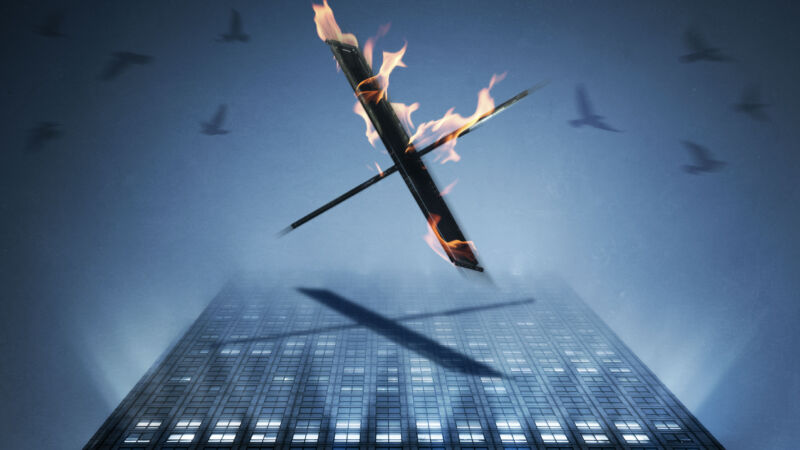

One year after Elon Musk’s $44 billion purchase of Twitter, which he completed on October 27, 2022, after months of legal drama, the social media firm that Musk renamed “X” is on shaky financial ground.

Musk has expressed ambitions to transform X into an “everything app” that includes a digital payments platform and audio and video calling. He told employees that, despite massive cuts eliminating most of Twitter’s pre-Musk workforce, he sees “a clear but difficult path” to a future valuation of more than $250 billion.

X doesn’t provide detailed financial statements or user numbers because Musk took the company private when he bought Twitter. But data leaked to news media and third-party research depicts a platform in decline, which might not be exactly what Musk meant when he called the firm “an inverse startup.”

Usage of X—which still lives at the twitter.com domain—has dropped under Musk’s leadership. But by at least one measure, the number of users isn’t far off from the pre-Musk era. A report in early October by The Information said that “X’s daily active users have dropped 3.7 percent to 245 million” since Musk’s purchase.

Many users were put off by highly controversial moves like reducing moderation teams and charging for blue checkmarks that used to denote that a Twitter account was notable and authentic. While other estimates suggest the drop in users and usage may be significantly higher than 3.7 percent, it seems most pre-Musk users stayed on the platform and that Musk may have attracted some new ones to partially offset those who left.

But the drop in users is coupled with big drops in advertising revenue, spurred largely by concerns about the risk of advertising on a platform that isn’t moderated as heavily as it used to be. Through a combination of layoffs and actions that caused workers to resign, Musk reduced the social network’s employee count from about 7,500 people to around 1,500.

Ad firms recommended that clients pause spending on Twitter shortly after Musk bought it. Many advertisers continued to stay away despite Musk’s promise that the platform wouldn’t become a “free-for-all hellscape.” The spread of Israel/Hamas misinformation, notably amplified by users who purchased blue checkmarks under Musk’s paid “verification” system, helps illustrate why brands are reluctant to advertise on X.

While X CEO Linda Yaccarino tried to reassure European regulators about its compliance with moderation rules, Musk publicly argued with a key European Union commissioner on the same topic. And despite promising to expand safety and election groups in late August, Musk later cut about half of the company’s election integrity team and accused them of “undermining election integrity.”

Time spent on X keeps falling

Some research indicates that the decline in time spent using X has been more severe than the decline in total users, widening the usage gap between X and other social platforms like Facebook. According to market research firm Sensor Tower, “X was the sole social media app to exhibit a material decline” as measured by total hours of usage in August 2023 compared to August 2022.

-

Year-over-year changes in daily active users for major social media platforms.Sensor Tower

-

Average hours of usage per day in August 2023.Sensor Tower

Sensor Tower provided the report to Ars, and a summary was posted on the firm’s website. X’s usage drop occurred “as it grappled with user dissatisfaction over the rebranding and flagrant content in the post-acquisition era,” Sensor Tower said. Data for September 2023 was not yet available from Sensor Tower this week.

X’s August 2023 usage was 91 million hours per day, down 13 percent year over year, according to the Sensor Tower report. X’s August 2023 usage was also down 6 percent since July 2023.

By contrast, Sensor Tower said Facebook’s August 2023 usage was 1.31 billion hours per day, up 10 percent compared to August 2023. Unlike X’s performance from July to August, Facebook usage did not drop month over month, according to Sensor Tower.

On the plus side for X, the Threads app launched in July by Facebook owner Meta doesn’t seem ready to surpass X any time soon, if ever. Threads’ August 2023 usage was 500,000 hours per day, down 62 percent month over month, according to Sensor Tower.

X’s daily active users were down 9 percent in August 2023 when compared to August 2022, according to Sensor Tower. It was the ninth consecutive month of year-over-year declines in that statistic.

https://arstechnica.com/?p=1978912