On Friday, the United Auto Workers gained a key concession from General Motors in its ongoing strike. Workers at GM battery manufacturing plants will be allowed to unionize, as revealed by UAW President Shawn Fain in a livestream.

“We were about to shut down GM’s largest money-maker, in Arlington, Texas. The company knew those members were about to walk immediately. And just that threat has provided a transformative win,” Fain said. Our plan is winning at GM, and we expect it to win at Ford and Stellantis as well.”

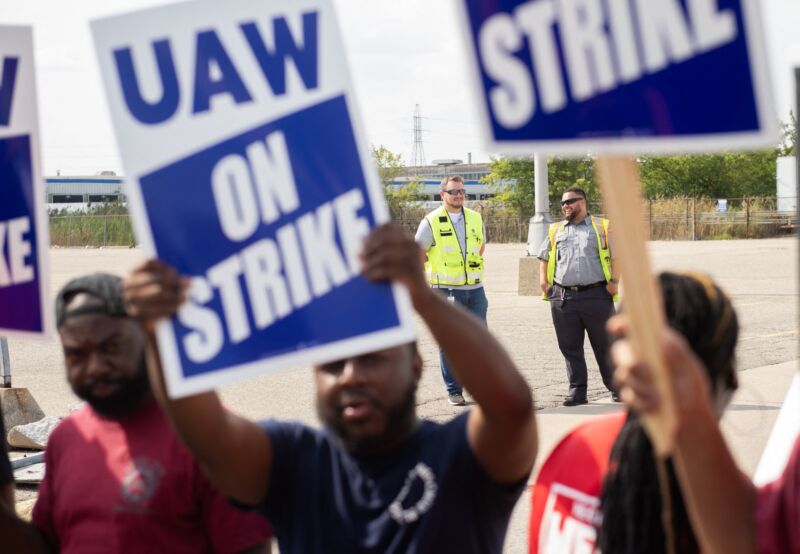

The autoworker strike began when around 13,000 workers walked off their jobs at three factories in Michigan, Missouri, and Ohio after the UAW’s previous contract with Ford, Stellantis, and General Motors expired without a new contract in place in mid-September. A week later, another 5,600 workers joined the strike at 38 locations across 20 states.

Among the union’s complaints are an end to the tiered pay structure in the industry for workers, a return to defined-benefit pensions, and a pay raise spread over four years. But the growing electrification of the auto industry is another pain point; even as car companies and their suppliers rush to build battery factories in the US, they’re often doing so in states that are openly hostile to unionization.

The strike action has evidently been working. Last week, Ford gave the UAW an offer including no job losses due to EV battery plants, profit-sharing (including temporary employees), and conversion of temps to full-time workers if they have at least three months’ continuous service. Ford also offered a 23 percent pay raise (over several years), exceeding the 20 percent offers made by GM and Stellantis but short of the 36 percent spread over four years that the UAW is demanding.

GM currently has a single operational battery factory, a joint venture with LG Energy Solutions in Lordstown, Ohio. This site builds the Ultium cells for GM’s range of new battery EVs, albeit very slowly. Problems with an unnamed supplier have meant fewer than 7,000 Ultium-based EVs were delivered to customers in Q3 2023, although this still represents a doubling in output from Q2 2023. GM has two more battery factories in development in Michigan and Tennessee, with a possible fourth site in Indiana on hold.

Well, actually

Both sides of the dispute have accepted the axiom that the transition to manufacturing electric vehicles means fewer workers are needed. But is this actually couched in fact? In a report published on Friday, Heatmap found that once battery-cell production is taken into account, EVs may well require more workers than vehicles with internal combustion engines.

In every case, EV manufacturing required more hours. The conventional powertrains took 4 to 11 worker hours, while the EV powertrains took 15 to 24. “A lot of the confusion sits around, what parts are you counting in this evaluation?” Cotterman told me. “We’re saying that if you were to produce every single component in an EV in the U.S., that the total sum of those powertrain components will be higher than the equivalent ICE components.”

While many of those battery components are not currently manufactured in the US, the new incentives put in place by 2022’s Inflation Reduction Act tie an EV’s tax credit to local manufacturing and assembly of those components.

https://arstechnica.com/?p=1974393