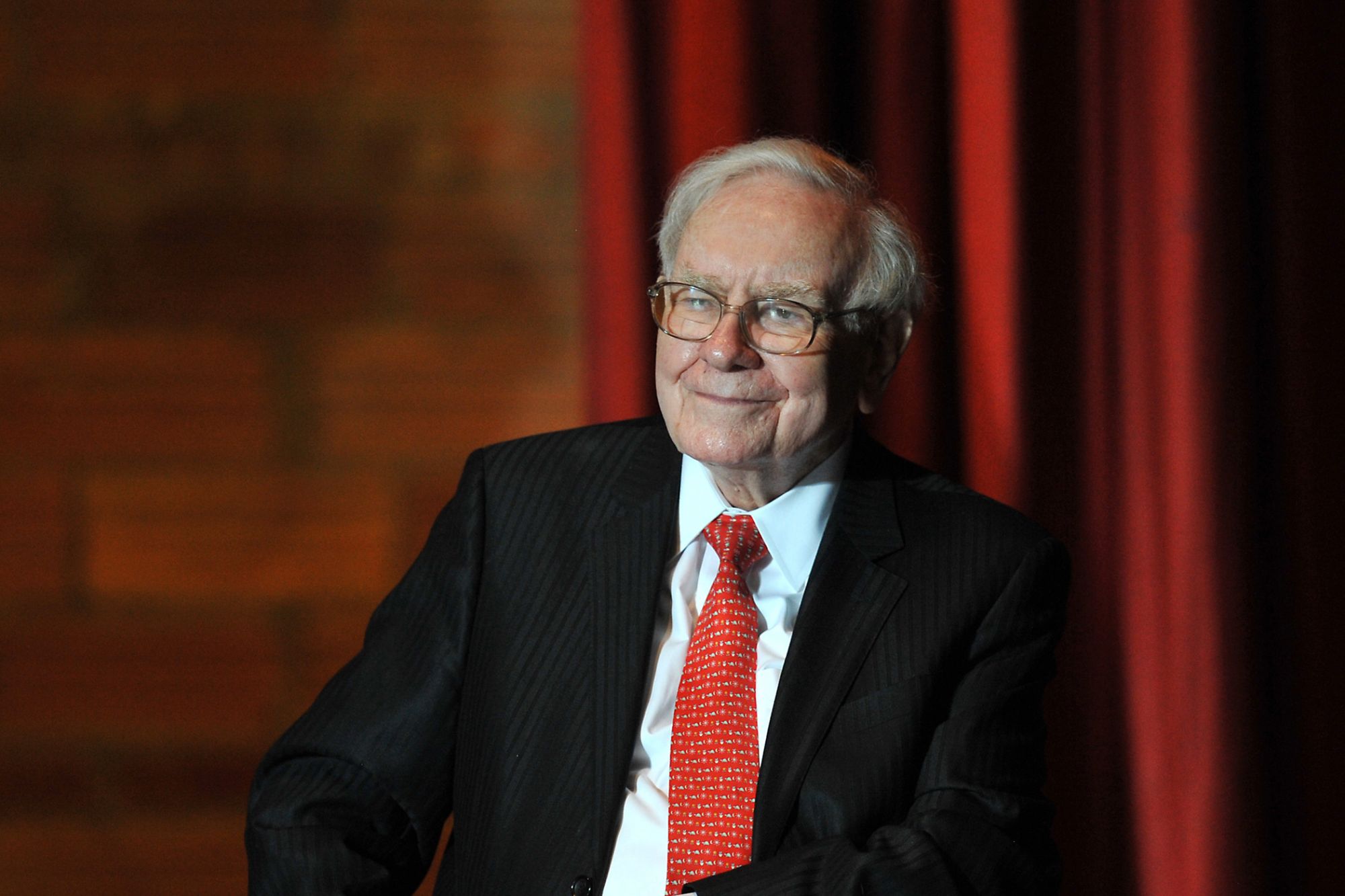

How Warren Buffett navigates the taxes on his income.

5 min read

Opinions expressed by Entrepreneur contributors are their own.

To provide entrepreneurs with insights on some of the 2020 Democratic Candidates wealth tax proposals, let’s take a closer look at how and why billionaire Warren Buffett still pays less tax as a percentage than his secretary. With several presidential frontrunners advocating programs to increase taxes on the rich to reduce wage gaps and pay for free government programs such as “Medicare for All” and free public college tuition, it’s important to look at the big picture questions.

