represent your stake in a decentralized finance protocol called Aave. Essentially, there are hundreds of companies looking to NFTs for situations where they need to trace and verify ownership of distinct digital goods.

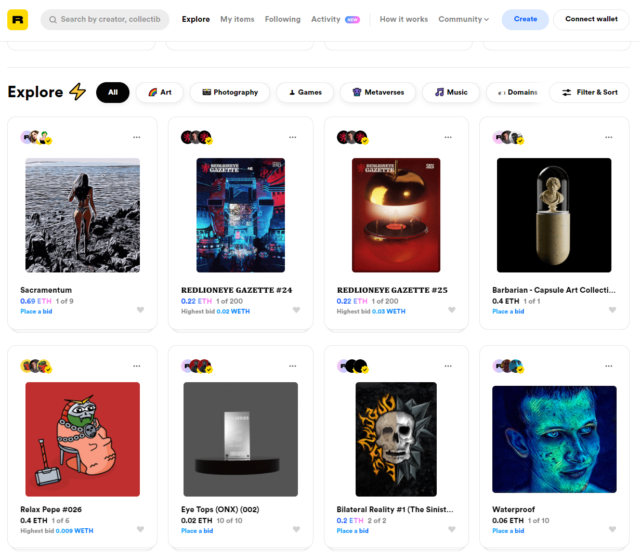

The idea has been catching on quickly, at least among speculators with a lot of money to throw around. Nonfungibles’ database of hundreds of different NFTs has tracked over $48 million in sales across nearly 40,000 NFT transactions in just the last week. Rarible, one of the most popular NFT marketplaces, saw its daily trading volume hit $1.9 million earlier this month, tripling the same number from just a day before. Cryptopunks, an early NFT representing 10,000 unique pixellated avatars, has seen over $176 million in total transactions since its creation in 2017 (with over 10 percent of that volume coming in the last week).

How does it work?

On a technical level, most NFTs are built on the ERC-721 standard. That framework sets up the basic cryptographic system to track ownership of each individual token (by linking it to user-controlled digital wallets) and allow for secure, verified transfer on the blockchain.

Some NFT contracts have built additional attributes and features on top of that standard. The NFT for a cryptokitty, for instance, contains metadata representing that digital avatar’s unique look and traits. That metadata also establishes rules for how often it can “breed” new cryptokitty NFTs and what traits it will pass down to future generations. Those attributes are set and verified on the blockchain, and they can’t be altered no matter how or where the cryptokitty is used.

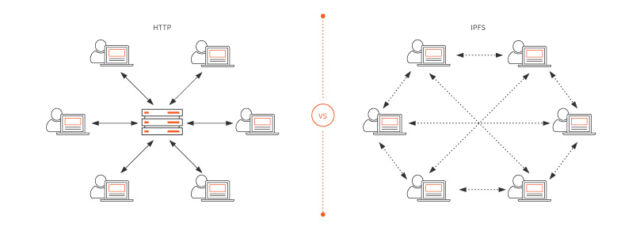

When NFT’s are used to represent digital files (like GIFs or videos), however, those files usually aren’t stored directly “on-chain” in the token itself. Doing so for any decently sized file could get prohibitively expensive, given the cost of replicating those files across every user on the chain. Instead, most NFTs store the actual content as a simple URI string in their metadata, pointing to an Internet address where the digital thing actually resides.

It may seem odd to link a system of decentralized, distributed digital goods to content hosted on centralized servers controlled by actual people or companies. Given that the vast majority of webpage links become defunct after just a few years, an NFT pointing to a plain-old web address wouldn’t seem to be a good long-term store of value.

Many NFTs get around this by using burgeoning blockchain-based file networks such as IPFS or pixelchain. These networks are designed to let users find, copy, and store cryptographically signed files that could be distributed among any number of independent nodes (including ones controlled by the NFT owner). In theory, linking an NFT to an IPFS address could ensure the digital file in question will continue to be accessible in perpetuity, as long as someone has mirrored a verifiable copy on some node in the IPFS network.

Are NFTs really that valuable?

