Where We Were

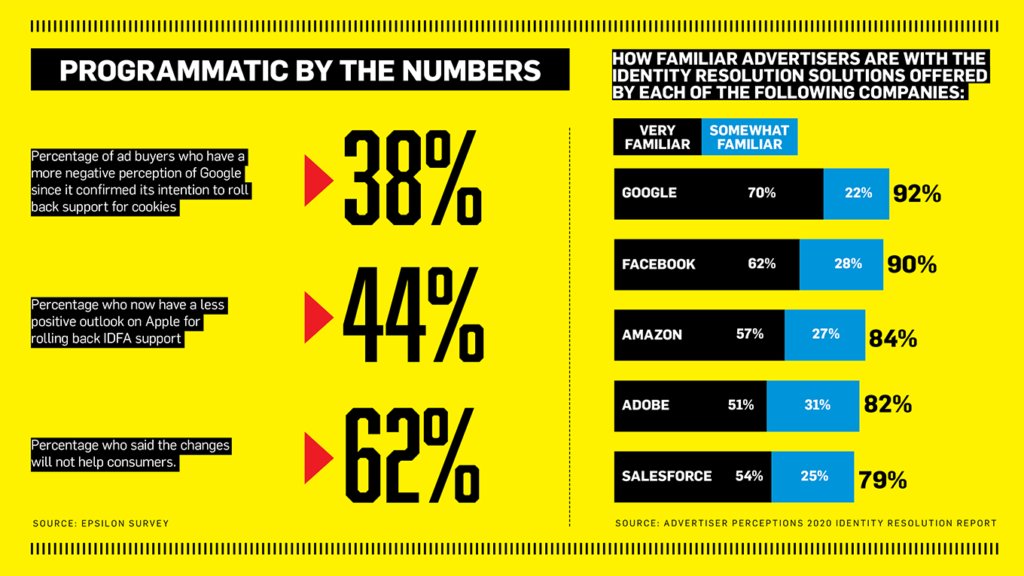

Prior to the Covid-19 pandemic, Google rocked the ad-tech world when it confirmed it would drop support for third-party cookies, the common currency for programmatic trading, in its Chrome web browser in 2022.

After Adweek first reported that Google was contemplating the changes in March 2019, imitating policies in Apple’s Safari, the industry went into a state of what Ratko Vidakovic, founder of consultancy firm AdProfs, calls “systemic flux.”

This prompted a raft of ID initiatives from multiple vendors that wanted to continue online ad targeting independent of third-party cookies. The Trade Desk, the largest independent ad-tech company outside of Big Tech, emerged as a market leader, helping drive adoption of the Unified ID 2.0 offering, the most successful of these initiatives in gaining popular support from vendors and publishers alike.

Where We Are Now

Now, the market will have to consolidate around a handful of these IDs, all of which will need to be interoperable, but such consolidation isn’t likely to play out until the years after 2022.

Without question, Covid-19 had an impact on programmatic advertising, but the shock, while immediate, was relatively brief because programmatic lent itself well to the recovering confidence of marketers, many of whom reasserted their advertising plans from late Q2 onward after a hiatus on spend during which corporations adjusted to the spread of the coronavirus. The fact that brands have realized they can adjust and optimize their ad campaigns more deftly using ad tech has set a welcome precedent, and will likely outlast the pandemic.

Meanwhile, Apple furthered its war on targeted advertising (outside of its own ecosystem) with the rollout of its iOS 14, which will require consumers to opt in before advertisers can access its iPhone-identifier IDFA—the app-based equivalent of the cookie—starting in early 2021.

Battles between some of Silicon Valley’s household names, including Apple and Google, will dictate the fate of countless ad-tech companies whose data practices are increasingly the subject of government scrutiny across the globe. However, the potential breakup of Big Tech could work in the favor of smaller ad-tech companies because a forced divestiture of some of Big Tech’s smaller ad-tech assets is likely to prove a boon to independent players.

Where We’re Going

Google has been making progress toward sustaining behavioral ad targeting in its Chrome browser, while maintaining user privacy, beyond 2022. This has primarily taken place via its Privacy Sandbox initiative, a back-and-forth series of proposals over privacy standards between Google and independents taking place via web standards body W3C.

Independent ad-tech players have voiced frustration at the lack of progress and communication from Google when it comes to Privacy Sandbox, especially since these proposals have the potential to form the bedrock of how the online advertising system will function.

Danny Hopwood, Omnicom Media Group, svp, head of digital display and investment solutions, says there’s a lot of uncertainty at a time when “we’re coming incredibly close to [identifiers]” going away. “There’s nothing definitive, and it all feels a little bit experimental,” he says.

Underpinning all of this is privacy legislation in the guise of Europe’s General Data Protection Regulation, and in the U.S., the advertising industry is lobbying for a federal law similar to the California Consumer Privacy Act, the most fundamental set of privacy laws in the U.S., to prevent a patchwork of regulations.

Apple and Google’s rivalry will dictate the fate of many

https://www.adweek.com/programmatic/ad-tech-is-primed-for-its-own-roaring-20s/