For the better part of two years now, I’ve been wondering how the 2019 WeWork debacle happened. Whatever, sure, Adam Neumann is a wild and crazy guy — but without commitments from a number of sophisticated investors (Benchmark! T Rowe Price! Fidelity! Harvard University!), his tequila-soaked dreams never would have become a reality. I’ve been waiting for someone to explain what these people were doing, handing Neumann all that cash, and The Cult of We by Eliot Brown and Maureen Farrell finally gets there.

Take the fateful S-1, the document required for its IPO. At the time, I wondered how so many people had read the document and decided it was fine. Helpfully, Brown and Farrell explain this: turns out bidding for the IPO was very intense between Goldman and JP Morgan. And all those weird provisions? Well, JP Morgan pointed out that the public might not like them! Mary Callahan Erdoes, the CEO of JP Morgan’s wealth management division, was dispatched to tell Adam that all the provisions in the S-1 that benefited him were likely to cause a major hit to WeWork’s valuation. He shrugged. And that was that — WeWork was the client and JP Morgan was getting paid.

I don’t mean to suggest the book is short on details about the Neumanns, who seem delusional. Rebekah Paltrow Neumann, for instance, saw six different iterations of her office, which featured a pink and yellow couch and a white sheepskin rug — but nonetheless complained when it was finished because it was smaller than Adam’s. (“My soul can’t breathe,” she said.) And Adam had a meeting with SpaceX CEO Elon Musk, where he told Musk that getting people to Mars would be the easy part; building community would be hard.

But, the book explains, WeWork was a functional business in 2012, when it made a profit. That was, incidentally, before it retooled itself to be appealing to venture capitalists. After reading Brown and Farrell’s reporting, it seems to me that after 2012, WeWork’s primary function wasn’t office space — it was raising its valuation. And the sky-high valuation wasn’t on the Neumanns alone; it was also on everyone who gave Adam money, but especially Masayoshi Son, who encouraged him to think even bigger.

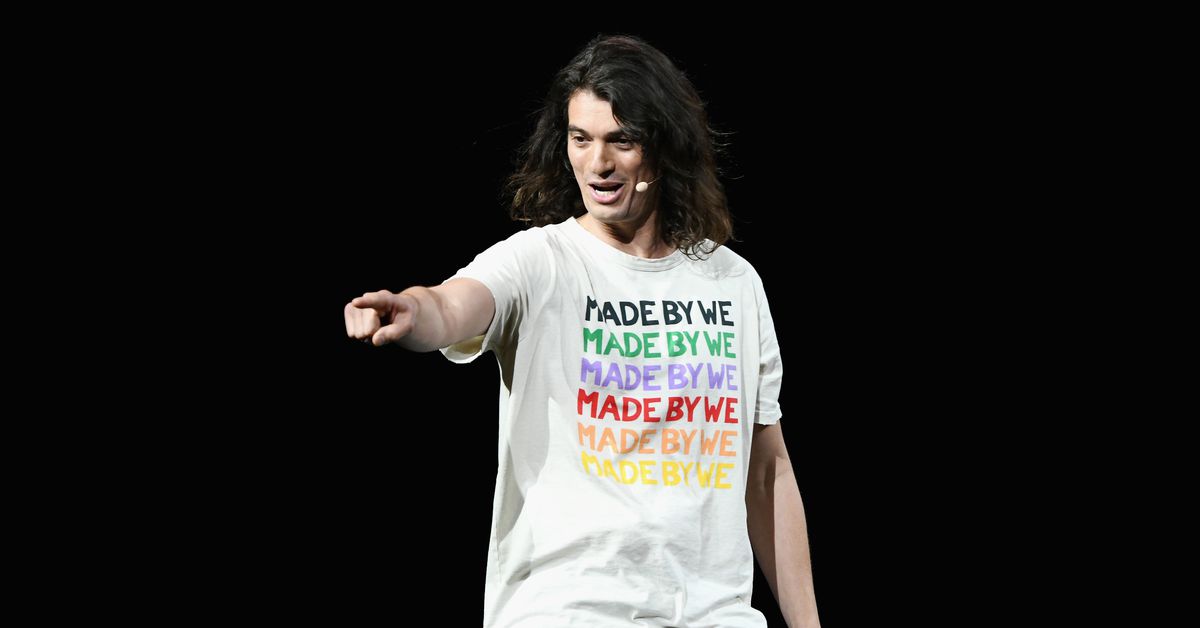

Another thing working in Adam Neumann’s favor was the tech industry’s cult of the founder, which had become part of the venture capital pitch; the phrase “founder friendly” appears in the book’s index. Founders were to be worshipped, adherents of this sect believed, and should have full, unfettered control over their companies.

