Lobbying is ostensibly a way to inform politicians about issues affecting their constituents. But it has also become an industry of its own as those with a financial interest in legislation vie to sway decisions in their favor. Windows into the lobbying world are limited in the US, but required public reporting can at least enable a postmortem of the actions associated with major bills.

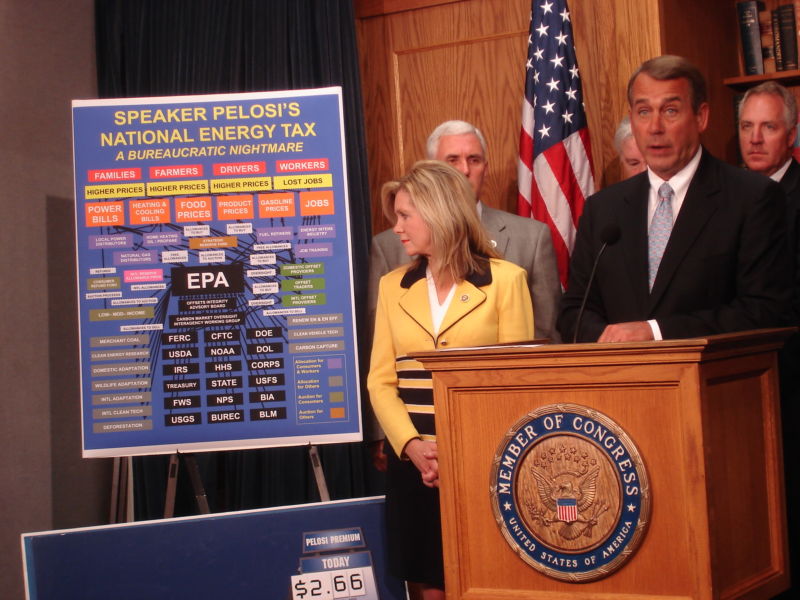

In the first two years of the Obama administration, healthcare legislation was not the only weighty proposal rattling around in Congress. The Waxman-Markey Bill very nearly led to a national cap-and-trade system for greenhouse gas emissions. It would have established a continually shrinking cap on national emissions, with tradable permits required for significant emitters. It was supposed to have bipartisan appeal, featuring a market-based mechanism rather than a simple tax or mandate. But while it passed the House of Representatives, it never achieved the filibuster-proof support in the Senate necessary to see a vote on the floor.

University of California, Santa Barbara, researcher Kyle Meng and the University of Chicago’s Ashwin Rode set out to investigate the role of lobbying in that failure. What makes this so difficult is the fact that public records of who spent how much on lobbying don’t tell you whether they lobbied for or against the bill.

So the researchers got creative.

Taking stock of lobbying

Publicly traded companies that lobbied accounted for 86 percent of the $725 million spent on lobbying. Meng and Rode tracked their stock prices during the bill’s debate; this essentially let the market indicate whether each company was expected to benefit or lose money under cap and trade. To make this work, they also needed another market: a prediction market.

Betters on the site Intrade bought contracts that would pay out if the Waxman-Markey Bill was passed by the end of 2010, with varying contract prices driven by the political twists and turns along the way. By comparing these two markets, the researchers could measure which companies saw stock prices drop when the prediction market went up—this was a sign that investors were afraid the cap-and-trade bill would pass and cut into the company’s profits.

With lobbying expenditures now assigned to the two sides, you can begin to break things down. For starters, there was a correlation between how much a company could be expected to gain/lose if the bill passed (based on stock behavior) and how much it spent on lobbying. But if you look for that correlation on each side separately, you get a slightly different slope to the lines—companies with the most to gain actually spent more than companies with the most to lose. (And in general, more companies that were expected to gain lobbied.)

Of course, the bill didn’t pass, so the companies expected to gain didn’t get what they wanted. In other words, their lobbying expenditures could be considered less effective. To quantify this, the researchers used a mathematical game-theory model that calculated the cost/benefit curves for lobbying. That model shows that you’d expect diminishing returns on lobbying—the first million dollars spent is a little more impactful than the next million dollars spent, and so on. That is especially true for the companies that expected to gain if their lobbying was less effective.

Local lobbying, global cost

Setting aside the other political factors, this model also calculates the probability of the bill’s passage based on the lobbying on either side. The model estimated that the balance of the lobbying reduced the bill’s chances by 13 percent.

Since thwarting greenhouse gas emissions reductions has an impact on everyone, the researchers also roughly estimate the global cost of this lobbying. Using conservative numbers for the cash value of the emissions that would have been avoided through 2050 under the bill, they put the cost of reducing its probability of passage by 13 percent at $60 billion.

The model also allowed the researchers to do one more thing: see if adjusting the bill could have changed lobbying behavior in a way that might have helped it pass. Part of instituting a cap-and-trade system is distributing the initial emissions permits. Even if the overall emissions cap is set in stone, you still have to figure out how to divvy up that cap.

The most effective way of adjusting this turned out to be targeting the companies that only stood to lose a little. Handing them a few more permits could flip them into the “expected to gain” category, changing the side they lobbied on. And if the first lobbying dollars are the most impactful, that’s a meaningful swing. While there are plenty of reasons one could object to distributing permits in this way, this is one way you could minimize resistance to a bill of this kind.

The researchers also acknowledge that lobbying is only part of the story. Events like the death of Sen. Ted Kennedy (D-Mass.) and the rise of the Tea Party movement played a role, and the political calculus can depend on an array of factors. And, of course, these lobbying records show nothing of the money spent outside the halls of Congress to sway public opinion or back election efforts. Still, there’s some value in getting a peek at part of the machine.

Nature Climate Change, 2019. DOI: 10.1038/s41558-019-0489-6 (About DOIs).

https://arstechnica.com/?p=1511547