Let’s take a closer look at five ways Warren Buffett and other billionaires pay less tax and the economic benefits.

1. Pays primarily capital gains tax versus income tax

The top reason that Warren Buffett pays less tax as a percent than his secretary is because he is being taxed primarily on capital gains income as an investor versus his secretary, who is taxed on a salary or earned income as an employee. And while Buffett does pay himself a relatively small salary of $100,000 (same for the past 25 years, Investopedia) as CEO of Berkshire Hathaway, the majority of his income is from stock market investments. And even though the long-term capital gains and qualified dividend taxes did not change in the TJIA (taxed at 0%, 15% and 20%), they remain much lower than ordinary income tax rates.

Related: 75 Items You May Be Able to Deduct from Your Taxes

2. Warren Buffett makes major contributions to charity

The Oracle of Omaha further reduces his salary by making major donations to charity, including the Bill and Melinda Gates Foundation. Buffett has made it a mission to give away most of his wealth versus leaving it to his heirs, and actually advocates increasing the estate tax.

3. Hires top accountants to legally reduce the effective tax rate

The rich also can pay tax accountants to help them find legal ways to reduce their effective tax rate. For example, the current maximum tax rate in the U.S. is currently 37% (down from 39.6% with the Tax Cuts and Jobs Act of 2017). By hiring a great tax advisor, this top tax rate can be reduced significantly.

Related: Warren Buffett’s 3 Top Pieces of Advice for Entrepreneurs

4. Creates jobs

The government rewards companies who create jobs with tax incentives that significantly reduce taxes. Warren Buffett’s Berkshire Hathaway has created 360,000 jobs at 25 headquarter offices and subsidiaries (CNBC). In comparison, Jeff Bezos has generated 647,500 jobs at Amazon. And while these companies are required to pay Payroll Taxes (Social Security, Medicare, etc.) for every employee, there are many tax deductions and credits that help offset these costs.

5. Takes advantage of new tax law

Berkshire Hathaway’s net-worth increased last year to $63 billion, with $29 billion of that coming from the change in tax law. According to Buffett, there were two primary reasons (CNBC). One was a new Bonus Depreciation for fixed assets, which includes car purchases. For example, for a $10,000,000 asset, Buffett used to take 10% per year deduction or $1 million per year, and now he takes 100% the first year as a deduction. The second biggest change was a corporate tax rate that went down from 35% to 21%, which he describes as a “huge tailwind.”

So the real debate should be whether raising corporate rates and eliminating tax incentives that create jobs and investments in the U.S. economy should be changed? Senator Elizabeth Warren has proposed a Wealth Tax that would include a 2 percent tax every year on households with assets over $50 million and a 3 percent tax on households with assets over $1 billion. Rep. Alexandria Ocasio-Cortez, D-New York, proposes a 70 percent marginal tax rate on income above $10 million. And Senator Bernie Sanders is talking about raising the Estate Tax.

And the second debate is should capital gains taxes be raised? Presidential Candidate John Delaney wants to raise the 20 percent top tax rate on long-term capital gains because he believes investors no longer need a lower rate to encourage investments. The counter-argument, of course, is that an increase may impact the bottom line for companies so much that it results in lay-offs, reduced income and hurt the overall economy.

If we look back at the Tax Reform Act of 1986 passed by President Ronald Reagan, the bill lowered the top tax rate for ordinary income 50% to 28% and raised the bottom tax rate from 11% to 15%. It also raised the maximum tax rate on long-term capital gains to 28% from 20% (Investopedia). And for businesses, the corporate tax rate was reduced from 50% to 35%.

And while the Reagan Tax Reform Act of 1986 did help clean up the tax code, the economic results were mixed as a result of many other economic issues (NPR). It did attack the 1980 recession and stagflation and promised to reduce the government influence on the economy. It was based on supply-side economics that believes corporate tax cuts are the best way to grow the economy.

So I think the real question every American should be asking is who do you trust more with your money: the government, corporations or yourself? Would you rather have Warren Buffett and Jeff Bezos generate jobs that produce income or have big government collect more money and be more responsible for our economy?

Related: The Top 4 Tax Strategies To Save Your Business Money

https://www.entrepreneur.com/article/338189