This article originally appeared on Inside Climate News, a nonprofit, independent news organization that covers climate, energy, and the environment. It is republished with permission. Sign up for their newsletter here.

If money makes the world go round, it should be no surprise that fossil fuel still powers the global economy. Ever since world leaders reached the Paris climate agreement in 2015 to limit warming and slash the pollution driving it, environmental groups have chronicled the continued flow of finance from the wealthiest banks to the oil and gas industry.

Climate advocates have been increasing the pressure on banks to change course, and many lenders have responded by adopting policies to reduce the climate pollution generated by their vast portfolios. Some have also pledged to stop financing certain types of fossil fuel extraction altogether, such as coal mining and Arctic drilling. But have those policies made any difference?

A pair of new reports provides a muddled picture. Banks lent significantly less money to fossil fuel companies last year, according to a report by a collection of environmental groups led by Rainforest Action Network. However, the decline was likely driven not by choices the banks made, the report said, but because oil companies were sitting on so much cash they didn’t need to borrow any. Many oil firms, including ExxonMobil and Chevron, earned record profits last year.

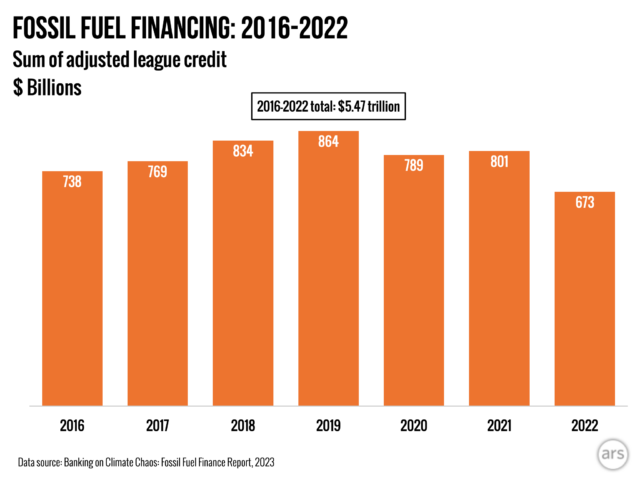

All told, the world’s top 60 banks plowed $673 billion in financing into fossil fuel companies last year, according to the report, which is the lowest amount since the groups began tracking in 2016. Despite the decline, the report’s authors said the banks’ fossil lending policies remain weak and inadequate, and that such financing is not declining nearly fast enough to curb climate pollution in line with the Paris Agreement’s more ambitious target of limiting warming to 1.5° Celsius, or 2.7° Fahrenheit.

“We still see just this tremendous flow of finance into fossil fuel companies, including into companies that are expanding fossil fuels,” said April Merleaux, research manager at Rainforest Action Network and the report’s lead author. The report singled out the largest companies involved in fossil fuel expansion—those exploring new oil fields, for example, or building new pipelines—and found that banks had lent them $150 billion last year. “Every dollar that’s going into expansion is a dollar that is pushing us past that 1.5-degree target.”

In 2021, the International Energy Agency said that no new oil and gas fields should be developed if the world is to meet that goal of the Paris Agreement.

A second report analyzed the fossil fuel lending policies of the top six American banks and similarly found them to fall short of meeting the Paris Agreement goals. That report was published by the sustainable investment nonprofit Ceres and the Transition Pathways Initiative Center, a low-carbon research institute based at the London School of Economics and Political Science.

The reports come amid increased scrutiny of the role of financial markets in cutting emissions across the economy. Climate advocates have taken to the streets to urge banks to phase out fossil fuel lending, and the Biden administration has adopted new rules to increase climate disclosures in financial reporting. Meanwhile, Republicans have been pushing back, with some states enacting laws meant to punish banks that restrict lending.

Pavel Molchanov, an analyst with the financial firm Raymond James, agreed that the decline in lending last year was driven largely by the fact that many oil companies earned more money than ever. But new pressure from investors is beginning to have an effect on how oil companies spend their money, too, he added. Much of that pressure is from conventional investors seeking higher returns and more disciplined spending from the industry, rather than lower emissions. The result is the same, he said, “which is drill less.”

In a note this week, Molchanov and colleagues wrote that although capital spending by oil companies climbed last year, it was still slightly below pre-COVID-19 pandemic levels and far lower than a decade ago.

“These companies were swimming in profits,” Molchanov said, “but they’re not spending nearly as much as they used to. What do they need to borrow? It’s just not necessary.”

According to the Rainforest Action Network report, at least seven major oil companies, including ExxonMobil and Shell, asked for zero in financing last year after having borrowed, on average, more than $50 billion annually over the previous six years.

https://arstechnica.com/?p=1931717