Brown, who began covering WeWork as a real estate reporter at The Wall Street Journal, watched in surprise as the WeWork brand took off as a “tech company.” Farrell, whose specialty at the WSJ is IPOs, was writing madly as the IPO began to unravel. The two realized they had a book on their hands pretty quickly — “WeWork was the apotheosis of like, every concerning trend,” Brown says — and they wanted to know how the whole debacle had happened.

I talked with Brown and Farrell about their book, the venture capital industry, and the spineless cast of characters — the board of directors, for instance, who simply thought it would be easier to let Adam Neumann have his way. “It still is kind of wild to me how Adam Neumann had the ultimate power to make all of this happen and do all the things he did when you have some of the most sophisticated financiers in the world behind him,” Ferrell tells me. “How did they all get played?”

This interview has been edited and condensed.

Some of the things that freaked people out in the S-1 had actually been reported earlier, by you and others. So why didn’t someone press pause sooner?

Eliot Brown: I don’t know! We would write stories and then the valuation kept going up. We’d write stories on conflicts of interest and, you know, people would sort of just glide past that.

There were a couple things going on. People started coming to the reality in mid-2019 [after the IPOs of money-losing ride-share companies Uber and Lyft], that like, wow, companies that lose billions of dollars — that might not be a cool business model long term. There was this talk of “Oh, now companies need to show a path to profitability.” A path to profitability? That’s what a company is! Like, of course they show that! That’s the point!

And then the S-1 itself was just… It had so many things that were totally insane that it would have been just impossible to ignore all this stuff.

Maureen Farrell: It was grand delusion internally. Adam ran the company in the most chaotic way. And it worked up until a point. But I mean, when you’re just getting into the weeds on what was happening day to day, with the S-1 ramp up, it was just — everything was so crazy. People are living in this world of chaos, and so certain things didn’t become clear, like the $5.9 million payment for the word “We,” they kind of missed that. Because there’s so many other insane things in it.

But WeWork didn’t start as something crazy. In fact, renting people office space is not a terrible idea. Is there a specific point when things changed?

EB: Maybe broadly what WeWork shows is that not every business is a venture capital business. There’s this meme in Silicon Valley, and entrepreneurship today, that if you have an ice cream company, it’s not gonna be a good ice cream company unless you raise VC money. And so everything has to be tech and everything has to be, you know, rapid growth. And it turns out that some businesses do not need to do that and are not built for that. So I think the turning point is when WeWork first took venture capital.

They literally were profitable for one year in their history. And that was 2012, by their own numbers. After that, it was just nothing but losses, right? They originally hit this gold mine, where real estate was cheap and demand for this kind of cool, hipster-y, millennial chic space was high, and so they could make enough money. And so then a normal, rational human might say, “Okay, well, let’s just grow kind of at whatever pace that allows and not try to take over the planet in the next five years.” But that wasn’t the sort of venture capital mindset.

Why did venture capital get involved?

MF: Adam Neumann was fixated on making the company as big as it could possibly be and, you know, getting the valuation high as it could possibly be. So he kind of morphed the company into… like the venture capitals were almost his clients, you know? He focused the business and sort of changed it and explained it in such a way that it would appeal to them.

It was a leap of faith, believing that the business model was something it wasn’t. It didn’t make sense. It was a real estate company. And he convinced some of the most sophisticated and successful venture capitalists in the world that it was something else.

EB: It’s just a product of simply there being too much money, right? There’s only so many good ideas out there. Money could go into other things, but everyone was trying to get into Silicon Valley. So there’s this waterfall going into a small spigot because it really can’t absorb that much money. And so in bubbles, that’s what happens — people cast aside critical thinking. Instead, they’re like, “Maybe this mattress company is a tech company!” Because if you don’t say that, then you can’t spend your money. And if you don’t spend money, you can’t make money.

How much did the Silicon Valley focus on the founder play into this mindset?

MF: The whole cult of the founder was so central to this narrative in general and how this all played out. It really gave Adam Neumann this really long leash, because founders are geniuses and they are eccentric. So who’s the next Mark Zuckerberg that can create this Goliath of a company and make us gigantic returns?

