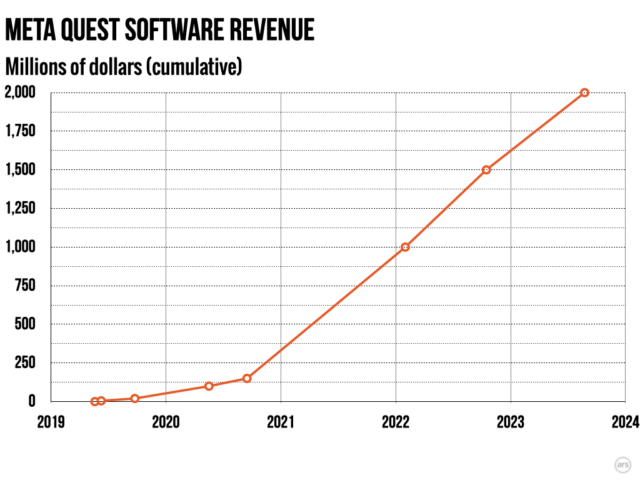

During Wednesday’s Meta Connect keynote presentation, the company announced a new milestone for its line of standalone Quest headsets: $2 billion in lifetime revenue from Quest apps and software since the platform launched back in 2019. On first glance, that’s a pretty big number that suggests the formation of a pretty healthy VR software ecosystem.

But looked at in context, Ars’ analysis suggests the Quest software market is roughly the same size as that for the Wii U at a similar point in its short life cycle. That’s not a great comparison for Meta to be facing, since the Wii U was rightly considered an embarrassing flop by the standards of the video game market.

Comparing apples to… VR apples

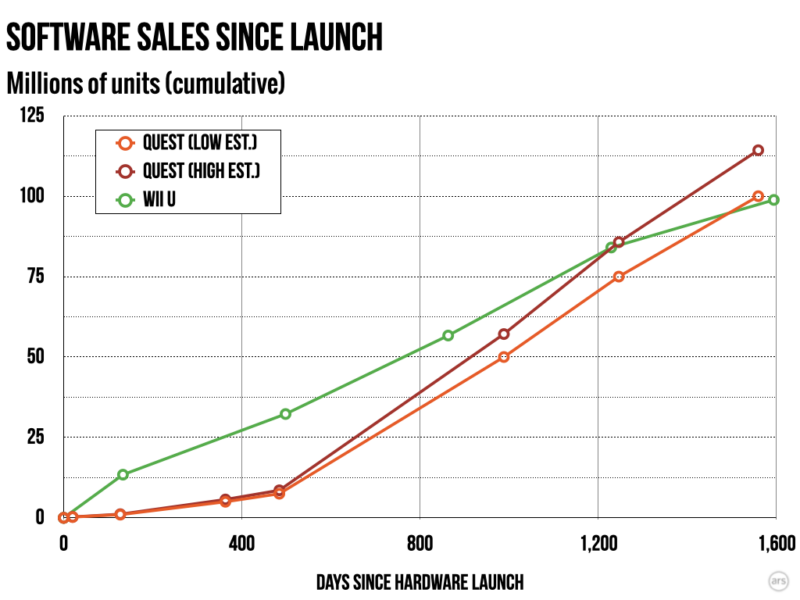

In making that comparison, Ars compared Wii U software unit sales numbers from Nintendo’s own quarterly reports to estimated software sales numbers based on Meta’s sporadic public announcements of Quest revenue milestones. To convert revenue numbers to unit sales estimates for the Quest, Ars divided total Quest revenue by the median sale price for best-selling Quest software ($19.99) and the mean sale price for that same software ($17.60).

These unit estimates are necessarily rough and don’t directly account for revenue made from Quest DLC, such as Beat Saber‘s popular music packs. They also don’t capture sideloaded Quest software purchased on platforms like Sidequest or itch.io, which are not included in Meta’s own numbers.

Even accounting for those adjustments, though, the software markets for the Wii U and Quest (at similar points in their life cycles) would seem to be in similar neighborhoods. The Wii U’s sales of nearly 99 million software units in its first 1,594 days on the market is just behind the roughly 100 to 114 million pieces of Quest software Meta has sold in 1,559 days, according to Ars’ estimates.

To be fair to the Quest, software sales for the headset have shown a distinct upward trajectory since the launch of the Quest 2 in October 2020. If you disregard the 16 months of Quest 1 software sales that preceded the Quest 2 launch, the headset has been selling software at a significantly faster rate than the Wii U. Meta also deserves credit for building the Quest’s software library from what was essentially a standing start into a robust storefront with over 500 apps. Comparing a new VR platform to a Nintendo console that could lean on ultra-popular first-party franchises developed over decades isn’t completely fair to the newcomer.

At the same time, many of the Wii U’s most popular first-party games consistently sold for $59.99, with exceedingly rare official discounts. That means Nintendo’s console likely generated much more overall software revenue than the cheaper software on the Quest. The Wii U was also selling its software to just 13.57 million Wii U owners (as of March 2017), compared to reports of over 20 million Quest headset sales so far. This suggests that the average Quest owner is spending a lot less on software than the average Wii U owner did.

A report from earlier this year suggested that only 6 million Quest owners were still using their headsets at least once a month as of last October. That could help explain why relatively healthy Quest hardware sales haven’t translated to Quest software sales on the same level.

https://arstechnica.com/?p=1971970