After a long career in the development of space and missile programs, Salvatore T. “Tory” Bruno was named chief executive of United Launch Alliance in August 2014. In this new position, Bruno has faced enormous challenges.

Over the last half-decade, SpaceX has emerged as a viable competitor, begun to fly its Falcon 9 rocket more frequently, and competed successfully for lucrative military launch contracts. Meanwhile, ULA faced a mandate from the US government to end its reliance on the Russian-made RD-180 engine for its workhorse rocket, the Atlas V booster.

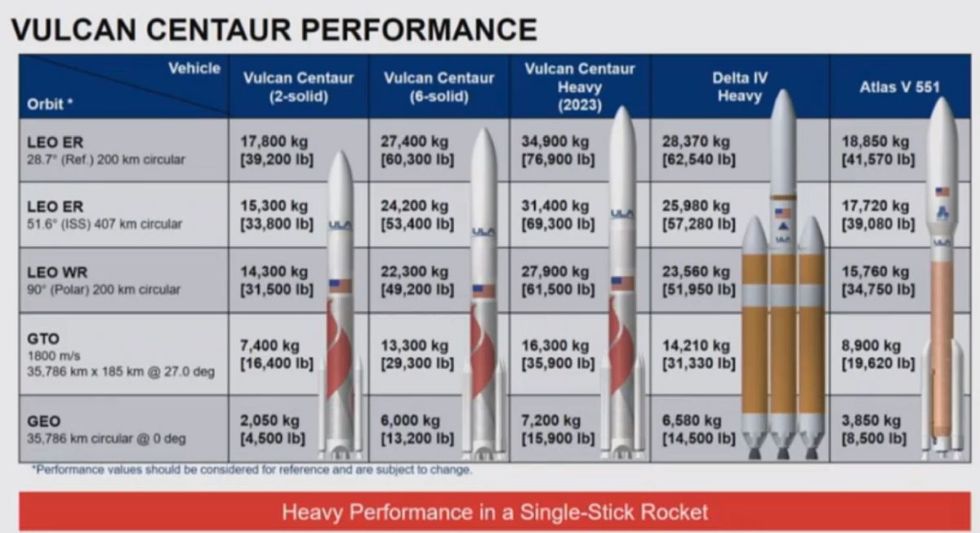

In response to these challenges, Bruno has sought to cut costs (through layoffs and other restructuring) and increase the commercial competitiveness of ULA, while also developing the brand-new Vulcan rocket with US-made components at the same time. Bruno also must answer to two demanding parents, Boeing and Lockheed Martin, each of which own 50 percent of his company and have competing aerospace interests. A little more than four years on the job, Bruno appears to be making progress. Most notably, the company recently won a $967 million contract from the US Air Force to complete development of the Vulcan rocket, which ULA says will be ready to fly by 2021.

With this in mind, Ars caught up with Bruno at the SpaceCom conference in Houston at the end of November. The resulting interview ran so long that we’re breaking it into two parts. The first half, which appears below, will focus on the development of Vulcan and other areas of ULA’s business. The second half, to be published Wednesday, will delve into Bruno’s relationship with Blue Origin, with which ULA is both a customer and a competitor, and the company’s turbulent past and present with SpaceX.

Ars Technica: If you had to eat a hat, would you prefer it with mustard or mayonnaise?

Tony Bruno: I’d just have to say with mustard, because hats are probably going to be a little dry and chewy.

But seriously, do you think you’ll fly a national security payload on Vulcan in 2022?

Yeah, I do. So our certification flights will be in 2021 for the LSA awards that were just made. And we intend to fly an actual customer on that flight, commercial customers, and we’re talking to them now. And then we’ll be certified a few months later and ready to fly national security space missions.

What do you see as the long pole in getting to Vulcan-Centaur’s first flight?

In a classic rocket-development program there are two things that are always the most difficult things to get done, and it’s always software and propulsion. And I expect that this would be no different.

The propulsion seems to be making some progress with the BE-4 engine tests. But talk to me about the software. What’s the challenge there?

I think people sort of don’t think of rockets this way, but they’re robotic vehicles. There’s no pilot. They’re fully automated. They have to be extremely fault tolerant because a rocket is a hugely complicated machine, and sometimes the different parts operate just differently, or have issues, and the rest of the vehicle has to compensate for it. And because there’s no human intervention possible, a little different than even a spacecraft, because once it’s on-orbit and running, typically has an A and a B side, it can go into safe mode. We don’t have any of that luxury. There’s very little redundancy. And the whole mission is over in 15 minutes. The software has to be perfect.

And so people think, well, it’s software. If something comes up late, you just change it. Thank God it’s just software, because it only takes a few minutes to change code. Whereas physical hardware may take months to build.

It’s actually not like that at all. You have to have such a structured and disciplined process around your software development that getting to your final version takes time, and making a change will send you way upstream to do retrograde testing and qualification of all of that. The software is incredibly complex. [With] every rocket I’ve ever developed—and it’s over three dozen systems now—software is always hard to do because of the complexity of the process you need to use to ensure its high reliability.

You’re bringing a common avionics system over from Atlas and Delta. Does that help you?

