Update at 6:15 pm ET: The jury sided with Elon Musk in a ruling issued about two hours after closing arguments on Friday.

“A jury rejected investor claims that Elon Musk violated federal securities law when he tweeted in 2018 about potentially taking Tesla private, handing a major win to the billionaire chief executive,” The Wall Street Journal reported. “The nine-person jury said the investors who brought the class-action case failed to prove that Mr. Musk hurt them by tweeting about a possible deal.”

Original story: The class-action trial over Elon Musk’s false “funding secured” tweets ended today with closing arguments. A nine-member federal jury now must decide whether Musk and Tesla should have to pay damages to investors who lost money after Musk falsely claimed in August 2018 that he had secured funding to take Tesla private.

“To Elon Musk, if he believes it—or even just thinks about it—then it’s true, no matter how objectively false or exaggerated it may be,” plaintiff’s attorney Nicholas Porritt said today. “Now it may work in his businesses—that’s not an issue for this trial. But it does not work in the securities markets, for public companies. The securities markets have rules governing what you can and cannot say, and one of those basic rules is that what you say must be true and accurate.”

Musk lawyer Alex Spiro blamed investors for their losses today, accusing them of “gambling and looking for lawsuits as insurance.”

Judge Edward Chen already ruled that Musk’s tweets were false “and that Mr. Musk recklessly made those representations.” The first false statement was that he had secured funding to take Tesla private for $420 per share. The second statement ruled false came in Musk’s follow-up tweet that said, “Investor support is confirmed. Only reason why this is not certain is that it’s contingent on a shareholder vote.”

Chen’s written instructions to the jury said they must assume these statements were “untrue” and that “Mr. Musk acted with reckless disregard for whether the statements were true.” But the jury “must still decide whether he knew that the statements were untrue,” and whether the false statements were material facts to investors.

That pre-trial ruling on one of the lawsuit’s key questions led some experts to say Musk is likely to lose the case.

Musk blamed for investors losing $12 billion

Once the truth came out that Musk hadn’t secured any funding for a going-private transaction, and Musk abandoned the idea because investors didn’t support it, “Tesla stock prices crashed and investors lost $12 billion in damages,” Porritt said. (That was the number offered by a plaintiff’s expert witness during the trial.)

Musk argued on the witness stand that he believed funding was secured from the Saudi Arabia government’s Public Investment Fund (PIF) even though he didn’t have a signed deal.

Spiro acknowledged in closing arguments today that “funding secured” was “technically inaccurate” but that the statement wasn’t really important to investors. “This whole case is built on bad word choice,” he said.

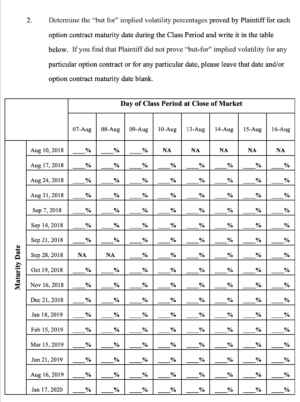

Deliberations could be complex for the jury in US District Court for the Northern District of California, particularly if they side with plaintiffs. If jurors find Musk is liable, they have to determine the “amount of artificial inflation” on Tesla stock proved by plaintiffs on each day from August 7 to August 17, 2018.

The jury also has to decide on any potential liability for members of the Tesla board of directors, including Musk’s brother, Kimbal Musk. If both Musk and Tesla directors are found liable, the jury must decide on “each Defendant’s share of responsibility for Plaintiff’s losses” with the total adding up to 100 percent.

You can read the full 10-page verdict form at this link. The jury was selected on January 17 and opening arguments were the next day.

Musk defense: Funding was no problem

Plaintiffs portrayed Musk as a “rich liar” and “fire-breathing dragon,” Spiro said. “They’re trying to condition you and distract you. ‘Bad tweet, bad tweet, fraud tweet.’ Just because it’s a bad tweet doesn’t make it fraud,” he said.

Defending Musk’s tweets, Spiro said that “‘funding secured’ was just this concept that some party had money and expressed interest, and that was indisputably true.” Spiro said funding “had never been a problem” in previous deals because “investors clamored for the opportunity to invest with Elon Musk. And, of course, he had his own wealth to finance a going-private [transaction].”

The going-private proposal wasn’t halted because of a lack of funding, Spiro said. Musk stopped pursuing the idea after it became clear “that the shareholders wanted to stay public,” Spiro said.

Musk’s “funding secured” tweet said in full, “Am considering taking Tesla private at $420. Funding secured.” Spiro argued that the “am considering” part of the tweet was more important and that “every reasonable investor was waiting for more information.”

https://arstechnica.com/?p=1915085