Few people have been working on self-driving cars longer than Chris Urmson. Urmson played a key role in Carnegie Mellon’s team in all three of DARPA’s famous Grand Challenges between 2004 and 2007. He then led Google’s self-driving project for several years. Urmson left Google after being passed over to become the CEO of the spin-off company that became Waymo.

“I’d been leading and building that team and, for all intents and purposes, general managing it for years,” Urmson told Bloomberg in a Thursday interview. “Of course I wanted to run the program.”

Bloomberg asked Urmson about Tesla’s Autopilot technology—and particularly Elon Musk’s claim that Tesla vehicles will soon be capable of operating as driverless taxis.

“It’s just not going to happen,” Urmson said. “It’s technically very impressive what they’ve done, but we were doing better in 2010.”

That’s a reference to Urmson’s time at Google. Google started recruiting DARPA Grand Challenge veterans around 2009. Within a couple of years, Google’s engineers had built a basic self-driving car that was capable of navigating a variety of roads around the San Francisco Bay Area.

A couple of years later, Google started letting employees use experimental self-driving cars for highway commutes—an application much like today’s Autopilot. Google considered licensing this technology to automakers for freeway driving. But the technology required active driver supervision. Urmson and other Google engineers decided there was too great a risk that drivers would become overly reliant on the technology and fail to monitor it adequately, leading to unnecessary deaths.

No time to waste

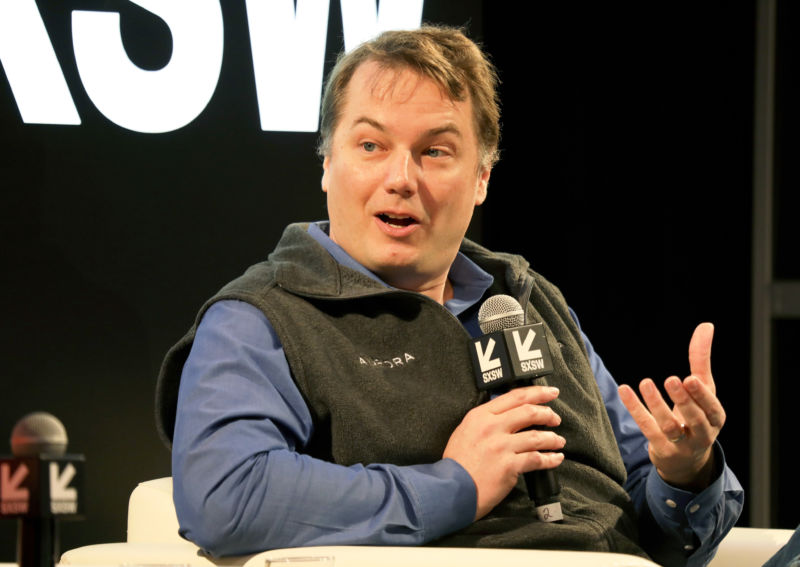

After leaving Google, Urmson co-founded the startup Aurora with two other prominent self-driving executives. Former Autopilot boss Sterling Anderson reportedly left Tesla in 2015 after clashing with Elon Musk over Musk’s aggressive timeline for developing fully self-driving technology. Drew Bagnell was a senior member of Uber’s self-driving project.

Late last year, Uber sold that project to Aurora, more than doubling Aurora’s headcount and cementing Aurora’s status as the largest remaining independent self-driving startup.

For the last couple of years, Aurora has focused on long-haul trucking as its first commercial product. Urmson predicted to Bloomberg that Aurora would be the first company to deploy self-driving technology for long-haul trucking routes at a “meaningful” commercial scale.

But the Uber deal could also make Aurora a contender in the self-driving taxi business. Not only has Aurora absorbed dozens of engineers with expertise in this area, but a close relationship with Uber will give Aurora an easy way to scale up once its technology is ready.

At the same time, Aurora’s swelling headcount of 1,600 souls puts Urmson under a lot of pressure. At this point, most of Aurora’s rivals are majority-owned by huge companies—either car companies like General Motors and Ford or tech companies like Alphabet and Amazon. These companies can continue pouring money into self-driving technology for as long as it takes to get it working.

But Aurora doesn’t have a parent company with infinitely deep pockets. So if Aurora can’t bring a product to market soon, it’s going to need to raise additional money on top of the more than $1 billion it has already raised.

“Urmson doesn’t shy away from the possibility the company may need to raise more money,” Bloomberg reports. “And he’s confident it would be able to do so.”

Of course, that’s what any startup CEO is going to say. But the reality is that investors are fickle. If Aurora can’t demonstrate substantial progress toward a viable commercial product, it might not be able to raise another round of funding. That seems to have been the fate of Zoox, a promising startup that was forced to sell to Amazon at a fire-sale price last year.

https://arstechnica.com/?p=1757299