What exactly is bitcoin mining doing to the electric grid? In the last few years, the US has seen a boom in cryptocurrency mining, and the government is now trying to track exactly what that means for the consumption of electricity. While its analysis is preliminary, the Energy Information Agency (EIA) estimates that large-scale cryptocurrency operations are now consuming over 2 percent of the US’s electricity. That’s roughly the equivalent of having added an additional state to the grid over just the last three years.

Follow the megawatts

While there is some small-scale mining that goes on with personal computers and small rigs, most cryptocurrency mining has moved to large collections of specialized hardware. While this hardware can be pricy compared to personal computers, the main cost for these operations is electricity use, so the miners will tend to move to places with low electricity rates. The EIA report notes that, in the wake of a crackdown on cryptocurrency in China, a lot of that movement has involved relocation to the US, where keeping electricity prices low has generally been a policy priority.

One independent estimate made by the Cambridge Centre for Alternative Finance had the US as the home of just over 3 percent of the global bitcoin mining at the start of 2020. By the start of 2022, that figure was nearly 38 percent.

The Cambridge Center also estimates the global electricity use of all bitcoin mining, so it’s possible to multiply that by the US’s percentage and come up with an estimate for the amount of electricity that boom has consumed. Because of the uncertainties in these estimates, the number could be anywhere from 25 to 91 Terawatt-hours. Even the low end of that range would mean bitcoin mining is now using the equivalent of Utah’s electricity consumption (the high end is roughly Washington’s), which has significant implications for the electric grid as a whole.

So, the EIA decided it needed a better grip on what was going on. To get that, it went through trade publications, financial reports, news articles, and congressional investigation reports to identify as many bitcoin mining operations as it could. With 137 facilities identified, it then inquired about the power supply needed to operate them at full capacity, receiving answers for 101 of those facilities.

If running all-out, those 101 facilities would consume 2.3 percent of the US’s average power demand. That places them on the high side of the Cambridge Center estimates.

Finding power-ups

The mining operations fall in two major clusters: one in Texas, and one extending from western New York down the Appalachians to southern Georgia. While there are additional ones scattered throughout the US, these are the major sites.

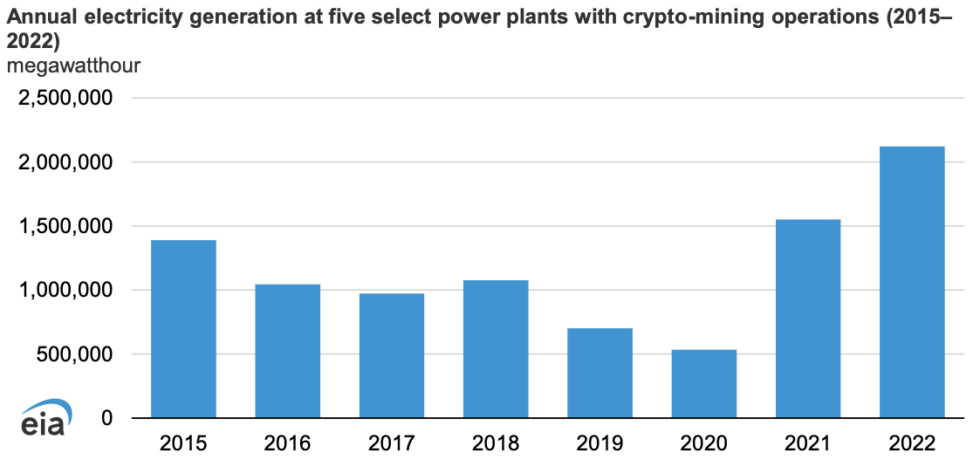

The EIA has also found some instances where the operations moved in near underutilized power plants and sent generation soaring again. Tracking the history of five of these plants showed that generation had fallen steadily from 2015 to 2020, reaching a low where they collectively produced just half a Terawatt-hour. Miners moving in nearby tripled production in just a year and has seen it rise to over 2 Terawatt-hours in 2022.

These are almost certainly fossil fuel plants that might be reasonable candidates for retirement if it weren’t for their use to supply bitcoin miners. So, these miners are contributing to all of the health and climate problems associated with the continued use of fossil fuels.

The EIA also found a number of strategies that miners used to keep their power costs low. In one case, they moved into a former aluminum smelting facility in Texas to take advantage of its capacious connections to the grid. In another, they put a facility next to a nuclear plant in Pennsylvania and set up a direct connection to the plant. The EIA also found cases where miners moved near natural gas fields that produced waste methane that would otherwise have been burned off.

Since bitcoin mining is the antithesis of an essential activity, several mining operations have signed up for demand-response programs, where they agree to take their operations offline if electricity demand is likely to exceed generating capacity in return for compensation by the grid operator. It has been widely reported that one facility in Texas—the one at the former aluminum smelter site—earned over $30 million by shutting down during a heat wave in 2023.

To better understand the implications of this major new drain on the US electric grid, the EIA will be performing monthly analyses of bitcoin operations during the first half of 2024. But based on these initial numbers, it’s clear that the relocation of so many mining operations to the US will significantly hinder efforts to bring the US’s electric grid to carbon neutrality.

https://arstechnica.com/?p=2000859