The last decade or so has seen the creeping techification of the auto industry. Executives will tell you the trend is being driven by consumers, starry-eyed at their smartphones and tablets, although the 2018 backup camera law is the main reason there’s a display in every new car.

But automakers have been trying to adopt more than just shiny gadgets and iterating software releases. They also want some of that lucrative “recurring revenue” that so pleases tech investors but makes the rest of us feel nickeled and dimed. Now we have some concrete data on just how much car buyers are asking for this stuff, courtesy of a new survey from AutoPacific. The answer is “very little.”

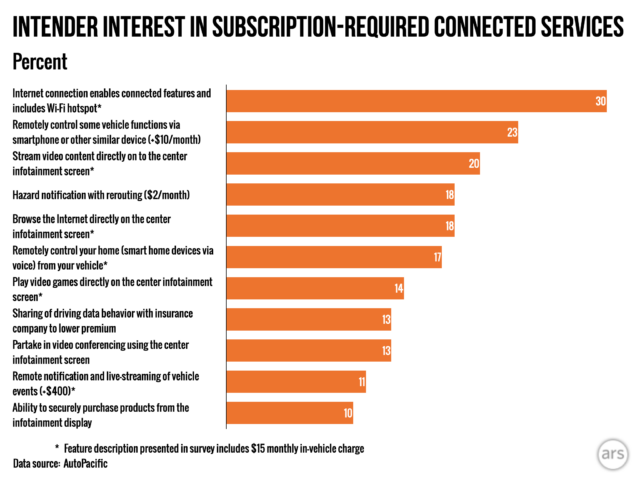

AutoPacific asked people looking to buy a new vehicle about their interest in 11 different in-car connected features, starting with a data plan for the car for a hypothetical price of $15/month.

The results may chasten some of the investors demanding that the car companies keep traveling down this path. The most in-demand or desirable feature was Internet connection with a Wi-Fi hotspot—not an unreasonable demand for $15 per month. But only 30 percent of people looking to buy a new car said they were interested in paying for their car’s Internet access.

AutoPacific broke the data out into those looking for internal combustion engine vehicles, plug-in hybrid electric vehicles, or battery EVs. Thirty-seven percent of PHEV buyers said they wanted in-car Internet, dropping to 32 percent for BEV buyers and 28 percent for fossil fuel-powered customers.

“Much of this higher demand comes from having more downtime spent in their vehicle due to charging,” said AutoPacific product and consumer insights analyst Robby DeGraff. “While not ideal, an EV’s battery does require a significantly longer time commitment than refueling an ICE vehicle. Thankfully, while the vehicle is parked, a cabin’s center infotainment screen is the perfect place for a consumer to conveniently stay occupied,” he continued.

The other features AutoPacific polled car buyers on all scored worse overall than in-car Wi-Fi. Twenty-three percent said they’d be interested in remotely controlling some vehicle functions via a smartphone at the cost of an extra $10 per month. (Again, this was higher for PHEV and BEV customers at 29 percent each, and it was just 21 percent for ICE buyers.)

As you can see from the graph, connected features get less popular from there. Last place goes to in-car commerce; just 1 in 10 people intending to buy a new car want to be able to buy things from their infotainment screens, a fact that may cause concern in some corners of the FinTech world. Here, too, there was a powertrain split—only 8 percent of ICE buyers would like to buy things via infotainment screen, but that rose to 13 percent of PHEV buyers and 15 percent of BEV intenders.

AutoPacific also broke down some of its data by age brackets. The 30- to 39-year-old group was consistently the most interested in connected subscription features for their cars—28 percent want to stream video directly to the infotainment screen, 20 percent want to play video games on the infotainment screen, and 18 percent want in-car video conferencing. As you might expect, the 60- to 69-year-old bracket was the least interested in any of this stuff; just 10 percent would want in-car video streaming, with video conferencing at 5 percent and in-car gaming at just 4 percent.

https://arstechnica.com/?p=1926557