In early June, much of the country was beginning to emerge from its pandemic-induced hibernation—cars creeping back on the road, restaurants moving tables outside and, of course, stores opening their doors.

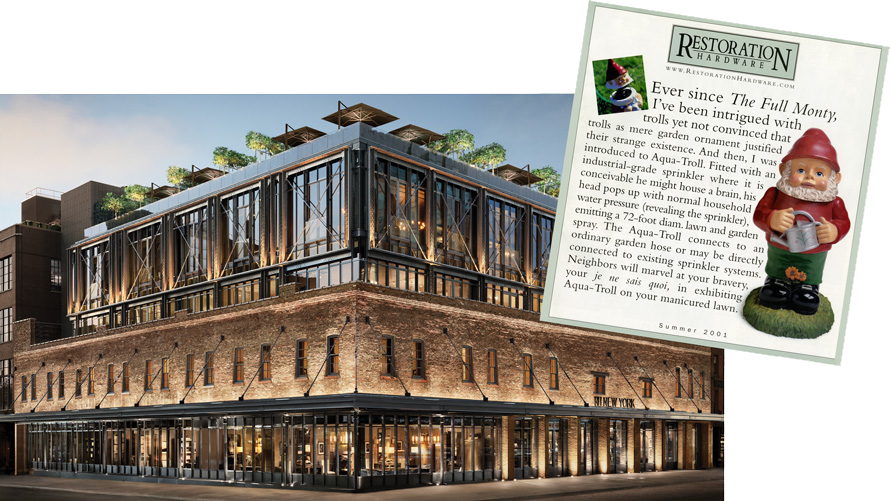

But while most retailers were shifting their focus to how they could reconfigure their existing stores to the new realities of the Covid-19 era, RH—previously known as Restoration Hardware—took a different approach.

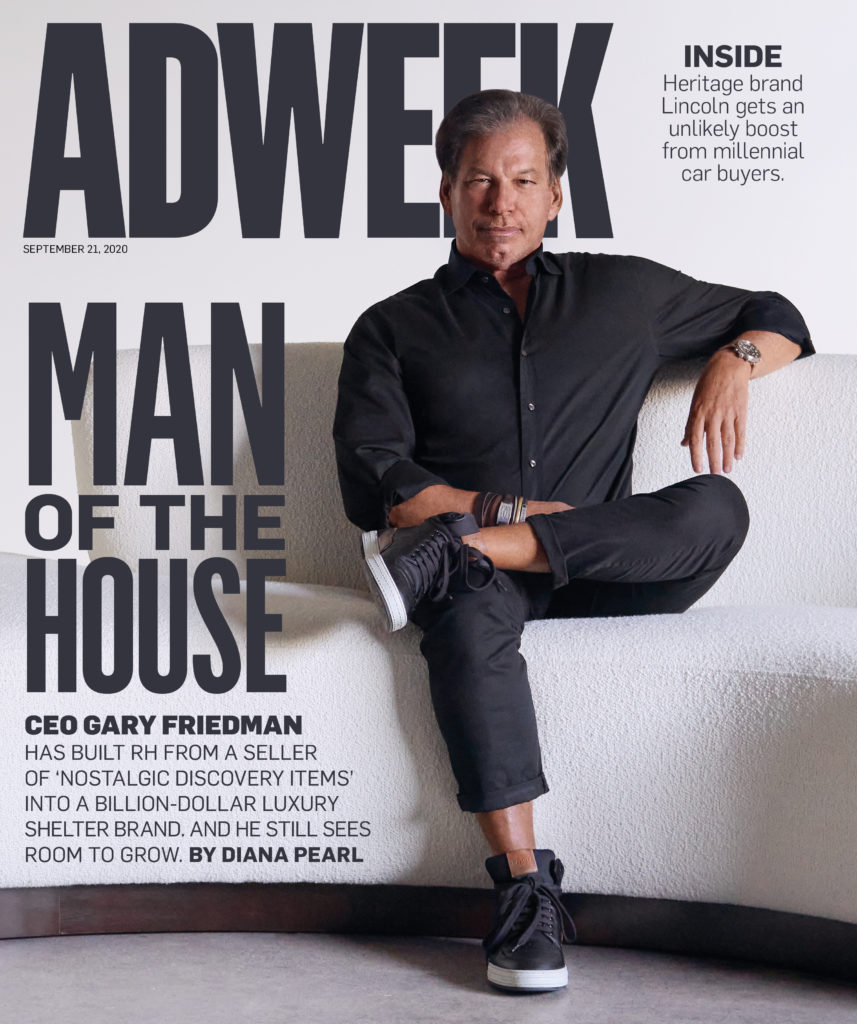

In an annual letter that Gary Friedman, RH’s CEO, wrote to shareholders, he laid out the brand’s plans not just for the next year, but for the company’s next chapter: opening new stores (or galleries, as RH calls them), expanding into the travel sphere (with RH-branded guest houses and a yacht) and entering the residential real estate market with RH Residences.

It was a bold blueprint at a time when the industry has seen five years’ worth of ecommerce growth in mere months.

“We invest with a long-term view, not a short-term,” Friedman, who spoke at Brandweek on Sept. 17, tells Adweek. “There’s going to be all kinds of distractions that happen along the way in our lives. Great brands have great lives and are built because of great vision.”

If he pulls off the changes he’s planned, it wouldn’t be the first time. Even in the prepandemic era, RH managed to defy the odds. It expanded its brick-and-mortar footprint while other stores shuttered; as retailers stopped printing catalogs, RH not only continued producing its thick tome, but eschewed the digital properties retailers migrated to instead. (Case in point: RH doesn’t even have an Instagram account.)

In fact, RH has done what seems impossible in today’s retail climate: maintain success, without the embrace of massive promotions or a digital-first model, while undergoing a near-complete reinvention as a luxury brand, guided by Friedman’s vision.

Since going public in 2012, RH’s stock price has multiplied more than 15 times the original offering. Most recently, its fiscal second-quarter earnings beat expectations, with revenue rising 0.4%, despite the ongoing pandemic, sending the stock price climbing again.

“This is the payoff of a really long-term commitment to innovation,” says Melanie McShane, senior strategy director at Siegel+Gale. “They’ve made it very clear that they want to get into the luxury business.”

How Restoration Hardware became RH

Friedman’s move to Restoration Hardware, nearly 20 years ago, came out of “heartbreak,” as he puts it. He spent 14 years at Williams-Sonoma, working his way up to president of the company. He was told for years that he was next in line for the chief executive role, but when he was passed over for the job, Friedman decided to make a change—despite the fact that he had around $50 million in unvested stock options at Williams-Sonoma.

Friedman was familiar with RH (then known as Restoration Hardware), as Williams-Sonoma had contemplated a purchase of the brand a few years prior—an acquisition that Friedman had championed and would have led had it gone through. He reached out to Steve Gordon, RH’s co-founder and then CEO, about coming on board.

The business was in dire need of a turnaround. Financials were in sore shape, with the stock price slumping—at one point to just 50 cents a share. An influx of capital was necessary if the brand was to survive, let alone grow.

https://www.adweek.com/brand-marketing/how-ceo-gary-friedman-built-restoration-hardware-into-rh-a-luxury-brand-juggernaut/