Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

You’re reading Entrepreneur United States, an international franchise of Entrepreneur Media.

If you aren’t concerned about where and how your personal information is being gathered across the web, then you definitely aren’t paying attention. In just the last several days, data breaches revealed against organizations like global IT giant Accenture and 3-D printing site Thingiverse compromised account information from literally millions of their customers. And that’s just in a matter of days.

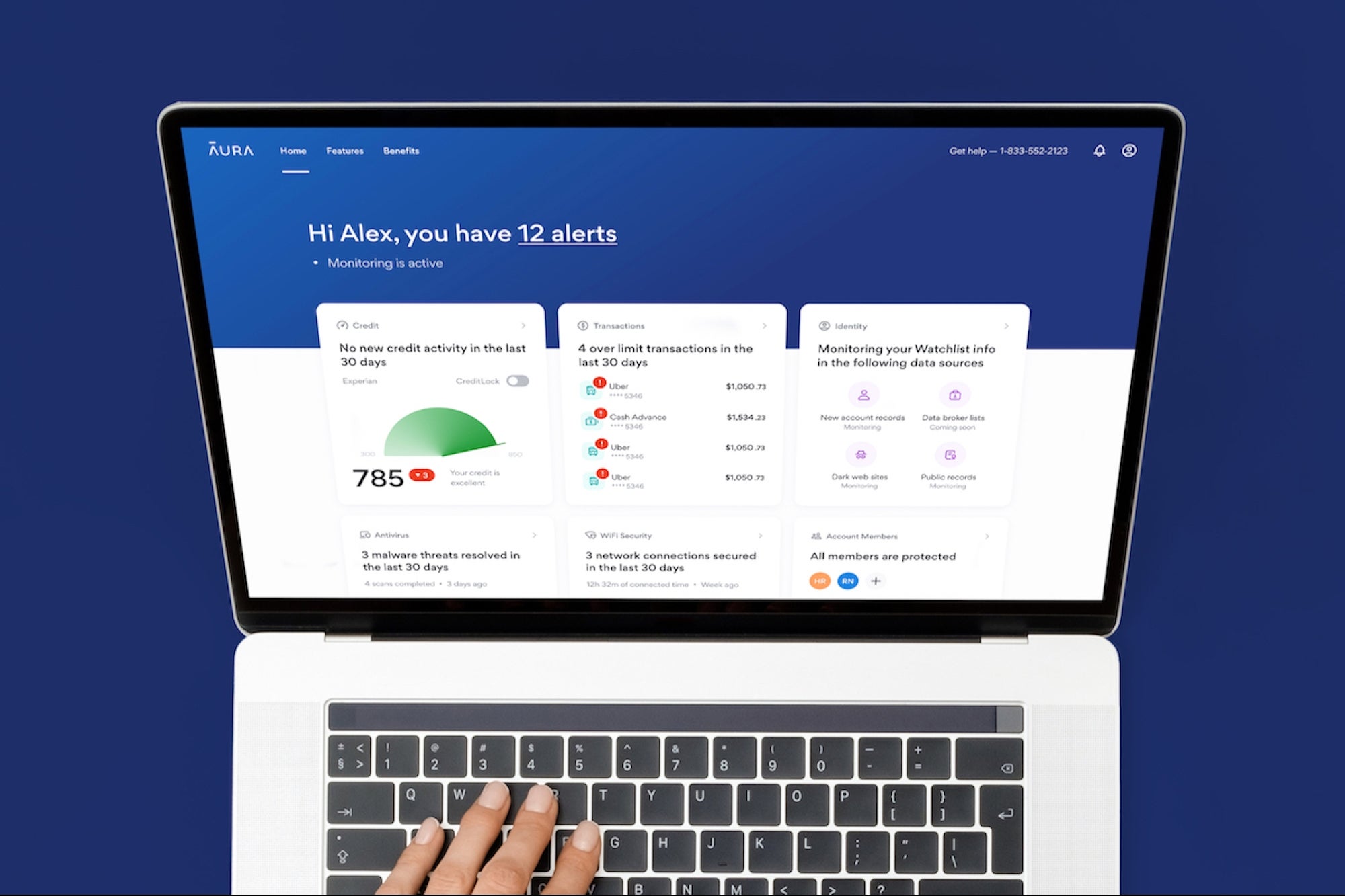

Aura

Then there’s what those companies do when you aren’t looking. Over 95 percent of Americans say they’re worried about businesses collecting and selling their personal information without permission. Another 80 are concerned about businesses accessing the data they share on social media platforms. However, barely half say they’re actually looking for new ways to protect their personal data.

Everybody is worried. Yet many aren’t doing anything about it. And when it comes to financial details and the state of each person’s vital credit, complacency could be disastrous.

Professionals and business owners who have worked tirelessly to build their nest eggs already have all the digital tools for managing those finances effortlessly. Aura thinks you should also have that same level of convenience and assuredness when it comes to protecting that money.

While you could set up your own web of credit monitoring, password protections, VPN coverage and more, Aura takes personal information security to the next level, providing all of these tools to help keep your personal data safe everywhere you go online.

Aura provides tools to help bolster your account security and other protection measures, and also proactively scans for signs of your data being compromised, then issues near real-time alerts to stop those efforts dead in their tracks.

Aura coverage begins with a staunch array of device security tools, deploying powerful antivirus and Wi-Fi safeguards to block malware and malicious sites, secure your Wi-Fi connection, strengthen passwords, and close up potential opportunities for cyber snoops to skim any personal details about you, the company says.

Aura looks for potentially suspicious spending activity tied to your registered accounts, catching early signs of fraud. They also send alerts in near–real-time for new inquiries on your credit file, including items like new credit cards or bank loans. And if anything suspicious is afoot, Aura makes it simple to lock and unlock your Experian credit file to prevent unwanted inquiries to your credit history. Aura plan features vary depending on which plan you choose.

Meanwhile, Aura protection extends in every direction, proactively scanning for instances where your name, personal data, or financial details show up in public records. From court cases to criminal activity, Aura alerts you if your Social Security Number, bank accounts, or other data tied to you is used somewhere else, then they let you know immediately, with fraud alerts up to four times faster than competitors¹.

Aura is ready to back up its protection bonafides too, and has partnered with a third party insurer to offer up to $1 million in identity theft insurance* to cover eligible losses and fees due to identity theft.

Aura’s team is staffed by experienced financial fraud investigators, each with an average of seven years experience who have collectively handled more than 150,000 cases of identity theft and fraud.

That no-nonsense approach also extends to Aura’s membership, where one transparent monthly price provides an all-in-one cybersecurity suite without any unexpected extra charges. Right now, Aura is offering its services for up to 50 percent for new customers.

Prices subject to change

¹ ath Power Consulting, 2018

* Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group‚ Inc. or Assurant. The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions.

https://www.entrepreneur.com/article/396284