Throughout the book, I kept wondering, What is going on with this board? Over and over again, they rubber-stamp Neumann’s decisions. In fact, there’s this excuse that shows up over and over: Oh, the public markets will create discipline. Why is that the public markets’ job?

MF: In the book, we spell that out, that the directors are saying that to each other, which is just so crazy. They handed him super voting control, they let him get that. And then it seemed like they absolved themselves of having any clear role in pushing back on him, when that’s the role they’re supposed to take. That floored us so much each step of the way. And the board finally stepped up and flipped out at him just as the IPO is about to completely blow up. That was the first time you see them really pushing back in a big way.

EB: Toward the end, he just stopped going to board meetings. He just didn’t show up. They finally just flip out, and say, “Adam, you have to come to these things.” One of the directors goes up to meet him in his office like, “Adam, it’s a board meeting.” That’s September 2019, which is when it was falling apart.

The other thing with the board is, we asked people, “Why wouldn’t you stand up?” And the answer was, “Well, he controls the board. So what’s the point of voting no? Because he’ll just be mad and he’s gonna win anyhow.” Okay, but if a majority of you voted no, then he would have to actually blow up the board — that’s a really big action. But they would never vote no, it was unanimous. It’s like “You want this jet?” Everyone would be like, “No, I don’t want the jet.” And then, you look at the minutes — oh, unanimously approved.

MF: You know, the easy answer was, “Well, my job as a board director is to have the share price go up.” The share price kept going up and up and up, and they were getting extremely wealthy. They were killing it on their investments. So from that perspective, it was working. It would be easier to argue with Adam if the company were declining in value. So then the first time that they stand up to him is when the company is running out of money and, you know, its valuation has plunged.

If the same thing had happened now — after GameStonk stuff in January — would there have been the same kind of rebellion on the part of the public markets? Or would people have been like, yeah, sure, we’ve got a bunch of weird shit out here?

MF: One of the things we saw on Palantir, even, there are some very extreme steps that the founders had taken — they could have no economic stake in the company and keep voting control. So there’s been a lot of crazy stuff that’s come out into the public markets.

Someone I talked to right after the S-1 came out said there’s a menu of things that founders can pick from to kind of push the envelope. And in that menu, maybe people pick a few of them. Adam Neumann picked every single one on that menu, and it was just so egregious. Even in this market, it was a lot.

EB: The super loss-heavy startups, where you can have, literally, one, two, three, four billion-dollar losses in a year — that has fallen a bit out of vogue. Who knows if it comes back! Most of the super-highly-valued unicorns going public are slightly better in terms of, you know, not hemorrhaging cash.

Did we learn any lessons from WeWork?

EB: No.

MF: For a minute, it really seemed like they did. In 2019, for a while, Masayoshi Son was telling everyone, “Oh, you suddenly have to be profitable.” And then the pendulum has swung back faster than we ever could have anticipated. And it almost feels more extreme in some ways than it was then.

EB: When we started the book, we thought it was the punctuation of an era of, you know, Silicon Valley unicorn insanity. And then the pandemic happened, and the Fed printed money and cash rolled even more into Silicon Valley. And, yeah, it seems to have gone the other way. So WeWork was more of a blip than the end of an era.

These things go in cycles. If you were to be a super charismatic founder out there trying to raise money for a co-working company right now at a $47 billion valuation, it would be extremely difficult. People still do mention WeWork in VC circles. But one of the things that the pendulum has swung so the public markets are kind of where the crazy is right now. So this is a long way of saying we have learned nothing.

MF: We hope people take some lessons from the book. Maybe there are lessons to be learned or — even just a wake-up call. The reckoning that seemed to happen immediately, we hope can happen again, when you just put every piece of the story out there. What does it mean to be a director? What does it mean to be a banker to these companies? Should you stand up to someone like him?

EB: One of the things we really feel strongly about is this isn’t a story about Adam Neumann and WeWork being special. WeWork and Adam Neumann were the manifestation of the financial system that was structured this way. And if it wasn’t Adam Neumann, who, you know, bought a plane and a jet wave pool company and started an elementary school with his VC money, it would have been someone else doing something maybe slightly less crazy. But this is what happens when you have these forces where there’s just so much money in Silicon Valley, there’s this meme that founders are immortal beings and special, and we should give them control. Like, this is the obvious manifestation.

https://www.theverge.com/22585805/adam-neumann-cult-of-we-wework-book-vc