When the Brazilian nutritional scientist Carlos Monteiro coined the term “ultra-processed foods” 15 years ago, he established what he calls a “new paradigm” for assessing the impact of diet on health.

Monteiro had noticed that although Brazilian households were spending less on sugar and oil, obesity rates were going up. The paradox could be explained by increased consumption of food that had undergone high levels of processing, such as the addition of preservatives and flavorings or the removal or addition of nutrients.

But health authorities and food companies resisted the link, Monteiro tells the FT. “[These are] people who spent their whole life thinking that the only link between diet and health is the nutrient content of foods … Food is more than nutrients.”

Monteiro’s food classification system, “Nova,” assessed not only the nutritional content of foods but also the processes they undergo before reaching our plates. The system laid the groundwork for two decades of scientific research linking the consumption of UPFs to obesity, cancer, and diabetes.

Studies of UPFs show that these processes create food—from snack bars to breakfast cereals to ready meals—that encourages overeating but may leave the eater undernourished. A recipe might, for example, contain a level of carbohydrate and fat that triggers the brain’s reward system, meaning you have to consume more to sustain the pleasure of eating it.

In 2019, American metabolic scientist Kevin Hall carried out a randomized study comparing people who ate an unprocessed diet with those who followed a UPF diet over two weeks. Hall found that the subjects who ate the ultra-processed diet consumed around 500 more calories per day, more fat and carbohydrates, less protein—and gained weight.

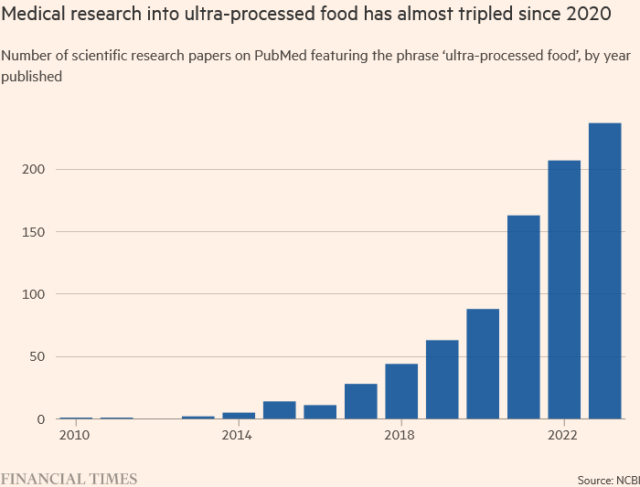

The rising concern about the health impact of UPFs has recast the debate around food and public health, giving rise to books, policy campaigns, and academic papers. It also presents the most concrete challenge yet to the business model of the food industry, for whom UPFs are extremely profitable.

The industry has responded with a ferocious campaign against regulation. In part it has used the same lobbying playbook as its fight against labeling and taxation of “junk food” high in calories: big spending to influence policymakers.

FT analysis of US lobbying data from non-profit Open Secrets found that food and soft drinks-related companies spent $106 million on lobbying in 2023, almost twice as much as the tobacco and alcohol industries combined. Last year’s spend was 21 percent higher than in 2020, with the increase driven largely by lobbying relating to food processing as well as sugar.

In an echo of tactics employed by cigarette companies, the food industry has also attempted to stave off regulation by casting doubt on the research of scientists like Monteiro.

“The strategy I see the food industry using is deny, denounce, and delay,” says Barry Smith, director of the Institute of Philosophy at the University of London and a consultant for companies on the multisensory experience of food and drink.

So far the strategy has proved successful. Just a handful of countries, including Belgium, Israel, and Brazil, currently refer to UPFs in their dietary guidelines. But as the weight of evidence about UPFs grows, public health experts say the only question now is how, if at all, it is translated into regulation.

“There’s scientific agreement on the science,” says Jean Adams, professor of dietary public health at the MRC Epidemiology Unit at the University of Cambridge. “It’s how to interpret that to make a policy that people aren’t sure of.”

https://arstechnica.com/?p=2026867