Google is bringing on a new executive who it hopes will turn the beleaguered Google Pay division around. Bloomberg reports that Arnold Goldberg, PayPal’s chief product architect, will now run Google Pay after the former payments chief, Caesar Sengupta, left in April.

Of the Google services that survived 2021, Google Pay had one of the most brutal years of any product. In March, Google Pay rolled out a completely new app in the US, replacing the old Google Pay app that had existed for years.

This new app was originally developed for India and is dramatically different from the old Google Pay app used in the US. For starters, the new app switched to using a phone number for identification instead of a Google account, which meant that a ton of features US users were accustomed to were no longer supported. Indian consumers are used to phone number identity thanks to apps like WhatsApp, and the limitations are not a big deal for users in that country thanks to smartphones being many consumers’ only device.

For Google Pay in the US, however, relying on a SIM card for identity meant the Google Pay website functionality had to die, multi-device functionality went out the window, and Google Pay went from supporting multiple accounts to only supporting a single account. As we wrote shortly after launch day, the new app was a disaster.

One month after the big US launch, Sengupta left Google, leaving US Google Pay users with a mess of an app and major feature regressions. The global Google Pay user base was still split across the old and new apps, and the future of the division—including already-promoted plans to launch a Google “Plex” bank account—was now in question.

An August report from Business Insider revealed that Sengupta’s departure kicked off a major exodus from the division, with “dozens” of employees and executives leaving, including “seven leaders on the team with roles of director or vice president” and “half the people working on the business-development team.”

By October, the division felt truly rudderless, and reports surfaced that Google’s plans to launch consumer bank accounts were dead. Google had already promoted the service in several blog posts and had 400,000 people who had signed up for the waitlist to get an account.

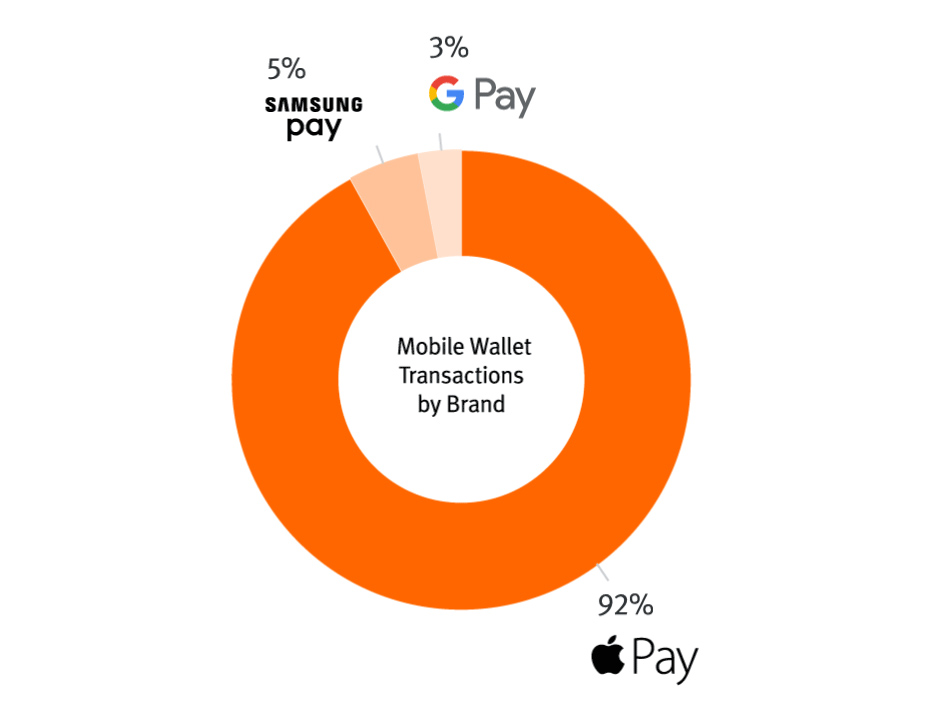

That BI report quotes one former employee as saying that “Caesar [Sengupta] leaving was the capstone on a lot of frustration felt by employees. The product wasn’t growing at the rate we wanted it to.” We can get some hard numbers for one of Google Pay’s main features—NFC payments—to support this claim that it wasn’t growing quickly enough. Pulse, a division of Discover card, puts Google at 3 percent of the US NFC payment market, while Apple dominates the market with 92 percent. Google was the first big tech company to get involved with NFC payments, starting with the Galaxy Nexus in 2011. That was three years before the launch of Apple Pay, but thanks to bungled management, an endless series of reboots and rebrands, and Android’s subservience to the whims of cell carriers, Google is now in last place. It’s embarrassing.

Google Pay’s re-re-reboot

Despite the just-canceled plans to launch a Google bank account, Google’s president of commerce (and another former PayPaler), Bill Ready, now tells Bloomberg, “We’re not a bank—we have no intention of being a bank.” Bloomberg’s report goes on to say that “as part of the overhaul, Google will focus more on being a ‘comprehensive digital wallet’ that includes digital tickets, airline passes, and vaccine passports.” This sentence actually says very little because tickets and COVID cards are both current Google Pay features.

The one new thing Google has mentioned is possible support for cryptocurrencies. Ready told Bloomberg, “Crypto is something we pay a lot of attention to. As user demand and merchant demand evolves, we’ll evolve with it.” Right now, Google partners with Coinbase and BitPay to store cards, but it doesn’t accept crypto for transactions.

The report mentions a lot of new people in high positions at Google Pay, so hopefully this will result in a more dramatic pivot than what is outlined in the article. It’s crazy to suggest this, but the service would be better if 2021 had never happened. Can we just have the old app and website back?

https://arstechnica.com/?p=1827141