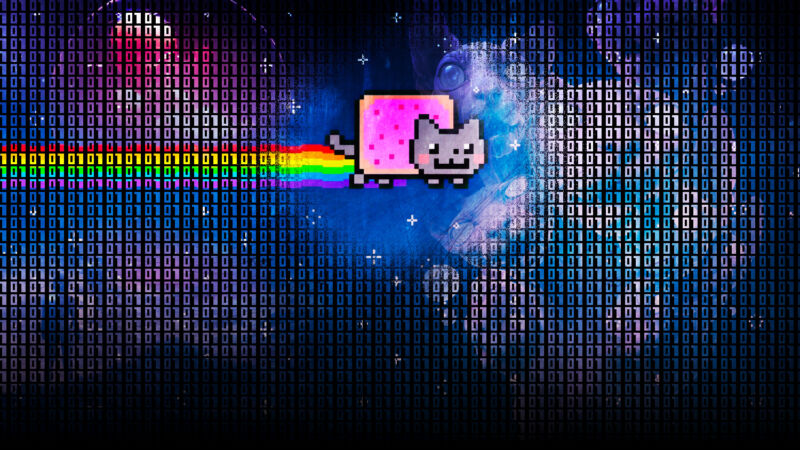

Just like a certificate of authenticity, the value of an NFT (and the “unique” digital item it represents) is strongly tied to its provenance. The person who spent $560,000 for an NFT representing the original Nyan Cat meme, for instance, obviously didn’t purchase every copy of the famous animated GIF of a pop-tart cat with a rainbow trail behind it. You can still download your own identical copy with a few clicks. The NFT doesn’t even include the copyright to Nyan Cat, which would at least give the owner some legal control over the work (though some NFTs try to embed such rights in their contracts).

What makes the Nyan Cat NFT interesting (and potentially valuable) is that it was verified and sold by Chris Torres, the person who created and posted the original Nyan Cat video to YouTube in 2011. That gives this copy of Nyan Cat a unique history and a tie to the meme’s creation that can’t be matched by any other copy (or any other NFT, unless Torres starts diluting the value by minting more). And the blockchain technology behind the NFT ensures the chain of custody for that version of the GIF can be traced back to Torres’ original minting, no matter how many times it’s sold or transferred.

Does that fact alone really give this NFT any more value than all of the other identical Nyan Cat GIFs floating around on the Internet? That’s for a highly speculative market to figure out. But just as a stroke-for-stroke copy of a Vermeer masterpiece doesn’t have the same value as the one-of-a-kind original, a verified “original” Nyan Cat from the meme’s creator may retain some persistent value to collectors.

Just because digital goods are easier to copy than paintings doesn’t make one less valuable than the other, either. It’s trivial to make a near-perfect copy of a photographic print, but original photographs can still sell for millions of dollars to the right buyer.

On the other hand, these NFTs might end up being more akin to those novelty deeds that claim the document gives you “ownership” of a star in the night sky. While there’s probably some sentimental value to the idea of owning a star, there isn’t any real robust market where the most coveted stars trade for large sums. And just like there are a lot of competing organizations offering “star deeds” these days, there are a lot of competing firms that could dilute the market with their own NFT offerings.

Do you know where your NFT came from?

All of this means that tracing the provenance of any given NFT can be of prime importance to its implicit value. NFT marketplace SuperRare ensures its NFTs are “authentic” by only minting tokens for a set of “hand-picked artists” for the time being. NBA Top Shot, meanwhile, relies on its NBA license to make sure its randomized packs of basketball video clips are each unique and have an “official” air to them.

But there are plenty of situations where the original ownership of a particular NFT is more questionable. Game developer Jason Rohrer drew some controversy earlier this month by trying to sell NFT tokens for artwork originally created by other artists for his 2012 game The Castle Doctrine. This did not please many of the artists who were not aware their digital work was being resold as a token, to say the least.

Then there’s Tokenized Tweets, a simple service that can create a sellable NFT token representing any tweet on the service, including ones created by other people. The service has recently stopped tokenizing tweets that include visual media, and it lets artists make takedown requests if their copyrighted art/photography is tokenized by the service. But that seems like a pretty skimpy Band-Aid for an offering that seems rife with fraud potential.

There are also gray areas like Marble Cards, which lets you create an NFT “frame” intended to go around a specific, unique webpage URL. That makes each frame akin to a unique trading card with a picture of a webpage on it. While the service states clearly that “no third-party content is claimed or saved on any blockchain,” the direct link and implicit association with the webpage in question could lead to some thorny questions of ownership.

With literally thousands of companies jumping into the NFT space, there’s a gold rush mentality that seems primed to spawn plenty of scams. And even legitimate NFT efforts could see their values fade away quickly if the market’s attention moves on to a different blockchain as its store of “authentic” value. Cryptokitties, one of the first popular NFT collectibles in late 2017, saw transaction volume plummet 98 percent in 2018 as high Ethereum fees and lack of novelty drove some of the more speculative players away.

Back in 2011, it was unclear if Bitcoin was going to be a lasting financial instrument or a flash-in-the-pan technological fad. And here in 2021, you can say the same thing about the future for NFTs.

https://arstechnica.com/?p=1752094