It absolutely does help us because there’s a whole bunch of that software that will come over the same. Depending on how you count it, somewhere between 40 to 60 percent of the software that we’re using today will be able to be used as-is on Vulcan. So it’s a smaller volume of work to get done.

From a hardware standpoint, is the biggest challenge integrating new engines into a new core stage?

Yes it is. It’s two engines instead of one, which complicates the fluid arrangements to bring the propellants down from the tanks to the two engines. So it’s different than what we do now, and all of that has to be very weight-efficient. We also have an entirely new type of thrust structure, which I showed pictures of, and some other pieces of structure on the aft end that I haven’t revealed yet that are super cool and use really new technology. So all of that is a really complicated systems-engineering job to make that work at the giant scale the rocket exists in.

You’re also upgrading the Centaur upper stage for Vulcan.

The very first Centaur we fly will be called Centaur 5. It will already have twice the propellant that Centaur 3 has. Centaur 3 (which flies on the Atlas V rocket) is 3.8 meters in diameter. The very first Centaur we fly on Vulcan will go straight to 5.4 meters in diameter. Then, what we will do in the second upgrade to Centaur is upgrade the thrust in the RL-10 engines and make it even longer, to stretch the propellant tanks to give it even that much more energy. That’s what takes it all the way to the Vulcan Heavy configuration.

How is the RL-10 upgrade being paid for?

There’s a public-private partnership RPS contract in place right now that is developing the RL-10CX, which also incorporates additive manufacturing into that engine. [Editor’s note: The RL-10 engine is manufactured by Aerojet Rocketdyne.] The RL-10 is exquisite. It’s a Swiss watch. It’s handmade. There are tiny tubes and passages. No excess beef or weight or anything on it. So being able to take that into an additively manufactured engine is a huge advantage in time, cost, and quality because once you dial those automated processes in and get them right, you’re not subject to the variability of people building them.

When we first fly the basic Centaur 5, it will have an existing RL-10C on it. However, the other part of going to the Vulcan Heavy configuration is that not only will the tanks be bigger, it will be powered by an additively manufactured RL-10CX engine with higher thrust. This involves private investment from us and our partner, Aerojet Rocketdyne, as well as a government co-investment. They have an RPS contract now to do that work. There will be work to finish it, and integrate it into the vehicle that will be part of our LSA activity.

You didn’t mention ACES, the Advanced Cryogenic Evolved Stage. Has that been deemphasized as an upper-stage option as you’re trying to get Vulcan out the door?

It’s just further down in the pipeline. It has always been in our roadmap after we start flying Vulcan. It still is. And now that we’re into the hot-and-heavy development and fabrication and qualification of Vulcan, that’s what we’re talking about. But yeah, it’s still on the roadmap, further out, where it always has been.

Europe is developing a new launch vehicle. Japan is developing a new launch vehicle. SpaceX continues to grow. Blue Origin is working on a new rocket. In light of all this competition, how confident are you in ULA’s ability to grow its commercial satellite market share?

I’m very confident. I’ll be honest with you. We do very few commercial satellite launches today. And what we are looking for is modest growth and a relatively modest share of that marketplace. Just like not all rockets are the same, not all missions and not all customers are the same. What we see in the commercial marketplace is a big segmentation. There’s a large center of satellites and other vehicles that are fairly price sensitive, but they still balance between price and risk in performance. There’s another segment where it’s just all about the price. It’s a relatively simple spacecraft; they’re able to insure the value of it, and their particular business model means that they’re not in a hurry to get to orbit, so they’re willing to take schedule risks in getting to orbit—and even sustain a loss so long as the insurance covers that.

Then there’s these guys over here, which are very similar to the US government in terms of their risk tolerance. They have large, typically geo-communications satellites that are big, big capital investments. They don’t own very many. Their business model and the economics of that marketplace still support that. They can’t afford to lose one. They’re usually in a rush to market. Because they are capital-intensive, that’s another way of saying they spend most of the money up front, and it’s imperative that they get it on orbit, on time, to start a revenue stream to close that up.

For many of these, in that group, they think seriously about things like directly injected spacecraft. That is an ideal marketplace for us. So we’re going to have some good success there, but we’re not going to have any success over here (Bruno waves at the market segment of customers most interested in price, and chuckles), and we’ll see how we do in the middle.

I haven’t heard much about the XEUS lunar lander concept. Have you stopped working on this because Lockheed is pursuing its own lunar lander?

It’s just fallen down the priority list for us. So right now we’re not doing anything with it. We’ve talked about getting Vulcan done. And making Centaur 3 into 5, and then the bigger one. And then ACES. XEUS is so far out there it’s basically off the map.

But that was a really interesting piece of your Cislunar 1000 architecture. Presumably you’d like to get back to it at some point?

Well, I don’t know, it depends on if other people are doing that. So we’re looking at this whole transportation network, and where we would fit in and add the most value. If other people take on that particular role then it won’t be something we need to do.

You’ve talked a lot about commercialization of the Moon. It seems like this administration has really embraced the idea of the Moon as the next step, and a commercial pathway.

Yeah. I wonder how that happened.

https://arstechnica.com/?p=1426265