Graphics card prices remain hugely inflated compared to a few years ago, but the good news is that things finally seem to be getting consistently better and not worse.

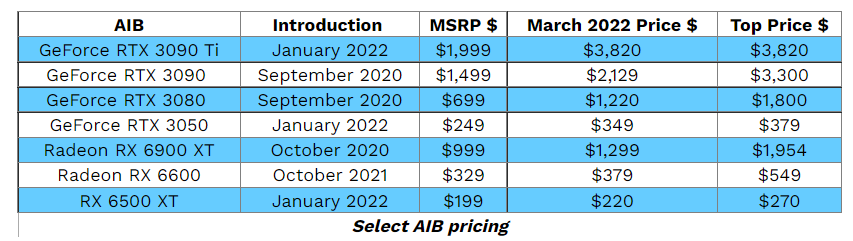

To quantify this, Jarred Walton at Tom’s Hardware and analyst Jon Peddie pulled together data on current and historical GPU pricing. The only modern card consistently tracking close to its manufacturer-suggested retail price of $199 is the harshly reviewed AMD Radeon RX 6500 XT, which is currently selling for an average of $220, according to Peddie’s data, and $237 according to Walton’s. But across the board, prices are way down from their 2021 peaks.

Pricing for Nvidia’s RTX 3080 demonstrates where the market sits right now—the card is currently selling for between $1,200 and $1,300 on average, and you can buy some models on retail sites like Newegg for as low as $1,000. The cost is still way up from the card’s MSRP of $699, but it’s down nearly a third from its peak price of $1,800.

Anyone who has been following this situation can name the factors that sent GPU prices soaring in the first place. New products like the RTX 3000-series promised performance jumps over previous generations, just as next-generation game consoles were driving new advancements in game engines and graphical fidelity. Those normal-ish factors collided with supply chain problems, chip shortages, and a cryptocurrency mining boom to drive up demand. The increased demand also attracted scalpers, who made the whole situation worse.

Peddie specifically blames scalpers, cryptocurrency miners, and retailers for the biggest price increases, rather than chip shortages or supply chain issues. He notes that the cost of a standalone graphics card (or “AIB,” for “add-in board”) “increased in price by at least 2x, maybe 3x, over PC notebook GPUs.” In other words, miners and scalpers weren’t buying gaming laptops en masse just to use them for mining or to resell them, and absent those demand distortions, gaming laptop supply and pricing weren’t nearly as bad as they were for standalone desktop GPUs. As cryptocurrency profitability has dropped (and as some coins like ethereum prepare to leave GPU mining behind entirely), prices for those standalone GPUs have gradually receded.

Shortages or not, the technology powering these GPUs is still marching on in the background—all three of the major GPU companies are said to be planning GPU launches sometime this year. Intel has already gone on the record about its dedicated Arc GPUs, which are due to arrive this summer. Nvidia’s power-hungry RTX 4000-series GPUs are also reportedly coming this year, as are AMD’s RDNA 3-powered Radeon 7000-series cards.

And the launch of new GPUs brings with it a bunch of new questions: Will the MSRPs for new cards go up because people are so used to paying more for GPUs? Will current-generation models stick around at lower prices or gradually fade to drive consumers to the newer products? Will consumers still be interested in buying “last-gen” cards or will they decide to hold out for newer models instead? GPU prices may be going down, but we can expect them to remain unpredictable for the foreseeable future.

https://arstechnica.com/?p=1846550